Channel Samples Show High Copper Values at Asset in Peru

Coppernico Metals Inc.'s (COPR:TSX; CPPMF:OTCQB) latest results, from a single target at the Sombrero project, highlight the mineral and exploration potential there. Read one analyst's take on it.

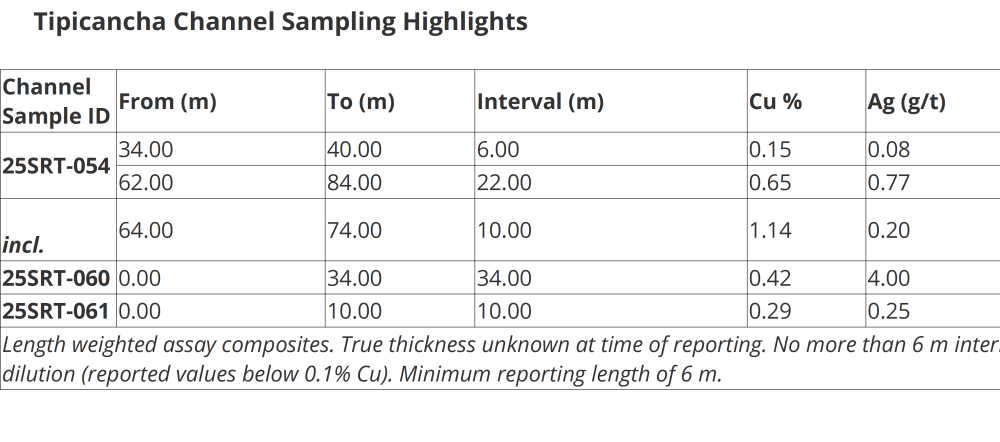

Coppernico Metals Inc.'s (COPR:TSX; CPPMF:OTCQB) initial surface channel sampling results from the Tipicancha target at its Sombrero project in Peru showed the presence of copper and silver, a news release noted. Tipicancha is a large-scale epithermal system with a possible porphyry source at depth.

"The high copper values at this level of the system are significant and demonstrate the potential for more extensive porphyry-related copper mineralization," Vice President of Exploration Tim Kingsley said in the release.

Highlight results include 22 meters (22m) of 0.65% copper (Cu) and 0.77 grams per ton (0.77 g/t) silver (Ag), including 10m of 1.14% Cu and 0.2 g/t Ag (true widths are unknown). Thus, Tipicancha is another prospective target in the company's growing pipeline of robust copper and precious metals exploration targets at Sombrero.

Recent geological mapping and systematic rock sampling extended the alteration footprint at Tipicancha by 500m, such that it now measures about 2 kilometers (2 km) x 400m.

As for the pyrite footprint, surface channel sampling over a 200m x 200m area showed trace to anomalous concentrations of gold, silver and copper as well as elevated values of pathfinder elements, including molybdenum, arsenic, antimony and tin, typical of the deeper levels of epithermal systems.

This, along with alteration, suggests the current surface exposure represents a vertical transition zone from an epithermal to a porphyry environment with possible lode structures containing gold and silver at depth.

Coppernico is working to determine the dimensions of the pyrite body and better under the geochemical zonation as well as the structural and lithologic controls. Exploration continues at Tipicancha, slated for drilling in the phase two drill program, and other areas at Sombrero.

Exploring for Major Discoveries

Coppernico, a British Columbia-headquartered mineral explorer, aims to extend the world-class copper-gold skarn and porphyry Andahuaylas-Yauri mining belt in Peru, and to this end is advancing its flagship Sombrero project.

Andahuaylas-Yauri is a prolific, globally significant, 300-km long geological trend that hosts Tier 1 copper deposits, Investing News Network described. Typically occurring at the margin contact of the Batholith Intrusive, the belt's globally significant deposits stand out due to their simplicity in discovery.

In the northwestern extension of the Andahuaylas-Yauri, Sombrero's ~102,000-hectare land package consists of an increasing number of prospective exploration targets characterized by copper-gold skarn and porphyry systems, and precious metal epithermal systems.

"We still firmly believe in the thesis and the potential for a large copper skarn deposit at Sombrero," Therrien wrote.In terms of rock type, scale, mineralization style, and age, Sombrero is analogous to MMG Ltd.'s (MMLTF:OTCMKTS) Las Bambas, the world's 11th largest copper producing mine, and other large mines in the area. They include Glencore International Plc's (GLNCY:OTCMKTS; GLEN:LSE) Antapaccay, Altair Minerals Ltd.'s (ALR:ASX) Vanatica, and HudBay Minerals Inc.'s (HBM:TSX; HBM:NYSE) Constancia.

Earlier this month, Coppernico confirmed the presence of a large-scale copper-gold skarn system in the Ccascabamba target area at Sombrero, Streetwise Reports reported. This was determined through results of the company's phase one diamond drill program, comprising 20 holes over 8,233m. The mineralization and alteration zones suggest exploration potential outside of the currently permitted area.

While advancing Sombrero, Coppernico's management is reviewing other projects in the Americas, for the potential to expand the company's portfolio and thereby offer more value to shareholders and reduce risk, the company said.

Impending Supply Deficit

The outlook for the copper market is one of uncertainty, experts say. A question mark remains around what the U.S. tariff on the metal will be, 10%, 25% or another percentage, and when the final determination will be made. "The unpredictability of U.S. tariff actions leaves this space highly speculative," Red Cloud Securities analysts wrote in May Commodities Report.

After the Trump Administration announced in February an investigation into U.S. copper imports, traders collectively moved a massive quantity of the physical metal into the States, according to a Reuters Senior Metals Columnist Andy Home on May 18. This inundated the U.S. market and depleted quantities throughout the rest of the world. Since the start of 2025, CME copper inventory has risen 81% to its now eight-year high of 168,563 tons. In contrast, LME copper inventory has fallen off to a one-year low of 179,375 tons.

"This process is still playing out and will likely continue doing so until the Trump Administration decides on whether to impose a copper import tariff and at what level," Home wrote.

Red Cloud pointed out that, amazingly, refiners are paying miners to process miners' ore because refiners are struggling to fill their smelter capacity.

"The situation can be reversed with either a large amount of ore being shipped to China, which would be negative for prices, or we will see smelter closures inside of China," the analysts wrote.

What is certain about the copper market, however, is that due to global electrification, demand for the red metal is continuing to grow, and this is happening despite real estate issues in China, Red Cloud wrote. By 2035, copper demand is set to outpace new supply, the International Energy Agency told The Guardian on May 21. If nothing is done, supply will fall short by 30%.

Goldman Sachs analysts predict that strong demand from sectors related to electrification along with limited mining growth will cause a copper supply deficit as early as next year, Mining.com reported on May 7. This would push the copper price to about US$4.75 per pound (US$4.75/lb), or US$10,500 per ton, by year-end 2026, up from the expected low in October 2025 of US$4.08/lb, or US$9,000 per ton. (Copper's current price is US$4.70/lb.)

LongForecast predicts a copper price of US$5.01 at year-end 2025 and of US$5.50/lb at year-end 2026.

The Catalyst: Drilling Permit

Coppernico plans to carry out a follow-up phase two drill program at Sombrero, for which it requires an expanded drill permit, which the company has applied for and is waiting to receive.

This permit application is to extend the permitted area, drill up to ~200 drill holes (up from 49 originally) and add more drill rigs.

Robust Target Pipeline

Steven Therrien, 3L Capital analyst highlighted in a May 14 research report that Coppernico has been busy generating new drill targets. Along with Tipicancha, these include Macha Machay, an area with strong copper-in-stream sediment anomalies, and Antapampa, potentially copper skarn.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Coppernico Metals Inc. (COPR:TSX; CPPMF:OTCQB)

*Share Structureas of 5/27/2025Source: Coppernico Metals Inc.Plus, the company has previously identified highly prospective targets, "the most obvious," the analyst noted, is Fierrazo. There, historical drilling returned significant intercepts comparable to Las Bambas, including 90.4m of 0.50% Cu, 51m of 0.43% Cu and 116m of 0.42% Cu.

Two other targets are the area north of Chumpi, the highly prospective intrusive limestone contact, and Nioc. Surface grab samples from Nioc historically returned high grades, including 4.33% Cu and 2.11 g/t gold (Au), and 9.09% Cu and 5.88 g/t Au.

"We still firmly believe in the thesis and the potential for a large copper skarn deposit at Sombrero," Therrien wrote.

Ownership and Share Structure

According to Refinitiv, six strategic entities own 15.08% of Coppernico Metals. Teck Resources Ltd. (TECK:TSX; TECK:NYSE) with 9.9%, Newmont Corp. (NEM:NYSE) with 6.28%, Coppernico CEO Ivan Bebek with 3.45% and other Directors and Officers with 1.6%

Institutional ownership amounts to 17.75%, and the rest is in retail.

Coppernico has 177.3 million (177.3M) outstanding shares and 150.56M free float traded shares. Its market cap is CA$22 million. Its 52-week range is CA$0.115-0.54 per share.

| Want to be the first to know about interestingBase Metals,Gold andSilver investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Coppernico Metals Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Coppernico Metals Inc. Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Disclosures From Coppernico Metals Inc.,

Coppernico is solely responsible for the technical information herein about its Ccascabamba project, such disclosure having been reviewed by its qualified person Tim Kingsley, C.P.Geo.Streetwise Reports has written this article with information compiled from third-party sources and does not make its own opinions. The information presented in this article comes from Coppernico Metals (when writing technically about the Ccascabamba project), and third-party sources outside of both Coppernico Metals and Streetwise Report's control.