Codelco vows not to cut copper output even if prices keep falling

Codelco's Chuquicamata is the world's largest open pit copper mine.

Codelco, the world's biggest copper producer, rained on all the metal bulls' parade Tuesday, as the company said it plans to keep output targets and warned investors not to expect any dramatic changes to its $25 billion investment plan.

Unlike its peers, particularly the No.3 copper miner Glencore, Codelco doesn't intend to hold back output. The state-run company, instead, will push ahead with its annual target of producing 1.6 million to 1.7 million metric tons this year and in 2016.

"All the announcements the CEO of Codelco has made about downsizing and optimizing [Chuquicamata, Andina and El Teniente], to be very frank, have absolutely nothing to do with copper prices," Codelco's chairman, Oscar Landerretche, told The Metal Bulletin (subs. required).

His comments come only days after mining and commodities giant Glencore said it would slash its zinc output by a third after the price of the industrial metal fell to a five-year low on concerns about slowing economic growth in China.

They also follow the decision by Chile's second-biggest copper mine Collahuasi, jointly owned by Anglo American and Glencore, to cut output by 30,000 tonnes per year.

But Landerretche, who has a Ph.D. in economics from Massachusetts Institute of Technology, believes Codelco mines can stay profitable even if copper prices don't pick up.

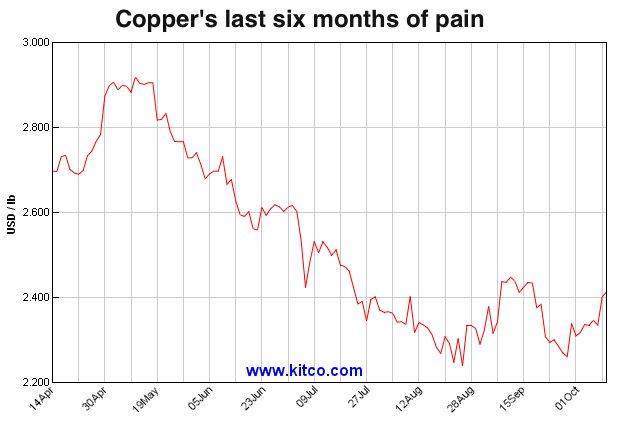

Source: Kitco Metals

The company expects prices to trade in a range of $2 to $2.50 a pound for the next few years. If they happen to drop below $2 a pound, Landerretche said, then Codelco may consider trimming production.

Rivals Rio Tinto (LON:RIO) and BHP Billiton (LON:BLT) (ASX:BHP) have followed a similar path. The companies have been ramping up production of their main commodities during the current price rout, betting that their low-cost assets will enable them to survive and maintain market share while higher-cost producers go bust.

Chile's Mining Minister Aurora Williams said Monday the government has no plan to raise Codelco funding for now, as it has already pledged $4 billion until 2020. (Image courtesy of Chile's government)

Even with copper prices in the pits, Rio has spent billions of dollars expanding output at its giant Oyu Tolgoi copper project in Mongolia, and is preparing a second underground phase of the mine.

BHP, in turn, has stated it believes the outlook for copper in the medium term remains "strong and healthy," as stated by The Olympic Dam President, Jacqui McGill, this week.

And while the company recently axed 380 positions at its Olympic Dam copper, uranium and gold mine in South Australia's far north, BHP still expects the operation to remain a key contributor to the global market.

Traders and analysts alike don't seem as optimist. Some, such as Kingdom Futures, believe the metal might not recover unless producers voluntarily leave more of the metal in the ground, especially in Chile, Africa's copper belt and the U.S.

Chile's Mining Minister Aurora Williams said Monday the government has no plan to raise Codelco funding for now, as it has already pledged $4 billion until 2020.

Williams also told Reuters that she expected some producers to exit the market, a move that should boost copper prices.