China's copper concentrate imports surge again

In New York trade on Wednesday copper for delivery in July bounced back after customs data from top consumer China showed imports of the red metal remain strong.

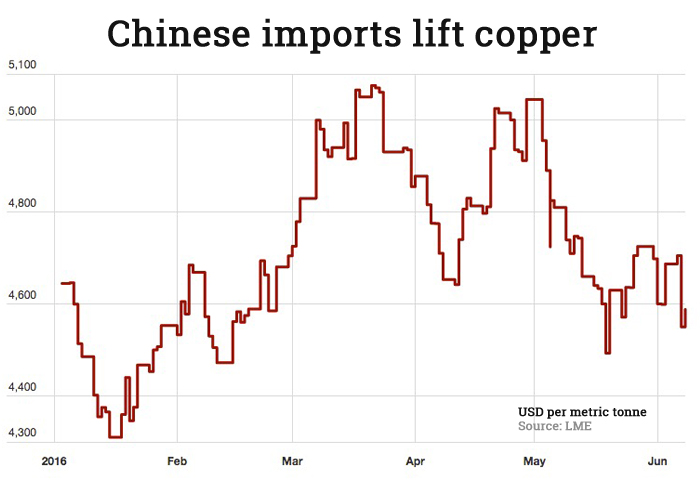

In midday New York trade July copper, the most active contract, exchanged hands for $2.0605 a pound ($4,588 a tonne) up slightly following yesterday's steep decline that pushed the price into negative territory for the year.

China is responsible for more than 45% of copper demand and according to customs data released today the country's imports of unwrought copper and copper products were 430,000 tonnes during May. That's a 3.7% decline from April but up 19.4% compared to May 2015.

Imports for the first five months of 2016 now total 2,310,000 tonnes, up more than 22% from the same period last year. Imports of refined metal hit a record 570,000 tonnes in March.

The increase in copper concentrate imports are even more dramatic. Chinese smelters imported 13% more concentrate last month than April and 45% more than May last year. For the first five months imports are up 34% at 6.7 million tonnes. Concentrate imports hit an all-time high in December.

After more than halving over the past year global LME stocks declined to below 150,000 tonnes in May, but this week shot up more than 20% to 207,000 tonnes on Wednesday driven by massive deliveries into Asia warehouses. Warehouse inventories in Shanghai hit a record high near 400,000 tonnes in March but have steadily declined since then falling to around 215,000.

Despite the sharp reduction in stocks on the SHFE, spot premiums for physical delivery continue to fall, reaching a four-year low of $45 a tonne this week. The premiums paid in an indication of the tightness of the market and the sharp fall from October premiums of $125 a tonne suggests demand remains subdued.