CHART: Despite unnerving gold price fall, mining rally's intact

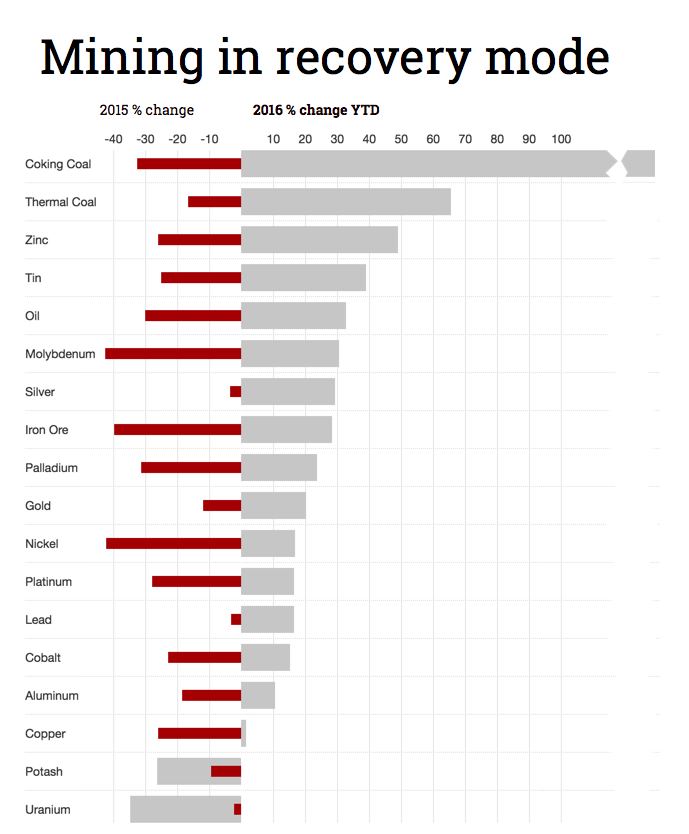

Gold's slide may be hurting sentiment and uranium and potash prices seem to be plumbing new depts every week, but 2016 is still a banner year for mining and metals.

Gold is just hanging onto bull market status with a 20.1% improvement since the start of the year, but recent weakness has seen platinum and palladium drop 8.5% and 7.4% from highs reached in August. With a 47% or $220 an ounce gain from trough to peak in 2016, palladium remains one the best performing precious metal.

While met coal is clearly the star performer, thermal coal is probably the biggest upset - seaborne prices are up 65% in 2016 to above $80 a tonneBase metals have also enjoyed a breakout 2016 with across the board gains year-to-date. Measured from recent lows which mostly occurred at the end of 2015 and in January and February this year the recovery in prices this year is even more impressive.

Zinc is the top performer for the year with a 49% gain since January and the recent rally in lead means the metal now boasts a 16.5% rise in 2016 scaling $2,000 a tonne in September. Bellwether copper has also been lacklustre adding only 1.5% in 2016 as it remains stuck in a tight range between $2.00 and $2.30.

Aluminum and cobalt have both enjoyed double digit gains so far this year and like tin (+39% just over $20,000) and nickel (+17% holding above $10,000) are currently trading at their 2016 highs.

Steelmaking raw material iron ore (+28.2% holding above $50) has defied expectations this year although forecasts are for further declines before the end of the year.

While coking coal is clearly the star performer (+163% to trade at $213.40 on Wednesday) thermal coal is probably the biggest upset - seaborne prices are up 65% in 2016 to above $80 a tonne thanks to a huge jump in recent weeks.

Oil this week has been attempting to retake the $50 a barrel level and measured from its February low, crude is up 88%, helping to bring price inflation across the mining and metals sector.

Potash prices at levels not seen since 2007 with a fall close to $200 a tonne and spot uranium losing more than 7% just last week to just over $22 a pound, a more than a decade low, prove that industry specific fundamentals could be behind the performance of other commodities, unlike the speculative gains experienced at the start of the decade.

Source: Steel Index, LME, Comex, Nymex, UX, Infomine, Quandl. Prices at Oct 5, 2016