CHARTS: Halfway through 2018 and the mining rally is over

Mining and metals investors started the third quarter the same way they ended the second, offloading the sector over fears of the impact of a global trade war.

A trade tit-for-tat comes at a bad time just as China, responsible for half the world's industrial metal demand, enters a period of slower economic growth.

"Escalating global trade tensions bring a risk of demand destruction across commodity markets as costs rise for end-users and access to materials is restricted," Morgan Stanley said in a quarterly report issued today:

"China's buoyant mood is giving way to concerns around tightening credit and a slowing manufacturing sector."

"As well as the direct hit to steel and aluminum, tariffs on end markets such as electronics, machinery and autos risk weakening demand for the commodities that feed them," Morgan Stanley said:

"Strong interest in demand from electric vehicle and renewable energy sectors is justified, but it would be unlikely to offset a fall in demand from more traditional commodity end-markets."

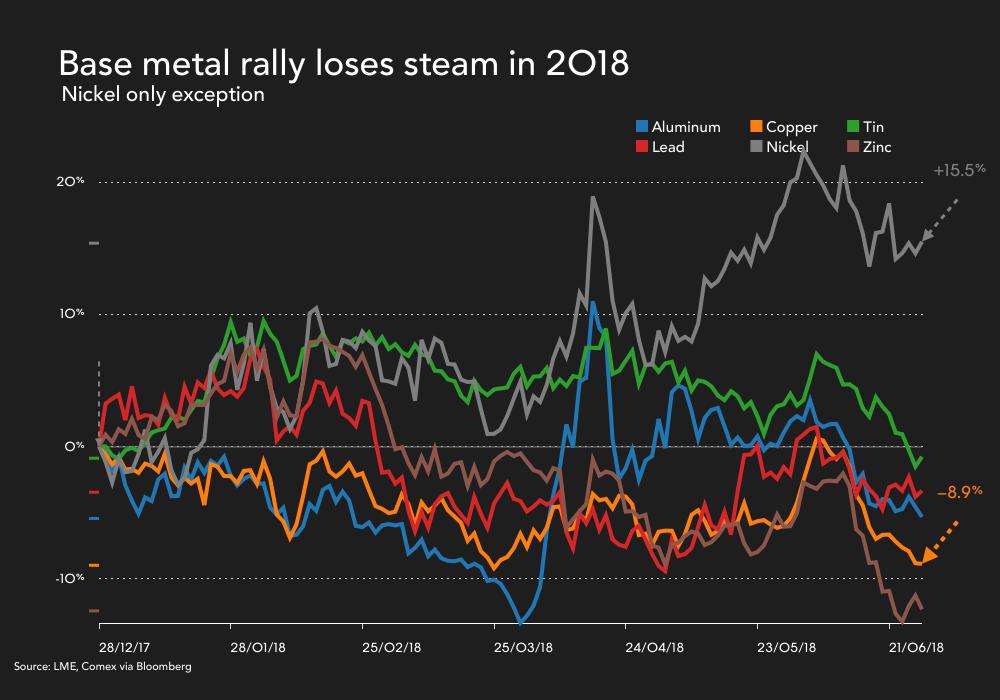

On Monday, copper fell to $2.94 a pound or $6,480 a tonne, pushing the bellwether metal into double digit losses just over the past month. Copper, widely used in manufacturing, transportation, and the construction and power sector, is seen as a barometer of global economic conditions.

With the notable exception of nickel which has been swept up in expectations of a demand boom from electric vehicles, base metals are all trending lower in 2018. Aluminum has given up all the gains it made following supply fears due to sanctions imposed on Russia at the start of the quarter.

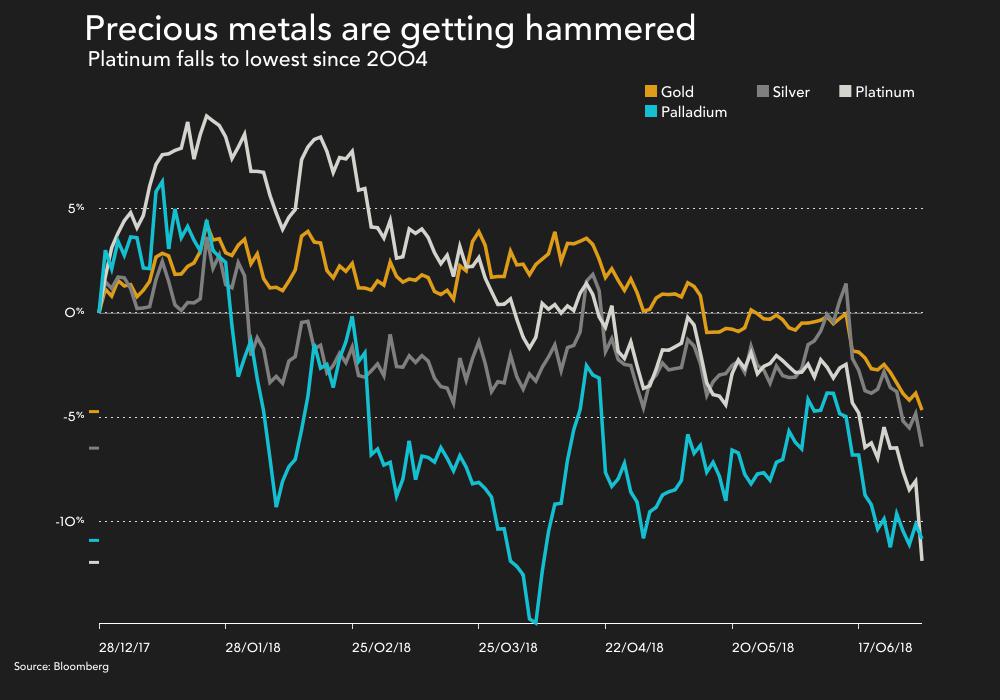

Gold fell to its lowest lowest level for 2018 on Monday at $1,420 an ounce as a stronger dollar adds to headwinds and investors pull money out of gold-backed exchange traded funds. Platinum plunged to levels last seen in 2004 as a spat between the US and the EU over vehicle imports clouds an already negative outlook for the metal mainly used to reduce emissions in diesel cars.