China Streaming Stock Eyes Technical Trouble

Huya's 80-day moving average has had bearish implications in the past

Huya's 80-day moving average has had bearish implications in the past

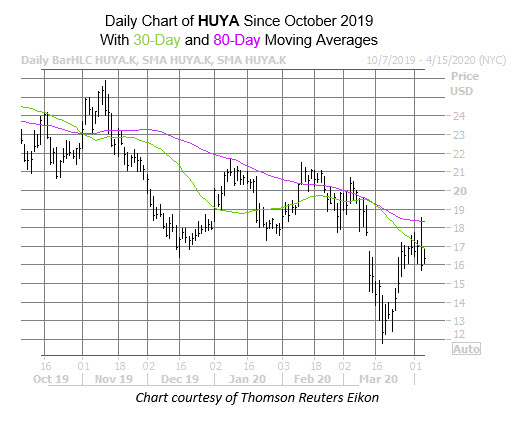

Shares of the Chinese gaming platform HUYA Inc (NYSE:HUYA) are making another attempt to close their early March bear gap today, up 3.1% at $16.46 at last check. This comes right on the heels of Friday's failed rally, sparked by news that Tencent (TME) moved forward with an option, making it the majority shareholder in HUYA. While the equity briefly closed its aforementioned bear gap, it eventually pivoted lower after running into its 80-day moving average -- a trendline that, if history is any indicator, could mean trouble for HUYA going forward.

This is per a study from Schaeffer's Senior Quantitative Analyst Rocky White, showing three similar run-ups to the 80-day moving average in the last three years. This study shows that one month after two of these signals, HUYA was lower, averaging a one-month negative return of 3.07%. A similar move, from its current perch, would put the online gaming concern at $15.95.

The 30-day moving average, as well as the $17 level have also helped to squash HUYA's recent attempts to rally off its March 18 all-time low of $11.78. Plus, the security is still down 8.9% year-to-date, and 37% year-over-year.

Despite this, the brokerage bunch has maintained a sunny outlook on HUYA, which could lead to some headwind-inducing downgrades and/ or price target cuts down the line. In fact, all but one analyst in coverage considers it a "buy" or better, while the consensus 12-month price target of $22.38 is a lofty 36.9% premium to current levels.

While calls are still outnumbering puts at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) on an overall basis, HUYA's 10-day put/call volume ratio of 0.53 sits in the 87th percentile of its annual range, meaning options players have been reaching for long puts at a quicker-than-usual clip.

That being said, now looks like a good time to speculate on HUYA's next move with options. The security's Schaeffer's Volatility Index (SVI) of 68% sits higher than just 12% of all other readings from the past year. This means options players are pricing in relatively low volatility expectations right now.