Chaotic BREXIT More Likely and Risk of "Death By A Thousand Cuts" For London

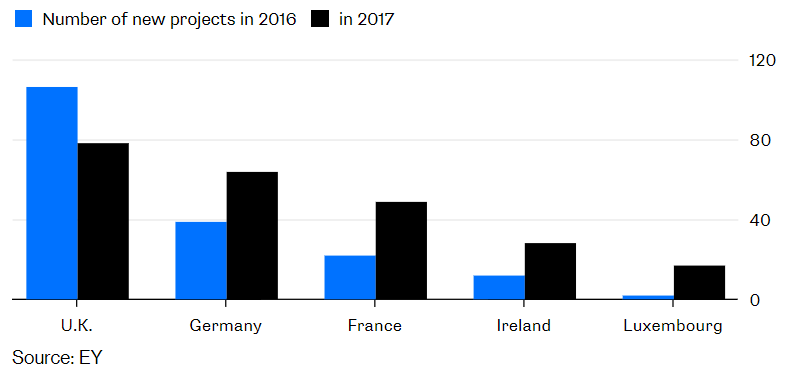

- "Chaotic" Brexit more likely after Davis, Johnson resignations from UK government- London's rivals are slowly carving chunks out of its financial services business- UK's Brexit options are increasingly unappealing which may pressure the pound- Already Frankfurt, Paris, Luxembourg and Dublin seeing more foreign direct investment and financial services jobs- Risk of "death by a thousand cuts" for London, it's financial services industry and its property market?

That Giant Sucking Sound is Post-Brexit London Losing OutThe U.K. capital's rivals are slowly carving chunks out of its business.

by Mark Gilbert of Bloomberg

Lingchi is the Chinese word for a form of torture in which flesh was systematically sliced from the body of the condemned, resulting in death by a thousand cuts. It was banned there in 1905; but, with Brexit looming, the practice is set for a revival in the City of London.

The British government continues to be riven by disagreements over what it wants its future relationship with the European Union to look like. And while the U.K. so far has only had one referendum on Brexit, the financial services industry gets to vote as often as it wants and it is signaling deep disquiet with the likely outcome.

Boris Johnson's Borexit Makes Brexit Even More ChaoticHe leaves Theresa May with an opportunity but the risks keep rising

by Mark Gongloff of Bloomberg

Boris Johnson will now have a lot more time for writing limericks and aggressive rugby.

The UK's Foreign Secretary and Brexit poster boy quit Theresa May's government on Monday. He and some other prominent Brexiteers in May's cabinet couldn't abide by her proposal for a "soft Brexit" from the European Union, which they decry as a Brexit in name only. The departures had some suggesting the end of May's reign was nigh, with her popularity slipping, her government crumbling and an October deadline for settling on a Brexit plan fast approaching.

Related Content

Stumbling UK Economy Shows Importance of Gold

Brexit Risks Increase - London Property Market and Pound Vulnerable

Soros Buying Gold On BREXIT, EU "Collapse" Risk

Italy EUR2.4 Trillion Debt to Create Eurozone Contagion? (Video below)

News and Commentary

Asian markets add to gains, led by Nikkei (MarketWatch.com)

Stocks hit 2-week high, led by banks ahead of earnings (Reuters.com)

U.S. Stocks Rally as Dollar Gains, Treasuries Slip (Bloomberg.com)

Consumer Credit in U.S. Jumps in May by Most in Six Months (Bloomberg.com)

Homeowners are sitting on a record amount of cash - and not tapping it (CNBC.com)

Buying Gold and Dumping Stocks Is A No-Brainer This Summer (TheNational.ae)

Gold Selling Exhausting (Zealllc.com)

Markets Are Crazy & This Is Anything But Goldilocks - Gundlach, Minerd Warn (ZeroHedge.com)

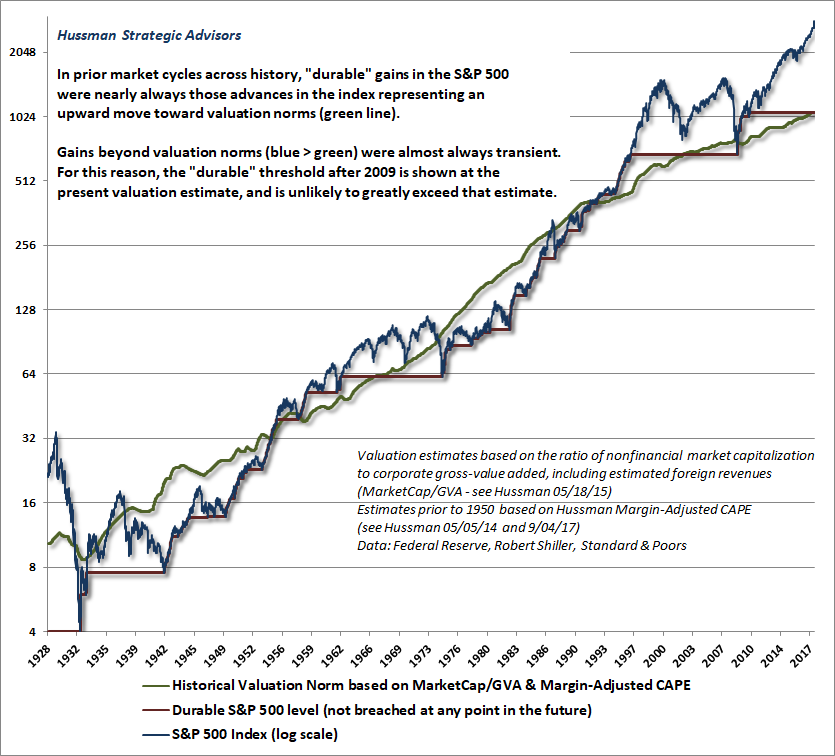

Warnings Grow About the Next Stock Market Crash (WallStreetOnParade.com)

Humane Immigration Will Make America Great Again. (GoldSeek.com)

Gold Prices (LBMA AM)

09 Jul: USD 1,262.60, GBP 946.95 & EUR 1,072.70 per ounce06 Jul: USD 1,254.20, GBP 947.55 & EUR 1,071.09 per ounce05 Jul: USD 1,252.50, GBP 946.89 & EUR 1,071.64 per ounce04 Jul: USD 1,256.90, GBP 951.47 & EUR 1,079.80 per ounce03 Jul: USD 1,245.85, GBP 944.85 & EUR 1,068.81 per ounce02 Jul: USD 1,249.00, GBP 948.87 & EUR 1,072.39 per ounce29 Jun: USD 1,250.55, GBP 950.29 & EUR 1,073.85 per ounce

Silver Prices (LBMA)

09 Jul: USD 16.21, GBP 12.15 & EUR 13.76 per ounce06 Jul: USD 16.00, GBP 12.09 & EUR 13.66 per ounce05 Jul: USD 15.95, GBP 12.04 & EUR 13.65 per ounce04 Jul: USD 16.05, GBP 12.15 & EUR 13.78 per ounce03 Jul: USD 15.93, GBP 12.08 & EUR 13.68 per ounce02 Jul: USD 15.98, GBP 12.14 & EUR 13.73 per ounce29 Jun: USD 16.03, GBP 12.20 & EUR 13.77 per ounce