CHARTS: Brutal May for metals and miners

Against expectations and in some instances in defiance of fundamentals, commodities managed to climb a wall of worry over the first four months of 2016 giving mining companies a welcome boost after three years of declines.

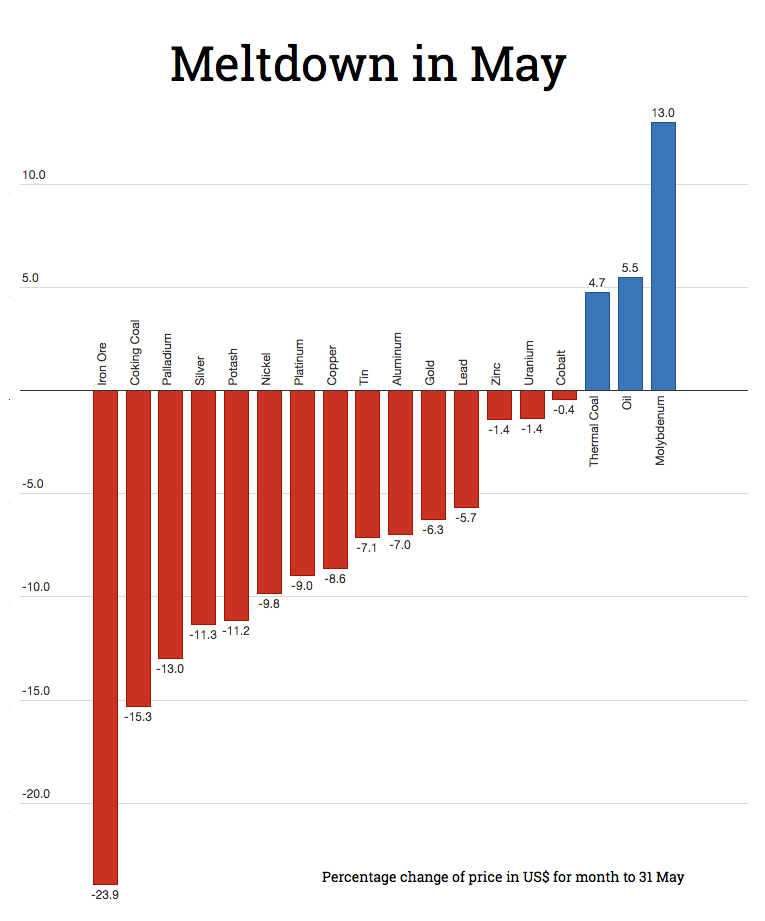

Sell in May and go away is one of the oldest adages on the equities market and it was especially true for the mining sector in 2016. While broader US share markets moved sideways and crude oil continued to rally, mining stocks, metals and mineral prices were hammered during the month.

Iron ore was trading back below $50 a tonne on Tuesday after a speculative bubble in Chinese derivatives in the steelmaking raw material popped during the month. After peaking near $70 mid-April, iron ore has managed to hold onto 16% gains for the year however. Coking coal came close to triple digits in April, but fell back to the early $80s by the end of the month and is now flat for 2016.

Weakening metals prices caused a broad-based sell-off with the top five diversified mining companies by output - BHP, Rio Tinto, Vale, Glencore and Anglo-American - losing a collective $41 billion in market valueCopper's dismal performance in May wiped out year-to-date gains for the red metal. The 2016 rally in other industrial metals also stalled with the exception of little-traded molybdenum which continues to climb from historic lows just above $10,000 struck last year.

Zinc is holding up the best and still sports a more than 18% rise year-to-date. Tin lost more than a $1,000 in May, but technically remains in a bull market after rising 21.6% from its January lows. Ever volatile nickel is now also back in negative territory for the year despite a jump this week following news of a possible strike at South32's Cerro Matoso mine in Colombia, the world's second largest ferro-nickel mine.

Precious metals have had a great year, but in May the gold price succumbed to a stronger dollar and a hawkish Fed declining more than 6%. The rally in silver - the year's best performing precious metal - was aslo severely curbed in May. Silver is now down more than 11% after scaling $18 an ounce for the first time since January 2015 at the end of April. Palladium's move back above $600 an ounce has also been cut short and the precious metal is down year-to-date.

Spot uranium prices continue to struggle near decade lows below $28 a pound and U3O8 has declined by more than 20% in 2016. Potash has also been punished by ample supply with free-on-board prices in Vancouver falling $30 a tonne to $239, down 11% for the month.

Source: Steel Index, LME, YCharts, Comex, Nymex, UX, Infomine, Potashcorp

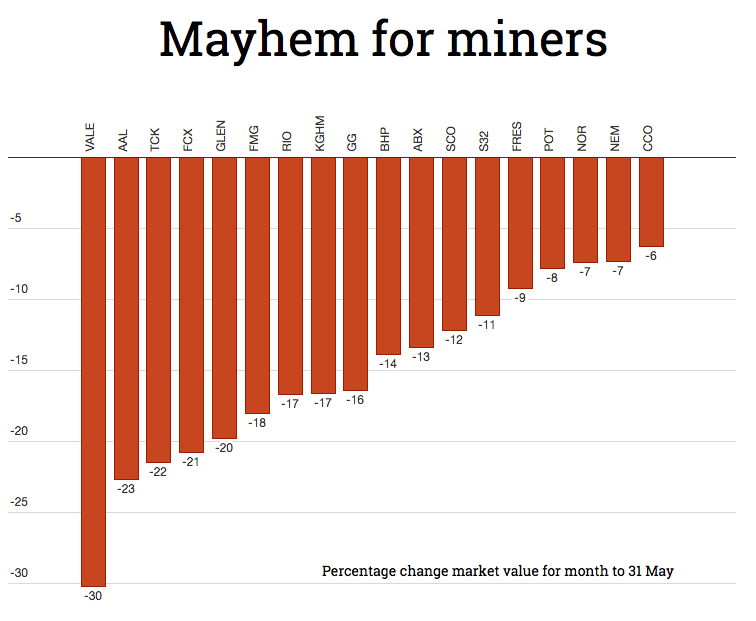

Among the major mining stocks the sell-off has been even more brutal led by Vale and other former high-flyers including Canada's Teck Resources, top copper producer Freeport-McMoRan and Swiss trading giant Glencore.

Rio de Janeiro-based Vale is the world's number one iron ore producer and number two in nickel, but its problems have been compounded by the fallout from a dam burst at its jointly held Brazilian iron ore mine in November. 50-50% owners Vale and BHP-Billiton are being sued for more than $40 billion in damages on top of a $6 billion-plus settlement with the federal government.

The weakening price environment for commodities caused a broad-based sell-off of mining stocks in May, with the top five diversified mining companies by output - BHP, Rio Tinto, Vale, Glencore and Anglo-American - losing a collective $41 billion in market value over the course of month.

Source: Steel Index, LME, YCharts, Comex, Nymex, UX, Infomine, Potashcorp