Coeur Mining: One Of The Most Undervalued Gold And Silver Miners

The recent correction in the sector has halted CDE's advance. Nothing has changed that would alter my opinion of the company. In fact, the fundamentals have improved even more since August.

In September, CDE agreed to exchange $20 million of its Senior notes for its common stock, and it also made an "at the market" offering of $75.0 million.

These two stock offerings have resulted in a $93.9 million reduction in net debt in one fell swoop, and it's possible net debt declined even more in Q3 thanks to FCF.

If CDE was above $15 in 2016, I see no logical reason why it can't get above $10 in the next 6-12 months.

Coeur Mining's (CDE) stock currently trades at under $5 a share. I believe CDE will be in the double digits within the next 6-12 months. In this article, I will explain why.

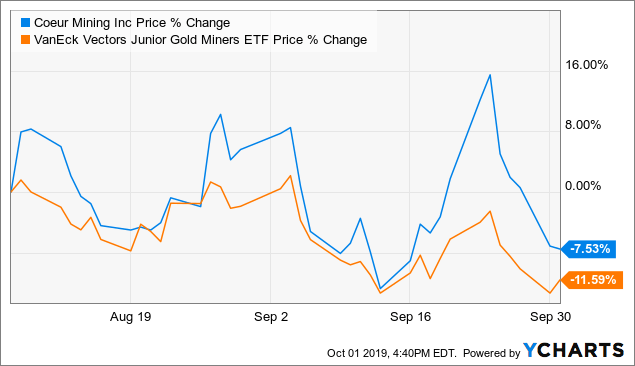

Performance Of CDE Since My Last Article On The Company

In early August, I discussed why I was ramping up exposure to Coeur Mining. Since then, the shares have declined by over 7% as the entire sector has been correcting. However, CDE is still holding up better than most small- and mid-cap gold and silver miners, and at one point last week was breaking out to new highs for the year even though the entire group was lower for the month. Over the previous five trading sessions, though, CDE has succumbed to the intense selling pressure taking place in the mining shares and physical metals.

Data by YCharts

Data by YCharts

I was aggressively loading up on CDE a few months ago because it was extremely cheap, and I believed the stock would start outperforming by a wide margin. It was on that path of outperformance, but the recent correction in the sector has halted CDE's advance. Nothing has changed though that would alter my opinion of the company. In fact, the fundamentals have improved even more since August as Coeur made drastic progress in reducing its debt in Q3.

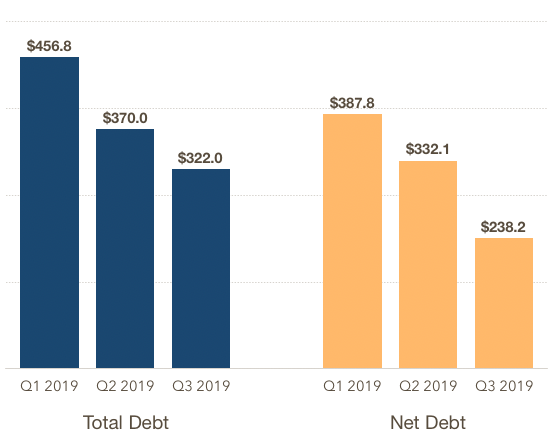

Coeur Has Likely Trimmed Net Debt By Almost 40% Since Q1

My main issue with CDE before August was the high levels of debt. Last year, the company's outstanding debt was on the rise, and by Q1 of 2019, it stood at $456.8 million (with net debt at $387.8 million).

In Q2, the company repaid $82.0 million of debt, mostly thanks to a $50 million equity offering and $25 million prepayment that was received - as Coeur favorably amended the gold concentrate agreement on its Kensington mine in Alaska.

This was already a strong start at lowering its debt and was reason enough to turn more positive on the stock. I assumed that the robust metal price environment in Q3 would further bolster the balance sheet, but CDE was making moves on the equity side as well. In September, the company agreed to exchange $20 million of its senior notes for 4,452,479 shares of its common stock, and it also made an "at the market" offering of $75.0 million of its common stock (raising net proceeds after sales commissions of approximately $73.9 million).

I would rather see net debt decline because of free cash flow and not dilution, but these two stock offerings have resulted in a $93.9 million reduction in net debt in one fell swoop (all things being equal).

It's impressive that despite just over 8% dilution last month, the stock has still been able to outperform.

The Q3 report hasn't been released, so the amount of free cash flow that was generated during the quarter is unknown at this point. Which means so is the actual net debt levels. If we assume FCF was $0, then below is how the debt picture would look and the progression. In this scenario, from the end of Q1 to the end of Q3, net debt has been reduced by almost 40%. As to how I'm arriving at the $322 million figure for total debt: 1). There is a $20 million reduction in debt because of the debt for equity exchange, and 2). the company also implied in its latest presentation that there was $25 million outstanding under the revolving credit facility (or a reduction of $28 million in the quarter).

(in millions)

(Source: SomaBull)

An Even Greater Reduction In Net Debt Is Possible

If Coeur generated free cash flow in Q3 - which I believe is possible thanks to increased metal prices and production - then net debt will be even lower than the projections above.

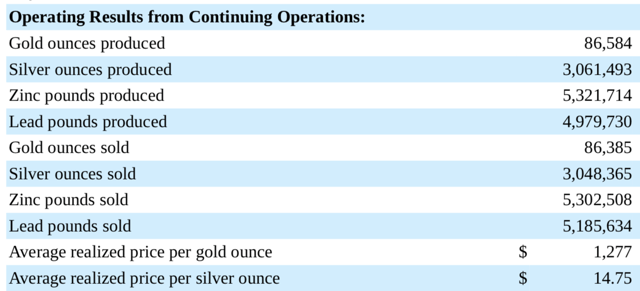

Below are Coeur's Q2 operating results, which include the amount of gold and silver ounces sold as well as the average realized price per ounce for those two metals. The company sold its gold in the second quarter at an average price of $1,277 per ounce, and silver was sold at an average price of $14.75 per ounce. It should be noted that CDE has a lower realized price for gold (compared to the actual average spot price) due to the stream on its Palmarejo mine.

(Source: Coeur Mining)

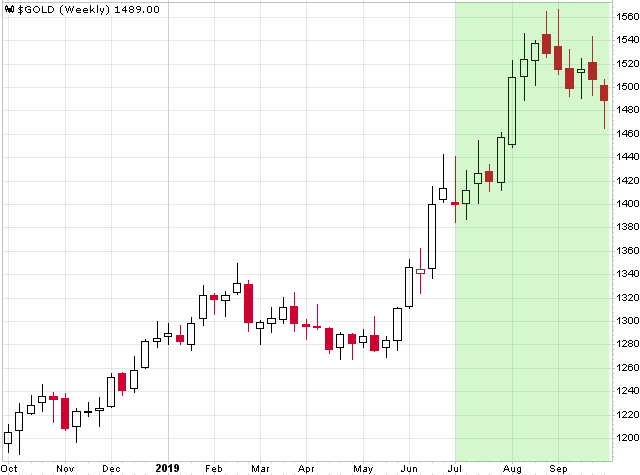

Gold began to ramp up in late May 2019, and about one month of this price appreciation was reflected in the Q2 results. However, since the end of Q2 (when gold was around $1,400), the price has only increased in value. I highlighted the third quarter in the chart below, which shows gold averaged between $1,450 and $1,500 (or roughly $200 more than the average price CDE realized in Q2 if we take the midpoint of that range). If we adjust for the stream, I estimate the average realized price per gold ounce for CDE was around $1,425-1,450 in Q3. At the expected average production rates per quarter in H2 2019, that means an additional ~$15 million of revenue was generated in Q3 because of the higher gold price.

(Source: StockCharts.com)

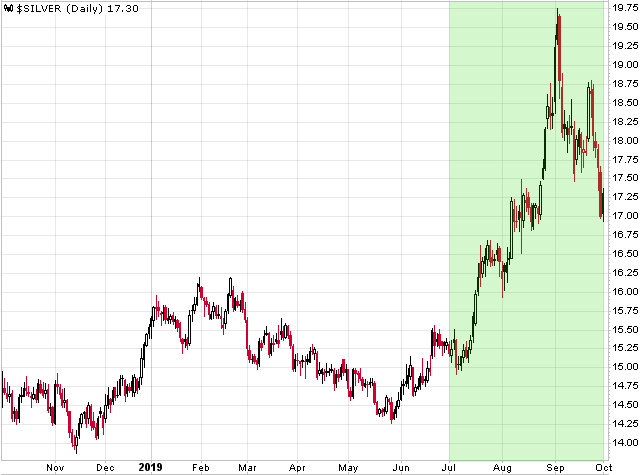

Silver didn't drastically increase in value until early Q3, and it's likely Coeur's average realized price per silver ounce in Q3 was around $17.25. Given the expected Ag production in the second half of this year, I would estimate the increase in revenue just from higher realized silver prices was around $10 million.

(Source: StockCharts.com)

The net result is ~$25 million of additional revenue in Q3 compared to Q2 thanks to higher metal prices. This doesn't account for increases in cash flow due to production gains either.

It should be noted that ~60% of Coeur's production comes from the U.S., and Coeur has a large pool of U.S. tax loss carryforwards that amount to $360 million. There won't be any taxes due on a good chunk of this increase in revenue due to higher metal prices; it will flow right to the bottom line.

There is another part to the FCF equation though, as we need to estimate the cash flow from investing activities. The company has spent about 44% of the expected CapEx for the year during H1 2019. If we assume the midpoint of guidance for growth and sustaining capital, then there will likely be an additional $10 million spent on CapEx during Q3 compared to Q2. That will offset some of the gains in OCF, but there will still be plenty of positive FCF in this scenario. That is also assuming all operations hit the guidance for Q3.

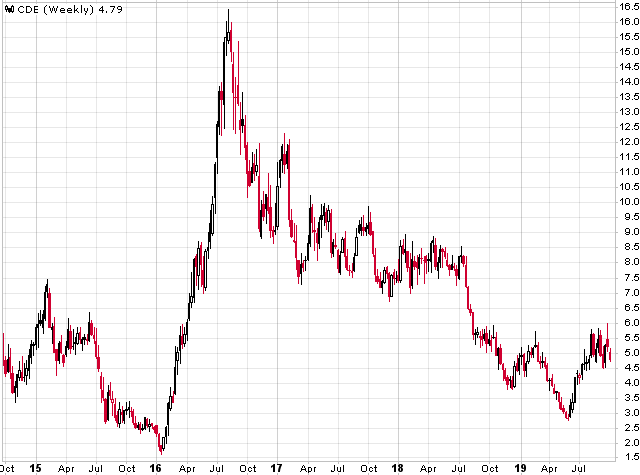

CDE Today At Under $5 Vs. 2016 At Over $15

CDE topped at over $15 a share back in 2016, yet today it sits at less than 1/3 of that price. There has been some dilution over the last few years, as the recent equity offerings discussed above along with a couple of dilutive acquisitions have increased the share count. But that would still only put CDE at $6.70 if we adjusted for this dilution.

(Source: StockCharts.com)

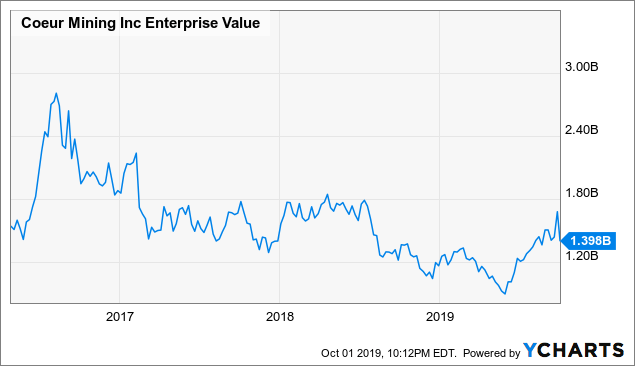

The current enterprise value vs. the peak EV in 2016 shows the dichotomy and is more of an apples-to-apples comparison.

Data by YCharts

Data by YCharts

What's different today compared to 2016? Or maybe a better way to phrase it is what advantages did CDE have in 2016 compared to now?

The price of gold peaked at $1,350 in 2016 compared to $1,550 about a month ago, so the gold price environment is much more favorable today.

The price of silver peaked around $20.75 in 2016, or only $1 higher than where silver plateaued several weeks back. Coeur gets the majority of its revenue from gold, not silver; the shares should be more sensitive to gold prices.

Gold and silver production levels are similar today as they were back in 2016, so that isn't a reason for this valuation gap.

Net debt was a little lower in Q3 2016 compared to projected net debt levels at the end of last quarter, but again I would go back to the EV graph shown above as that accounts for the additional net debt and it still doesn't explain the pricing discrepancy.

I believe the following are reasons why Coeur's stock price is trading at less than 1/3 its 2016 peak:

Wharf and a few other operations aren't generating as much profit as they were before (due to rising costs and other factors). It's cash flow that drives share prices and would explain - at least partially - why investors aren't putting a similar value on Coeur's stock as they did three years ago. Investors are skeptical that Coeur will hit its production targets this year given that output is backend weighted. Silvertip has been a disappointment as the ramp-up has gone much slower than expected. Investors aren't confident the mine will reach its ultimate goals. Investors still think of Coeur primarily as a silver producer and silver producers have been drastically underperforming the gold miners this year. Even though the balance sheet was significantly strengthened in Q3, investors have a "seeing is believing" mentality and won't reward the company until actual results are released.Rebuttal: Even though cash flow isn't as robust as it was in 2016, the first two quarters of the year aren't representative of how H2 will go. Again, Coeur expects H2 2019 to be stronger in terms of production. The Wharf operation, for example, has only produced 33,000 ounces of gold in the first two quarters of 2019, while guidance for the year is 82,000-87,000 ounces of gold. The company announced in the Q2 results release that it is maintaining guidance at Wharf. Output at the operation is anticipated to increase due to higher grades, and Coeur also added more crushing capacity (wet weather lowered crushing throughput last quarter, and it is expecting to make this up). This implies 26,000 ounces of production in each of the last two quarters of the year, or a 65% increase compared to Q2 levels.

Several of the company's operations have been either going through a low-grade cycle or were in a heavier CapEx spending cycle. Now these operations are starting to come out the other side and the outlook going forward is much more bullish. This hasn't shown up yet in the financial results.

Also, let's revisit the gold price and the fact that CDE hasn't even reported financial results that reflect the full impact of the recent surge in precious metals. Gold peaked a month or so ago at $200 above its 2016 top, and Coeur produces ~350,000 ounces of gold per year. That's a $70 million increase in revenue (peak vs. peak) just from higher gold prices. My argument is at current metal prices, Coeur's cash flow could equal what it was generating in Q3 2016.

Silvertip has been disappointing, but it's important to note that there is nothing wrong with the orebody; the issue is with the mill and personnel. The mill needed much more work than expected when the company first bought the mine, which is why the ramp-up has taken much longer. It appears that Coeur is finally getting over the hump and this should start to show up in the Q3 and/or Q4 results.

In 2010, almost 69% of Coeur's revenue came from silver production vs. 31% from gold. Now the roles have reversed as gold production accounted for 68% of revenue in 2018 vs. 31% of revenue from silver (the remaining 1% was from zinc and lead). Investors need to understand that while CDE still has exposure to silver, it's not primarily a silver play.

I believe CDE is one of the most overlooked and undervalued mining stocks at the moment. It's being grouped in with the silver miners and investors aren't giving it any credit for the recent debt reduction, the improvements that will be seen in second-half production, nor the significant impact that higher metal prices will have on Q3 results.

I'm confident that the bull market in precious metals is just getting started and prices will rebound back to previous highs. The main risk of this bullish thesis is just whether Coeur hits its guidance for the second half of this year, but even then I think the improved balance sheet should result in a re-rating higher in the share price. It just won't be as aggressive of a re-rating if CDE misses targets in conjunction.

If CDE was above $15 in 2016, I see no logical reason why it shouldn't be trading at $10 or above today. If the company delivers on guidance, then I believe CDE will reach that price level in the next 6-12 months.

Subscribe To The Gold Edge - Current Free Trial Offer

To keep up to date with how I'm playing this bull market in gold and gold stocks, just click the "Follow" button below. If you would like additional in-depth analysis of the sector, including all of my top picks, subscribe to The Gold Edge, which is my research-intensive service that provides extensive coverage of the sector. Click here for details.

Disclosure: I am/we are long CDE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow SomaBull and get email alerts