Chile's copper miners still making money despite price collapse

Chuquicamata, the world's largest open pit copper mine. (Courtesy of Codelco via Flickr)

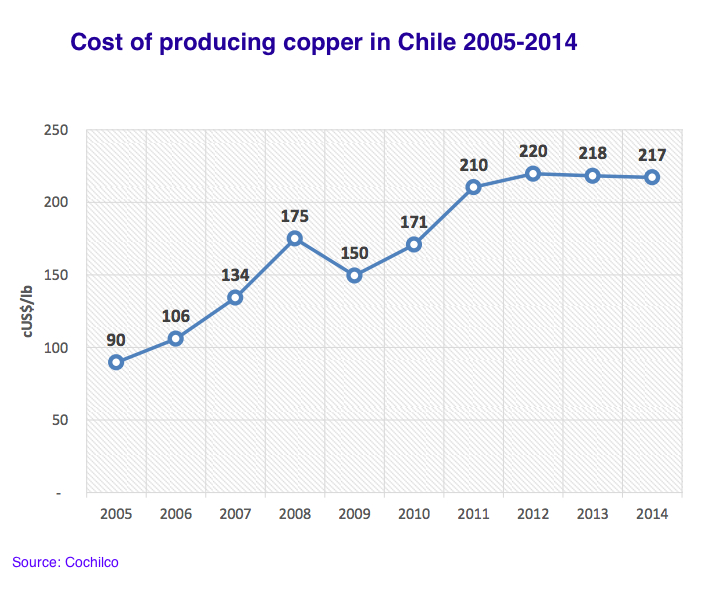

Chile, the world's top copper producing country, surprised investors by publishing for the first time ever detailed data related to costs for nearly its entire mining industry.

According to the recently launched "Costs Observatory," the average cash cost per pound of copper produced in the country during the second quarter of 2015, was $1.625/lb, down from an average $1.655/lb in the same period last year.

The index, which gathers data on production costs for 19 mining operations across Chile, representing 91% of the country's total copper output, also shows that mining companies have benefitted from lower fuel and energy costs, which saved 4.9 cents per pound during Q2. Additionally, lower wages for staff and contractors cut 4.6 cents per pound from costs.

The encouraging figures contradict recent reports from local mining associations, which show that most copper producers in Chile are barely breaking even at current metal prices.

However, the government noted this first report of mining costs is based on data collected up to June this year and, as such, does not reflect measures companies have taken in the last five months to weather weak prices for the industrial metal.

Copper, which is down around a quarter this year, battered by a supply glut and weak data out of top consumer China, fell to their lowest in more a week on Tuesday.

Copper, which is down around a quarter this year, battered by a supply glut and weak data out of top consumer China, fell to their lowest in more a week on Tuesday.

Benchmark copper on the London Metal Exchange traded down 0.1 percent at $4,686 a tonne in official rings. The metal, used in power and construction, earlier touched $4,617, its lowest since December 18.

News that nine large copper smelters in China have agreed to cut sales of spot metal by as much as 200,000 tonnes in the first quarter of 2016 initially provided support.