Chinese commodity demand: Crisis. What crisis?

Future looks brighter

Tuesday was another bleak day on commodity markets.

The price of crude oil ($37.65) and iron ore ($38.80) dropped again and the globe's two most traded raw materials are now at levels prior to the word supercycle even entering the popular lexicon.

Similarly precious metals and industrial continued to drift lower with bellwether copper exchanging hands barely above seven-year lows ($2.04) and coal (thermal $51, coking $72) continuing its inexorably decline.

The world's major mining companies were trading even weaker than their products would suggest with stock valuations reaching decade or more lows.

On Tuesday billions more wiped off the market value of BHP Billiton (-3.7%), Rio Tinto (-8.6%), Vale (-6.3%), Freeport McMoRan (-5%), Glencore (-6.9%) and Anglo-American (-12.7%) in New York.

The fact that the mining and metals are being overwhelmed by negative sentiment and that sector investors are willing to shrug any positive developments were very much on display on Tuesday.

Data released by Chinese customs early in the day showed the country's total import bill falling by 8.7% year on year in November. That was better than the 18.8% plunge in October but the weakness in the headline numbers gave bears an excuse to start selling again.But the US dollar figure masks a significant underlying recovery in demand.

In volume terms, overall imports of commodities accelerated by 17% compared to the same month last year. It was the greatest jump for almost two years.

Chinese iron ore imports surged 22% in November year on year and 8.8% compared to October. Imports for the first eleven months were up just 1.3% compared to 2014, but last year was a record breaking year.

Copper shipments was just as strong with inbound shipments of refined metal rising 9.5% to 460 000 tonnes from a month earlier and racking up double digit gains compared to last year.

While year to date copper imports are down slightly, ore and concentrate imports rocketed 37% to a record 1.44 million tonnes compared to October and for 2015 imports of copper mine output is growing by double digits.

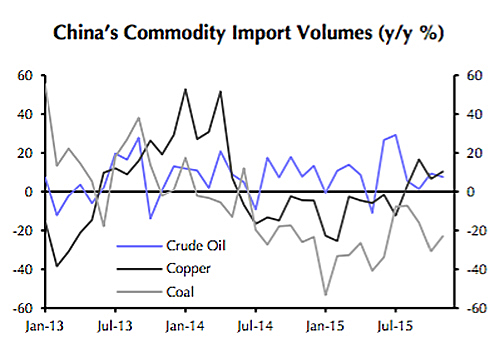

As this chart from Capital Economics shows crude oil imports are picking up again and even the decline in coal seems to be arrested.

John Kovacs, senior commodities economist at the independent research firm expects that overall commodity import volumes will increase further in 2016 due to an expected improvement in economic activity, a further lift from government policy support and an appreciation in the renminbi."

"This increase in Chinese commodity imports in turn supports our forecasts for a recovery in prices next year," says the research note.

Source: Capital Economics