Chinese factory jobs are disappearing - copper pays the price

The copper price fell again on Wednesday and is now down more than 10% over the past month as the economic news out of number one consumer China continues to rattle investors.

In morning New York trade July copper, the most active contract, fell more than 2% exchanging hands for $2.0515 a pound ($4,522 a tonne) following a reading of Chinese manufacturing activity that Beijing's economic stimulus program is already running out of steam.

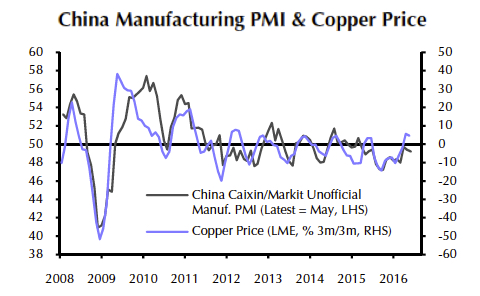

After a strong first quarter, the Caixin manufacturing purchasing managers' index (PMI) for May fell back for the second month in a row to 49.2. While the reading was only marginally lower than April, base metal bulls were hoping for a continued recovery .

Source: Capital Economics

A reading below 50 indicates weakening operating conditions and the index has now been stuck below neutral territory for fifteen months straight. May's reading was hurt by a drop in new orders and export contracts, pricing and most worryingly the rate of factory job losses in May were close to a post-global financial crisis record.

Zhengsheng Zhong, Director of Macroeconomic Analysis at Caixin Insight said "Overall, China's economy has not been able to sustain the recovery it had in the first quarter and is in the process of bottoming out. The government still needs to make full use of proactive fiscal policy measures accompanied by a prudent monetary policy to prevent the economy from slowing further."

China, the world's second largest economy, is responsible for 46% of total global copper demand of some 22 million tonnes and the country's PMI data is particularly closely correlated to the copper price.

Capital Economics in a research note says the latest data "adds weight to the view that the earlier rallies in the prices of copper and other industrial metals may have been premature.

Despite the added risk of a renminbi devaluation which makes commodities priced in dollars more expensive, the independent research house expects the copper price to recover in the second half of this year and into 2017. By the end of the year Capital Economics see copper near $2.50 a pound ($5,500 a tonne) rising to $2.60 a pound ($5,750 a tonne) by the end of the second quarter of 2017.