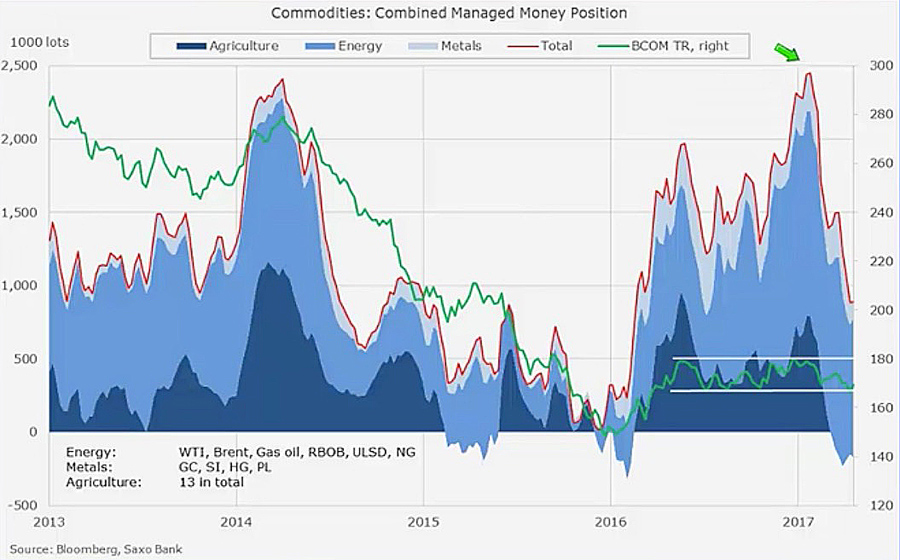

CHART: Hedge fund commodity bulls misread the market

After twelve months building momentum (with a big wobble in the middle) hedge funds bullish bets on commodities hit at a record high in February this year.

Turns out the smart money was too optimistic about the strength and length of China's economic recovery and the timing and scale of US stimulus under new leadership.

Prices went sideways for the better part of a year even as bullish positions continued to growLarge scale speculators or managed money investors in agriculture, energy and metals commodity futures and options have now slashed bullish positioning by 64% from the February peak.

Ole Hansen, chief commodity strategist at Saxo Bank, says the main reason behind the loss of confidence is simply that commodity prices never lived up to expectations.

Prices went sideways for the better part of a year even as bullish positions continued to grow. The gap between expectations and reality turned into a gulf.

There is an upside to this reversal says Hansen. Today's more realistic expectations at least provide commodity markets a base from which to grow.

www.TradingFloor.com