China Demand Paves Way For Gold Breakout

China's central bank demand for gold supports bullish interim trend.

Only the strong dollar stands in the way of a spring gold rally.

Gold stock internal momentum could use some major improvement.

Increased gold demand from China is making an upside breakout in the gold price later this spring a very real possibility. That's the conclusion from the revelation this week that China's central bank has added to its gold reserves. The news sent many short sellers of the metal scurrying and has helped to boost sentiment over the intermediate-term (3-9 month) outlook. In today's report we'll examine the latest figures from China and how it supports my outlook for a spring rally for gold. We'll also take a look at the gold mining stocks and discuss the conflicting signals that have kept the miners from rallying.

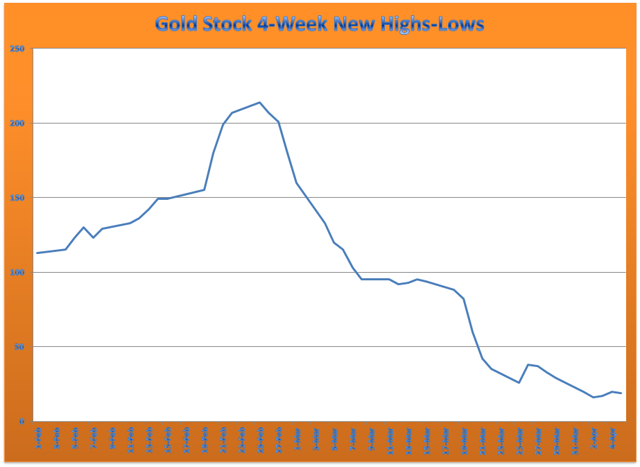

Gold prices rose above the widely watched $1,300 level to start the week after threatening to break below the floor of a 3-month trading band just a few days ago. The latest rally gives gold some breathing room as the buyers try and regain their control over the immediate-term (1-4 week) trend. The latest rally still wasn't enough to push the June gold futures price (below) back above its 15-day moving average, which means that buyers haven't yet formalized their control over the immediate trend. The gold price is also still below the 50-day moving average, so there is still much work ahead for the bulls.

Source: BigCharts

The latest attempt at a gold rally was attributed by one analyst to increased bullion demand from China. Stephen Innes of SPI Asset Management said that the revelation that the People's Bank of China has raised its gold reserves by a notable margin in the last few months triggered short covering early this week. This ties in to what I wrote in my previous report about the intermediate-term gold price outlook being dependent on higher demand from the world's number one gold consumer China. According to data from the People's Bank, its gold reserves increased to 60.62 million ounces in March from 60.26 million in February.

It should be remembered that the world's leading central banks have been on a gold buying spree in the last 12 months, which further supports the metal's longer-term outlook. Central banks added the highest level of gold reserves in 2018 in over half a century, according to the World Gold Council.

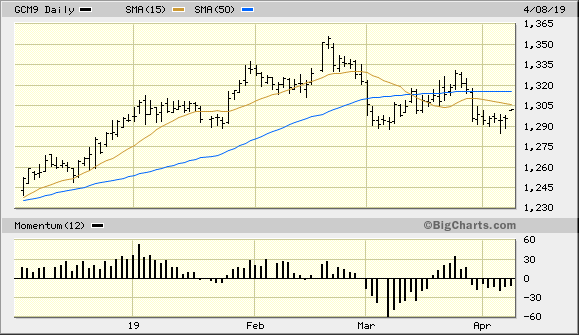

Gold's latest rally attempt meanwhile was supported by a decline in the U.S. dollar index (DXY) to start the latest week. While the gold bugs cheered Monday's pullback in the DXY, the charts show that the greenback still retains a measure of forward momentum and is acting as a headwind for the yellow metal. Shown here is the Invesco DB U.S. Dollar Bullish Fund (UUP), which many traders use to track the trend in the dollar index. UUP is currently above its 15-day and 50-day moving averages and is only slightly under a yearly high.

Source: BigCharts

As I've stated in past reports, we need to see significant weakness in UUP - namely a breakdown below the 50-day MA on a weekly closing basis. This would remove a major obstacle standing in the way of a sustained rally in the gold price. The dollar's strength is also arguably the only thing right now preventing an upside breakout from gold's 3-month lateral trading range.

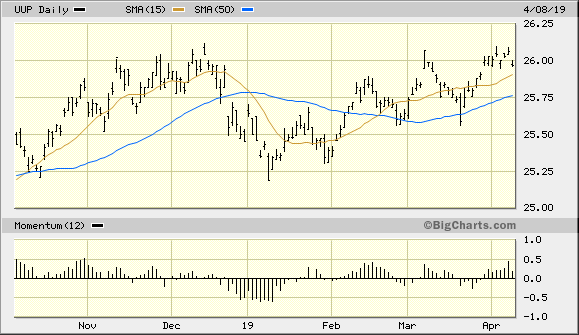

On the ETF front, the iShares Gold Trust (IAU) is still below its 15-day and 50-day moving averages to confirm that its short-term trend is currently neutral-to-weak. However, its 120-day moving average - which has longer-term significance - is still intact and is acting as a confirmation for the rising trend which has been underway for the yellow metal since late last year. While I'm not recommending any new trading positions in IAU until it manages to overcome its above mentioned 15-day and 50-day moving averages (see chart below), the longer-term recovery for the gold ETF can be considered intact as long as the 120-day MA remains inviolate.

Source: BigCharts

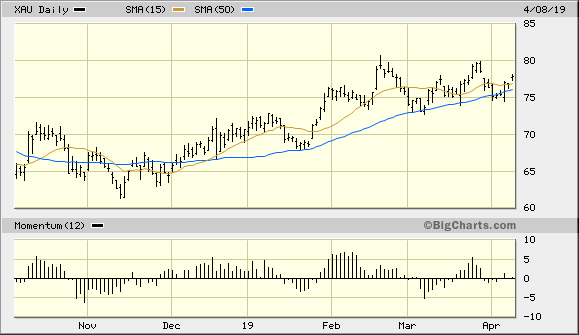

Let's take a look at the gold mining stocks, which I haven't mentioned in this report in a while. My reason for ignoring the actively traded gold shares has been the lack of confirmation between the recent price performance of many gold stocks (which has admittedly been encouraging) and the internal condition of the gold stocks in general. Shown here is the PHLX Gold/Silver Index (XAU) in relation to its 15-day and 50-day moving averages. As you can see here, both key trend lines for the benchmark XAU are rising, and the index isn't far from its 8-month high, which was established in February.

Source: BigCharts

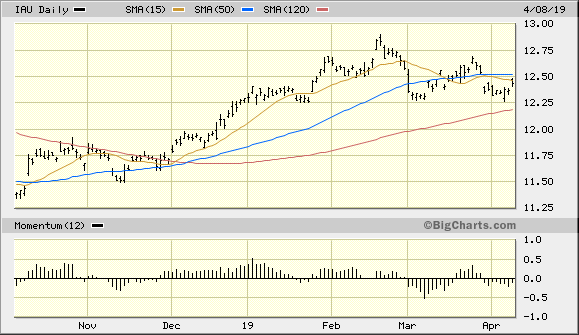

At first glance it would appear to be a sure bet that gold stock prices will head higher in the near term based on the upward trend in the XAU index. And while this may yet turn out to be the case, it would be risky to make this assumption based on the performance of prices alone. For when we look at the trend in the number of actively traded gold shares making new highs and lows we find an entirely different story. Below is a graph which details the declining trend in the 4-week rate of change (momentum) of the new highs and lows for the 50 most actively traded gold shares. This indicator is based on the net number of publicly listed mining and exploration companies that have made new 52-week highs minus lows on a quarterly basis. As you can see, there is a conspicuous negative divergence between the 4-week new highs-lows indicator and the XAU index.

Source: WSJ

This negative divergence between the XAU and the highs-lows isn't necessarily a reason to expect lower gold stock prices in the coming weeks. However, until the new highs-lows indicator shows improvement the conservative approach would be to hold off on initiating new long positions in gold stocks. Experience teaches that only when the trend of the XAU index is in sync with the new highs and lows trend is it safe to buy. It certainly increases the likelihood that the actively traded gold shares will move higher in the near term. But for now a defensive posture is warranted on the gold stocks.

While gold remains range-bound and is fighting to get back above the 50-day moving average, the fundamental and technical factors we've discussed here should keep the metal above the $1,280 level until its next breakout attempt. China's insatiable appetite for the yellow metal is providing a fundamentally supportive backdrop for this bullish outlook, as is increased central bank demand. What we're likely witnessing is a temporary setback for gold due to temporary strengthening of the U.S. dollar along with rising optimism over a U.S.-China trade war resolution. However, we should see renewed global investment demand for bullion by later this spring once gold has consolidated enough strength to break out from its sideways trend. Until that happens, however, gold investors should hold off on initiating new long positions in the yellow metal.

On a strategic note, only if the dollar breaks out to a new 52-week high and continues to rise on a sustained basis would I be forced to reevaluate my bullish intermediate-term gold outlook. While I don't recommend initiating new long positions in gold or the gold ETFs right now, investors are justified in maintaining intermediate-term long positions in gold based on the prevailing fundamental and psychological factors discussed in this report. Short-term gold ETF traders, however, are now on the sidelines and should wait for gold's next confirmed breakout signal before initiating new long positions.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts