China says Chile move to block $5bn SQM lithium deal could be harmful

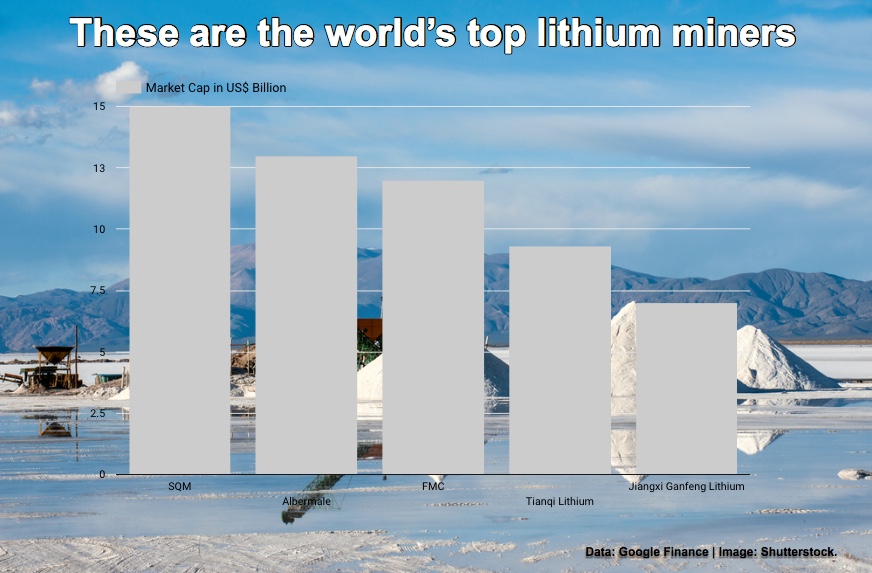

Chinese authorities intervened this week in favour of Tianqi's attempt to grab a 32% interest in Chile's Chemical and Mining Society (SQM), the world's second largest lithium producer, saying that any efforts to block the $5 billion deal could "leave negative influences."

According to Chilean newspaper El Mercurio (in Spanish), Chinese Ambassador Xu Bu openly condemned the move by the country's development agency Corfo, which in March appealed to antitrust regulators to block the sale of SQM stake to Tianqi, the Asian nation's largest lithium producer.

Chile says if China's Tianqi grabs a stake in lithium miner SQM, the top three producers would control at least 80% of the global market by 2020.Bu said opposing the stake sale could "leave negative influences on the development of economic and commercial relations between both countries."

He also refuted former Corfo vicepresident's claims that China's government was involved in the negotiations, as the country's strategy is to concentrate production of strategic resources.

During his term at Corfo, which oversees SQM's lithium leases in the Atacama Salt Flat, Eduardo Bitr??n repeatedly said a sale to Tianqi or any company backed by China could affect "the competitive rivalry of the lithium market," a key mineral used in the manufacture of batteries for electric cars.

Nutrien (TSX:NTR), born from the recent merger between Potash Corp. and Agrium, has to sale its interest in SQM by April 2019, as part of the condition of the business combination that created the company.

US chemical company Albemarle Corporation (NYSE:ALB), which is also said to want the stake in the Chilean lithium producer, is a close partner of Tianqi.

Albemarle has a 49% stake in Talison Lithium, with Tianqi owning the other 51%. That relationship is seen as threatening for Chile because Talison is not only a major player in the market, but it's also developing several lithium projects in Chile and Australia.

Chile's National Economic Prosecutor's Office has until August to decide whether to pursue the case filed by local authorities. Tianqi officials met with the office on March 29 to discuss the issue, according to local newspaper La Tercera (in Spanish).

Speaking to that media outlet, Bitr??n said he had seen classified documents that prove Tianqi presented in late in 2017 a "non-binding" offer for Nutrien's stake in SQM, which was more than 20% over market value at the time.

He also said those documents confirmed that together, Albemarle and Tianqi have 34% of the global lithium market, through Talison.

Bitr??n warned that due to Talison, Albemarle and SQM recently announced plans to hike production, the companies would end up controlling at least 80% of the world lithium market by 2020, should Tianqi be allowed to buy a stake in the Chilean company.