Chile helping miners to stay afloat, but threat of labour reform, lower copper prices loom

Escondida, the world's largest copper-producing mine. Image courtesy of BHP Billiton

Copper mining companies operating in Chile, the world's top producer of the industrial metal, have begun bringing contractors in-house and bracing for salary hikes ahead of a pro-worker reform bill, which on track to be approved this month.

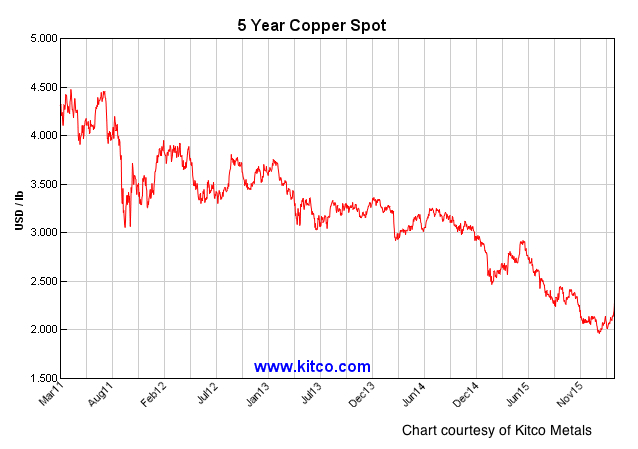

Miners are not happy about the upcoming legislation because they believe it would increase labour costs in a sector already hit by slumping productivity and prices near six-and-a-half-year lows.

But the country's mining minister, Aurora Williams, is quick to provide a wider view on what such regulation would really mean for Chile and its copper industry.

While she acknowledges the bill ultimately increases the power of unions by extending collective bargaining rights and promoting union membership, she notes it also contains unique clauses that will reduce strike frequency.

"Substituting a striking miner in Chile is especially difficult, not only because unions are powerful and have a long and proven success record when it comes to negotiations, but also for technical reasons - it's not easy, for example, to find workers capable of working at 4,000 metres above sea level," Williams told MINING.com in the sidelines of he Prospectors and Developers Association of Canada (PDAC) conference, which kicked off Sunday in Toronto.

Companies say the imminent labour reform would increase costs in a sector already hit by slumping productivity and prices near six-and-a-half-year lows.According to the minister, the desired effect of the proposed law is to improve working conditions and labour regulations. This as it aims to give miners more leverage in a country with loose collective bargaining rules, while also introducing fresh sanctions for certain types of industrial action, which are likely to deter worker unrest.

No mine closures in sight

Chilean Mining Minister Aurora Williams will highlight at PDAC the country's benefits for mining explorers. (Photo provided)

While about 93% of Chile's copper output comes from large mines, analysts say that further drops in copper prices could kill most small and medium-sized miners operating in the country. In fact, the Consejo Regional Minero de Coquimbo (Corminco) - which represents some of Chile's top miners in the copper sector - said in November that the "majority" of its members were already unable to make a profit.

Mining companies in Chile axed some 23,000 jobs last year alone, or about 10% of positions in the sector, making it by far the biggest loser in the country's economy, according to data from the government's INE statistics agency.

The situation, Williams acknowledges, is serious, but not as catastrophic as some have made it sound. She explains that Chile has strict regulations in place that make it hard for companies to close an operation just because of low commodity prices.

"It is a process that has technical, environmental and social implications," she says, adding that when it comes to large=scale miners - the main contributors to Chile's GDP - mine closures are not foreseeable in the near future, as big companies know how to navigate the ups and down of mining cycles.

Chile government buys copper from small miners at a subsidized rate - $2.48 per pound, some 40 cents more than average spot prices.When it comes to small-scale mining, however, Williams says the government is running relevant initiatives, including loans, that are set to increase productivity and strengthen the sector.

Subsidies, loans, "societal" model

Among the most important of those initiatives, state-run mining company Enami purchases copper from such miners at a subsidized rate. Last year, Chile spent some $22 million on this program, and once prices recover the loans must be paid back with interest.

The interesting aspect of this social model for is that loans are not tied to a specific company, but to a group. That means that, once the market recovers, companies that are active at that particular moment in time, collectively, pay the debt.

Chile's government has set aside roughly $20 million through June for the loans and, as February, Enami was paying small miners up to $2.48 per pound for their copper, some 40 cents more than average spot prices, and has said that will not increase at least until midyear.

The goal, says the minister, is to turn the unique and -so far - successful financing model into a law that would include the creation of a "Price Stabilization Fund" to permanently protect Chile's mining industry.

Chile's copper production dropped in January as the year-long rout in prices forced miners to scale back. Even so, Williams said the government continues to forecast the nation's copper output level with last year's 5.76 million tonnes.

What is Chile presenting at PDAC 2016?

Soquimich's (SQM) lithium mine on the Atacama salt flat, the world's second largest salt flat and the largest lithium deposit currently in production.

Chile is looking to boost mining exploration by offering interested parties to partner up with the national mining company (ENAMI) to turn at least ten specific projects into producing mines in the medium-term.

According to official figures, about 59% of Chile's territory has not been permitted yet, which offers interesting opportunities for exploration and exploitation.

The country is also reminding investors that a stake in Chile-based SQM - one of the four global companies controlling the lithium market- is up for grabs after an indirect shareholder, Oro Blanco, invited buyers in December to make an offer for its entire holding.