Coca-Cola Stock Could See More Downside After Earnings

KO's 120-day trendline is emerging as resistance

KO's 120-day trendline is emerging as resistance

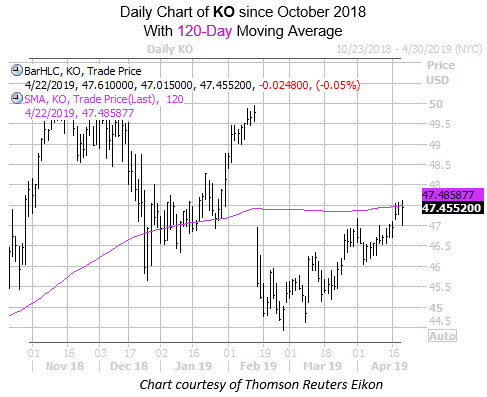

The Coca-Cola Co (NYSE:KO) is scheduled to report first-quarter earnings before the market opens tomorrow, April 23. The security has been stuck beneath several layers of resistance since its mid-February post-earnings bear gap, including the $47.50 region -- near its year-to-date breakeven mark at $47.35 -- and its 120-day moving average, a former floor that now appears to be emerging as a ceiling for the shares. At last check, KO stock was down 0.05% at $47.46.

Moving onto Coca-Cola's earnings history, KO has closed lower the day after the company reported in four of the past eight quarters, including an 8.4% plunge last quarter. Over the past two years, the shares have swung an average of 2.1% the day after earnings, regardless of direction. This time around, the options market is pricing in a loftier 4.1% swing for Tuesday's trading.

From a broader perspective, options traders have been call-heavy on Coca-Cola stock for weeks. Data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows speculators have bought to open 1.87 calls for each put over the last 20 sessions. A shift in sentiment from this group could create additional headwinds for KO stock.

Further, of the handful of brokerage firms covering the Dow stock, six sport "strong buy" recommendations. Plus, the stock's average 12-month price target sits at an elevated $50.38. This leaves the door open for a round of downgrades and/or price-target hikes on another post-earnings slump.