Chile injects $600 million into state-owned copper giant Codelco

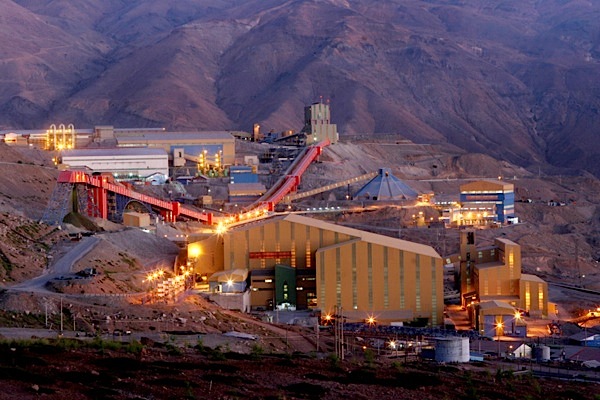

A new mine level being constructed at Codelco's El Teniente, the world's largest underground copper operation and the sixth biggest copper mine by reserve size, will extend its life by 50 years.

Chile's government will give state-owned copper miner Codelco $600 million in funds to finance its investment plans, as the world's No.1 producer of the industrial metal battles to keep up production at its aging mines.

The cash injection, the country's Finance Ministry said in a public statement (in Spanish), is the first instalment of a $3 billion financing plan authorized under a new funding mechanism set up for Codelco.

The decision comes on the heels of a revised investment proposal presented by CEO Nelson Pizarro earlier this week, which saw the original five-year investment plan reduced from $25 billion down to $21 billion.

Codelco's management said the investment cuts were a response to the drop in copper prices, which have fallen almost 18% since January.

But analysts say that the cuts won't be sufficient to reverse a global glut. This, as supply is still perceived as exceeding demand at least in the short term due to weak demand from China, according to a report by broker Huatai Futures Co on Tuesday.

The surplus is forecast to widen as the pace of supply reduction is slower than the demand contraction, it added.

Codelco holds vast copper deposits, accounting for 10% of the world's known proven and probable reserves and about 11% of the global annual copper output with 1.8 million metric tons of production.

However, most of its mines are running out of copper and need heavy investment in order to extend their productive life. The company is also allocating funds to search for new high-grade deposits.