Commodity bulls twisting in the wind

On Wednesday investors curbed their enthusiasm for commodities, sending everything from copper and gold to oil and iron ore sharply lower.

But despite nervousness returning to metals and mining markets this week, 2016 is still looking decidedly better for the sector. Year to date gold is holding onto 15% gains, silver and platinum are up 10% while bellwether copper's trading nearly 15% higher than its January lows.

Key commodities are set for further gains if supply remains constrained, demand improves further and investor sentiment doesn't turn sourIndustrial metals have all advanced in 2016 led by zinc which has jumped by more than 20% in three months while volatile iron ore is the best performer with a 33.5% gain this year. The improvement in oil prices to around $40 a barrel has underpinned the rebound by halting the cost deflation that's plagued mining for more than two years.

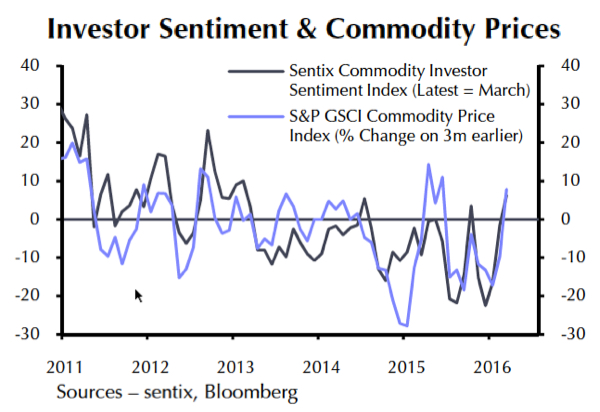

There is little doubt that sentiment has improved. Frankfurt-based sentix, a leader in the emerging field of behavioural finance, has been compiling a commodity sentiment index for more than a decade by surveying more than 4,500 institutional and private investors.

After a false dawn in October the sentix Asset Class Sentiment for Commodities index dropped precipitously in December to lows not seen even at the height of the global financial crisis or during the fall in the price of crude in the second half of 2014.

Source: Capital Economics

From the record low of -22.5 in December the sentix index has shot back up to 6.25 above with the new bullish mood reflected on the the S&P GSCI, a global production-weighted commodity price index.

A new note by Capital Economics argues that key commodities are set for further gains if supply remains constrained (mining capex peaked in 2012 and the bulk of new supply should be absorbed by now), demand improves further (Chinese imports continue to break records, although stocks remain high too), and investor sentiment doesn't turn sour (today's retreat may be a bad omen).

Julian Jessop, head of commodities research at the London-based firm says "any two of these three should be enough for prices at least to stabilize, but all three may be needed for substantial gains."

As for the turnaround in sentiment Jessop warns that sentiment tends to track prices, rather than lead them:

The turnaround has also been boosted by an improvement in sentiment towards riskier assets more generally, so may be vulnerable to shocks that are not specific to the underlying fundamentals of commodity supply and demand.

Capital Economics' house forecast sees copper gain another 10% from today's levels to around $2.50 by the end of the year. The company is less optimistic about a continued rally in iron ore however. Capital Economics believes the steelmaking raw material will drop to $45 by end-2016. International oil prices should improve to $45 a barrel during the fourth quarter.