Co. Building a Multi-Asset, Low-Capex Gold Producer

Ron Struthers of Struthers Resource Stock Report explains the potential he sees in Minera Alamos Inc. (MAI:TSX.V; MAIFF:OTCQB) to evolve into a multi-asset gold producer.

Ron Struthers of Struthers Resource Stock Report explains the potential he sees in Minera Alamos Inc. (MAI:TSX.V; MAIFF:OTCQB) to evolve into a multi-asset gold producer.

Today, we are looking at a junior exploration company going into production. Minera Alamos Inc. (MAI:TSX.V; MAIFF:OTCQB) is transitioning from a single-mine ramp-up story in Mexico into a multi-jurisdiction gold producer after two key acquisitions this year: the Copperstone mine in Arizona (via Sabre Gold) and the Pan/Gold Rock/Illipah package in Nevada (acquired from Equinox/Calibre U.S.A.).

With Santana ramping, Copperstone targeted for restart, and Cerro de Oro nearing permits, the company has line-of-sight to a materially larger, diversified production base over the next five years.

Share Price: $0.33Shares Outstanding: 580.8 million52W Range: $0.225 - $0.49 Revenue: $9.928 millionNet Income: -$51.099 millionMinera Alamos currently has a market capitalization of approximately CA$187 million.

As of December 31, 2024, the company held cash and cash equivalents of CA$11.76 million, down slightly from CA$13.75 million a year prior. While specific quarterly burn rates haven't been disclosed, the year-over-year cash decline suggests moderate cash usage amid operational and corporate development activities in 2024.

To fund its transformational acquisition of Calibre U.S.A. from Equinox Gold valued at US$115 million (US$90 million in cash plus US$25 million in equity consideration) Minera Alamos has successfully closed a CA$110 million bought-deal private placement (including a CA$25 million underwriters' option), fully allocated thanks to strong investor demand.

This equity raise provides the necessary liquidity to complete the acquisition, substantially rebalancing the company's capital structure and positioning it for immediate production and future growth. Now let's dive right into the properties, management team, and near-term outlook of MAI. Buying now around $0.325 - $0.33 gets you in fractionally lower than the big guys in the recent deal.

Core Assets & Properties

Santana Gold Mine (Sonora, Mexico) Operating; ramp-up phase

Status & plan: Heap-leach, open-pit operation. First gold in Oct-2021; in mid-2024 MAI re-worked the mine plan and initiated mining at the Nicho Main Q4-2024 saw improved performance; the company expects higher 2025 output vs. 2024/2023 as the new plan takes hold. A partial leach-pad expansion is planned around mid-2025.Recent operating color: Mining/stacking at Nicho Main restarted June-July 2024 (approx. 900 oz stacked in June; 1,300-1,500 oz guided for July placement during start-up). As of Dec-31-2024, ~10,226 recoverable ounces sat on the pad inventory for leaching into 2025.Geology & upside: Breccia-hosted, intrusive-related gold system with multiple surface breccia pipes; MAI continues systematic target generation around Nicho and satellite pipes.Santana provides operating cash flow and a platform that MAI has used to bootstrap growth.

Cerro de Oro (Zacatecas, Mexico) Development; permits in process

Status: 100% owned oxide gold project advancing through permitting; engineering and metallurgical optimization continue so construction can follow permit In Aug-2024, MAI made the final option payment and now owns the project royalty-free.PEA basis: Open-pit, heap-leach scenario with resources based on 2022/2023 estimates (oxide/heap-leach parameters used). MAI's presentations outline the mine concept and costs for a low-capex build consistent with the company's playbook.Cerro de Oro is designed as the next build in Mexico, adding scalable oxide ounces with modest capex once permits arrive.

La Fortuna (Durango, Mexico) Advanced; permitted federal approvals in place

Status: 100% owned high-grade open-pit gold project with positive 2018 PEA and federal permits secured for key The project carries a capped 2.5% NSR that Argonaut sold to Metalla in 2021.2018 PEA highlights: ~50 koz AuEq/yr concept, low capex and rapid (25 years across mining analysis, M&A, and corporate development; former Great Bear director.Janet O'Donnell CFO. Former CFO at Castle Gold and Gowest; deep experience in mine-level financial operations.Federico ?lvarez, M.Eng COO. 35 years' Mexico operating leadership; ex-VP Operations at Argonaut/Castle Gold.Miguel Cardona VP Exploration. Led 3x resource growth at El Castillo; discovery experience at Los Filos/El Lim?n.Carolina Salas VP Technical Services. Metallurgy/process specialist (gold & copper) with design/operations background across Mexico.Victoria Vargas VP IR. Former Alamos Gold IR leader; broad capital-markets and comms experience.Kevin Small, P.Eng EVP Mining Operations (Copperstone). Ex-CEO Jerritt Canyon; formerly Director of Mining Ops at Beta Hunt; brought in to lead Copperstone's restart.Incoming Chair: Jason Kosec (capital markets and development background), enhancing board-level growth and financing expertise.This is a team that has repeatedly taken low-capex, heap-leach gold assets into production and is now complemented by U.S. underground restart expertise.

Equinox Gold Corp. (EQX:TSX; EQX:NYSE.A) plans to maintain a 9.9% ownership in Minera Alamos.

Key Drivers for the next 12 - 24 Months

Santana: continued quarter-over-quarter operating improvement post-pad works and optimized mine plan.

Copperstone: financing package finalization, plan-of-operations adjustment approval (targeted late- 2025), then restart execution into 2026.

Cerro de Oro: Mexican permit issuance and construction decision; ongoing metallurgy/engineering to shorten time-to-build.

Nevada platform: integration of Pan and a development plan + schedule for Gold Rock leveraging Pan infrastructure. Deal closed Aug 5, 2025.

Funding: deployment of proceeds from the CA$110M bought deal and any project-level debt packages (esp. Copperstone).

Potential Risks

Permitting timelines (Mexico): MAI notes signs of an improving 2025 landscape, but timing remains a variable for Cerro de Oro.

Restart execution (Copperstone): Underground ramp-up and plant refurbishment carry schedule and cost risk; MAI is adding seasoned personnel and pursuing project finance.

Integration (Nevada): Maintaining Pan's output while advancing Gold Rock; sequencing and capex discipline are critical to deliver the >175 koz/yr potential cited by the company.

Commodity & FX: Gold price sensitivity is material for PEA/NPV outcomes; MXN/CAD volatility affected 2024 results via non-cash FX something to monitor.

Value/Ounce Gold

Their 5 projects contain 1,469,000 ounces of M&I gold. Cerro De Oro had a pre-feasibility on 790,000 ounces of inferred resources, so I will include 1/2 of these ounces. That gives a total of 1.864 million ounces.

Considering the recent financing of $135M (includes $25M over allotment) to obtain some of these projects will result in issuing 380.2 million shares plus the previous 548.7M = 929 million shares outstanding.

The current market cap at CA$0.34 is CA$315.85 million minus $45 million cash ($90M used to buy assets) = about CA$270.85 million enterprise value. That is about US$196 million, so it is a value of US$105 per ounce. That is a low valuation for what will soon be a mid-sized producer.

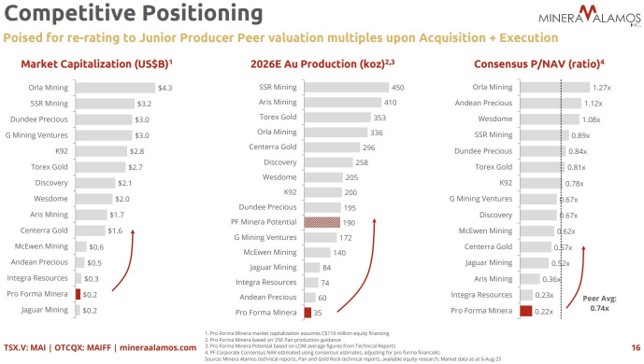

The next graphic, a slide from their presentation highlights the great value the stock ate current prices offer compared to their peers.

Bottom Line

Minera Alamos has quietly assembled a three-pillar platform: (1) operating Santana in Mexico; (2) a permits-advancing oxide build (Cerro de Oro) plus La Fortuna optionality; and (3) a U.S. growth hub with Copperstone (restart) and Nevada (Pan producing + fully permitted Gold Rock).

With fresh capital raised, an enlarged technical team, and multiple near-term catalysts, MAI is positioned to evolve into a multi-asset gold producer over 2026-2028 provided it executes on permits, financing, and integration.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Ron Struthers: I, or members of my immediate household or family, own securities of: Minera Alamos Inc. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.