China In Talks To Set Up Gold Commodity Corridor

Strengths

? The best performing metal this week was palladium, up 0.11 percent as hedge funds boosted their net bullish in the metal. Gold traders are split between bullish and bearish on the yellow metal after the U.S. dollar rose this week. In the prior week traders were bullish and positive sentiment sent $529 million into the VanEck Gold Miners ETF.

? According to Haywood Cheung Tak-hay, president of the Chinese Gold & Silver Exchange Society, China is in talks with Singapore, Myanmar and Dubai to set up a gold commodity corridor to promote gold trading using yuan as the main currency. This is part of Beijing's "One Belt, One Road Initiative" and would use Hong Kong as a base for the exchange.

? The Russian Central Bank surpassed China to become the fifth-largest sovereign holder of gold, reports Bloomberg. Russia increased its holdings to 1,857 tons, topping China's reported 1,843; however, China has not officially reported its holdings since October 2016. Switzerland's gold imports increased 26 percent in January to 204.5 tons, the highest amount since last September with the majority exported to China and Hong Kong.

Weaknesses

? The worst performing metal this week was gold, down 1.36 percent. Gold fell this week on the heels of a stronger U.S. dollar. UBS strategist Joni Teves writes that gold continues to be sensitive to dollar moves and that equities bouncing back have hurt the yellow metal some. Teves said that gold's year-to-date performance "has to do with the dollar falling as much as 4 percent so far this year, and being down as much as 15 percent since early 2017."

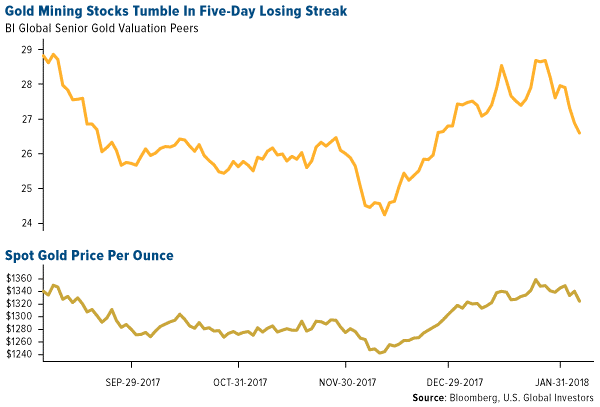

? The gold price fell five consecutive days, the longest stretch since last June after the Federal Reserve meeting minutes from January showed increasing confidence in economic growth, reports Bloomberg. Bullion for immediate delivery fell to $1,321 on Thursday, the lowest since February 14.

? Several gold companies experienced losses in the fourth quarter last year according to Bloomberg First World. Alamos Gold's fourth quarter operating revenue missed the average analyst estimate, coming in at $161.7 million versus estimates of $165 million. Iamgold reported an unexpected fourth quarter loss with a loss per share of 3 cents while estimates were for a loss of 2 cents per share. Torex Gold also reported losses per share of 25 cents versus the estimate of a 12 cent loss per share.

Opportunities

? Analysts are debating how high 10-year Treasury yields will go with median forecasts compiled by Bloomberg see them rising to 3 percent by the end of this year. If history is any guide, during the last five rate hiking cycles the short end of the curve raised the most with the long end largely anchored. If long rates do indeed remain subdued, perhaps the dollar will not see renewed strength which would be positive for the price of gold.

? BMO has picked up coverage of Wesdome Gold Mines with an outperform rating and price target set to C$3.75. SilverCrest Metals has also been given a buy rating with drilling active at their high grade Mexican mine and a new larger resource statement is expected shortly.

? Northern Star Mining recently paid out a 4.5 cents per share, which is higher than estimates of 4 cents. The stock has grown from 2 cents per share up to $6 per share in the last eight years, and its executive chairman Bill Beament says that it is still a "growth stock" with their forecasted production. Newmont Mining Corp almost took over Barrick as the biggest bullion producer in the world, according to Bloomberg. Newmont was just 50,000 ounces, or 125 gold bars, away from claiming the top spot. Newmont doubled its quarterly payout to 14 cents a share and pushed itself ahead of Barrick in terms of market share.

Threats

? At Janet Yellen's final Fed meeting, she and her colleagues received a special briefing on what had gone wrong with the computer models used to forecast price measures and inflation, reports Bloomberg. According to that briefing, the models used seemed to come up short on explaining and forecasting inflation. "Perhaps even more troubling for policy makers is that inflation appears to be anchored below the Fed's 2 percent target," the article reads.

? Canada, the top steel and aluminum exporter to the United States, is hopeful of being exempt of President Trump's crackdown on foreign shipments, reports Bloomberg. Although the U.S. Commerce Department didn't recommend giving Canada a pass during the outline of tariffs and quotas on Friday, it did single out its importance to the U.S. aluminum industry and numerous cross border manufacturing relationships, the article continues.

? Apple has become the latest major consumer to seek long-term supply deals with cobalt firms, which sent China Molybdenum's stock surging as much as 10 percent on the news, reports Bloomberg. In fact, Apple is one of the world's largest end users of cobalt for the batteries inside of its various gadgets, but up until now left the business of buying the metal to the companies that make its batteries. With the rapid growth in battery demand for electric vehicles threatening to create a shortage of raw material, the tech giant maker is "keen to ensure that cobalt supplies for its iPhone and iPad batteries are sufficient," the story continues. This is almost reminiscent of when Ford started switching to a more palladium centric catalyst for emission and drove the price up ten-fold to later fall about 80 percent. However, the next generation of batteries may be cobalt free, as Nano One had developed for commercial testing a high voltage spinel (HVS) using lithium, manganese and nickel. Besides avoiding the high cost and supply chain risk of cobalt, the higher six-volt cells would mean fewer battery cells needed, less weight, less cost extending range, longer lifetime or better warranties, greater storage, faster charging and more power.