Cobalt thrifting in EV batteries won't dent price any time soon

Even best-case, early roll-out of new cobalt-light batteries won't solve supply issues

Cobalt, a crucial element in batteries for cellphones and electric vehicles, has been drifting lower since hitting near 10-year peaks on the LME in March, but is still up nearly fourfold from its 2016 trough.

Mindful of the fact that the volatile commodity reached $115,000 a tonne a decade ago, long before EV demand was included in price projections, battery makers have been working hard to find a substitute for cobalt, or at least reduce the required loading to as little as possible.

To reduce cobalt to such a minor role - the major element involved in stabilising the battery - brings with it huge risk, especially in the first wave of pure EV models to hit the road when safety scrutiny is at its highestLithium-ion batteries using nickel-cobalt-manganese (NCM) cathodes favoured by most vehicle makers contain around a third cobalt with a chemical composition of 111 - 1 part nickel, 1 part cobalt and 1 part manganese.

Battery manufacturers (with ample pressure from the auto industry) are hard at work to get the mix to 811 or better. NCM batteries with 523 (20% cobalt) chemistries are being mass-produced and Tesla claims its nickel-cobalt-aluminum (NCA) technology has cobalt content equivalent to 811.

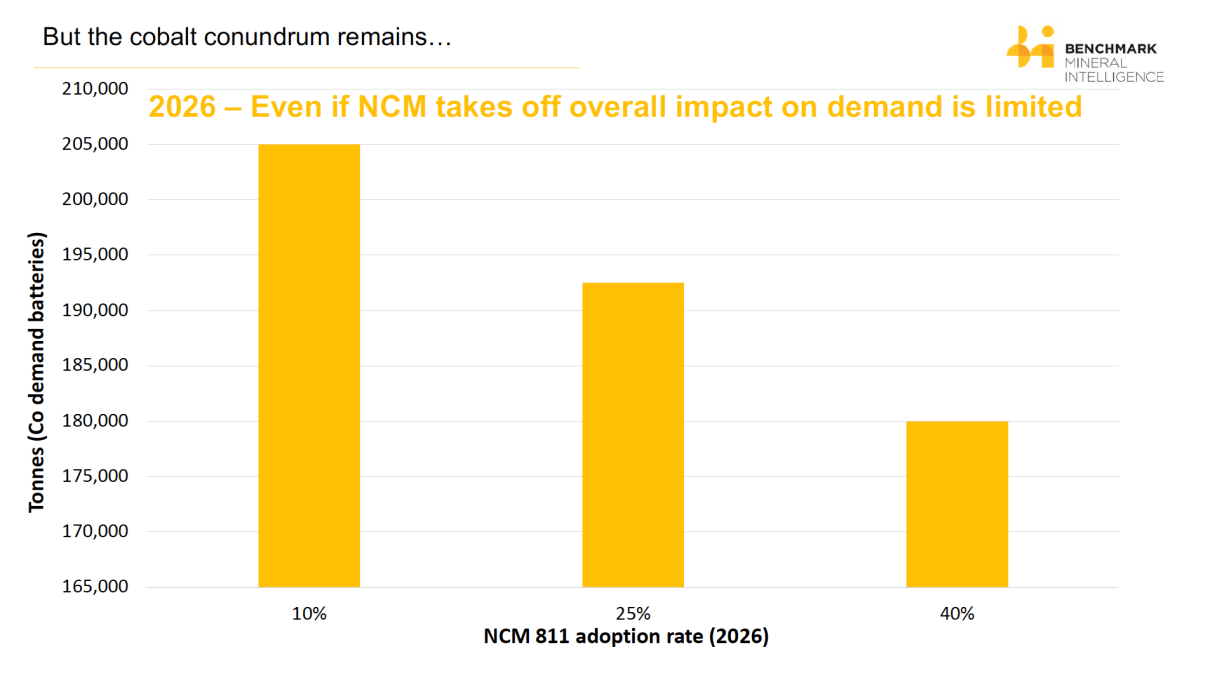

In a trenchant new note Benchmark Mineral Intelligence, a provider of price information and research on battery supply chains, warns that the impact of 811 "is going to be minimal in the short term".

The London-HQ firm forecasts 811 will not exceed 5% of total NCM cathode production until after 2020 and reducing the cobalt would not necessarily lower cost:

Current technology dictates that 811 cathodes need to be produced in an inert environment as to prevent any reaction with the atmosphere. Therefore, any new cathode plant producing this material will need to build a new, dedicated, inert atmosphere, production line specific to 811.

Benchmark calculates that even with the most ambitious roll-out of 811 battery technology - 40% market share by 2026 - output of battery grade cobalt would have to more than triple from last year's production of 50,000 tonnes (out of total cobalt production of just over 100,000 tonnes).

Benchmark points out that there are other risks associated with cobalt thrifting which has the potential to have a huge impact on wider adoption of EVs:

To reduce cobalt to such a minor role - the major element involved in stabilising the battery - brings with it huge risk, especially in the first wave of pure EV models to hit the road when safety scrutiny is at its highest.