Commodity Seasonality Points Down For WTI And Gold

Energy: May has historically been a seasonal turning point in WTI, the WTI term structure is still in backwardation, and natural gas seasonality weakens in June.

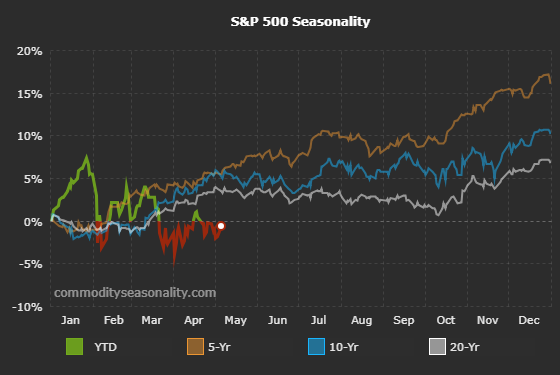

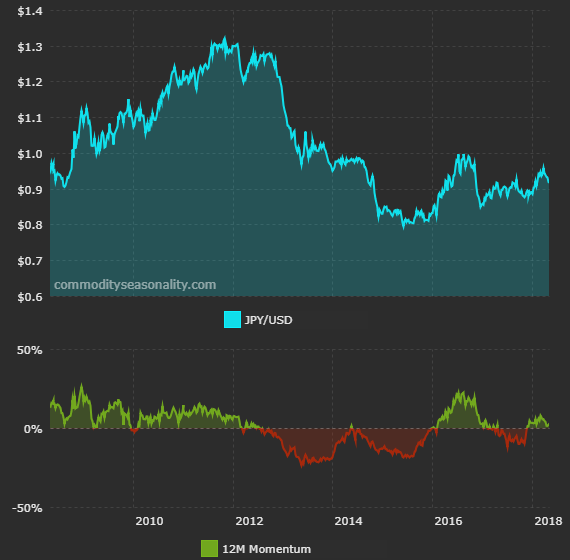

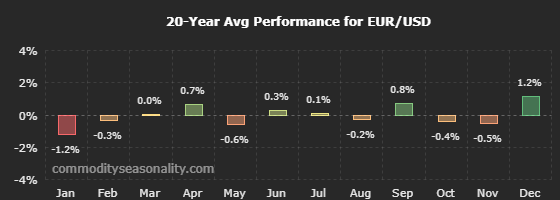

Financials: April marked the end of a seasonally strong period in the S&P, JPY/USD 12-month momentum is slightly positive, and May has historically been the second weakest month for EUR/USD.

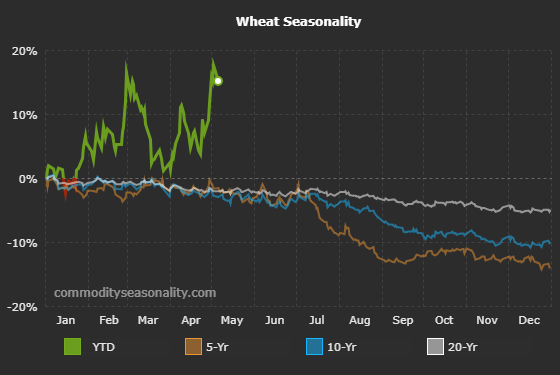

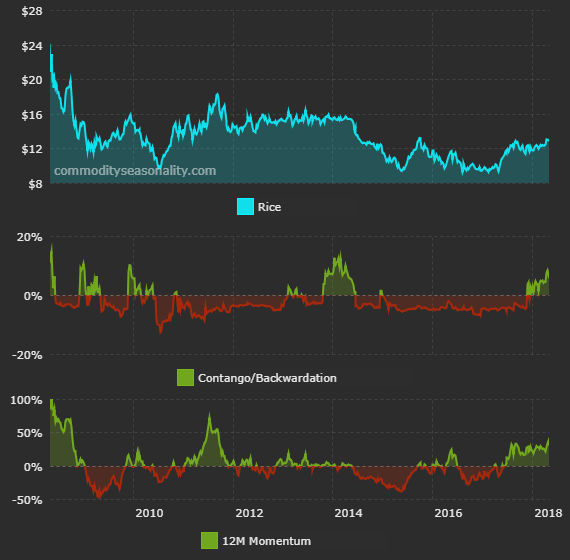

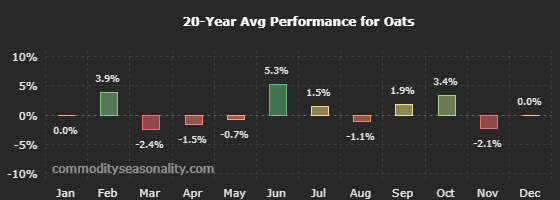

Grains: Agricultural commodities have rallied in 2018, rice is in backwardation, and June has historically been a very seasonally positive month in oats.

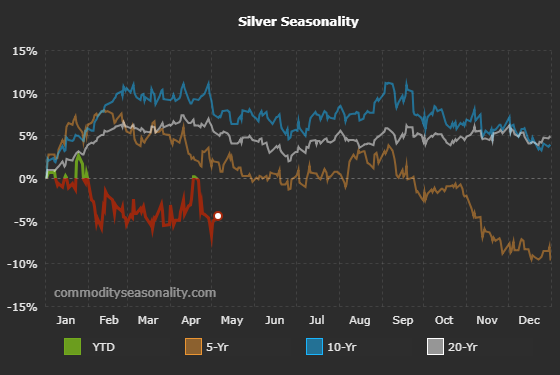

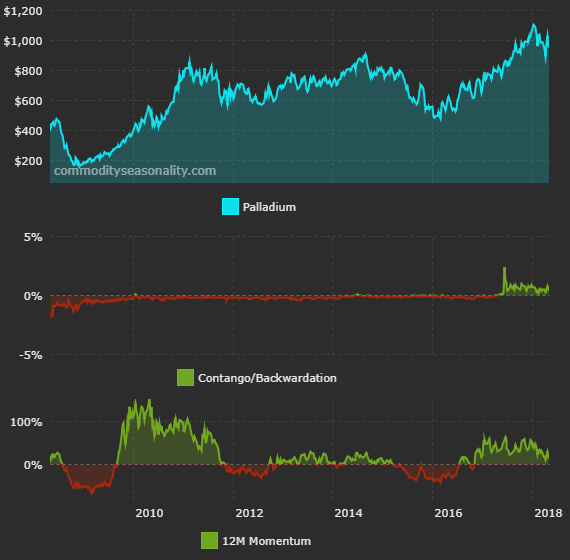

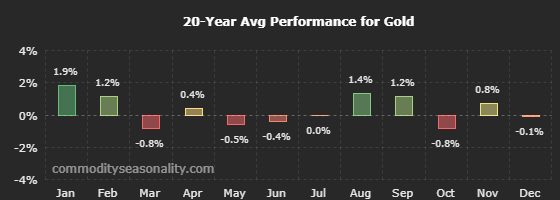

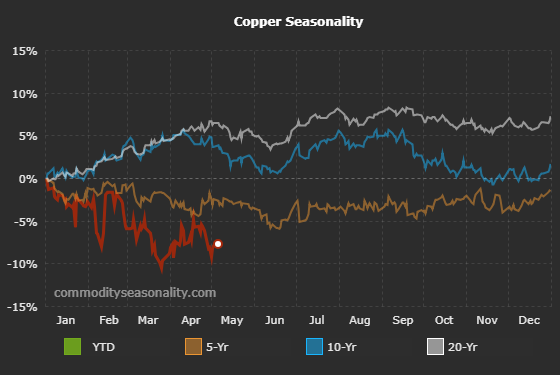

Metals: Silver seasonality is negative until the end of June, palladium is in backwardation, and gold seasonality has historically been strong in August and September.

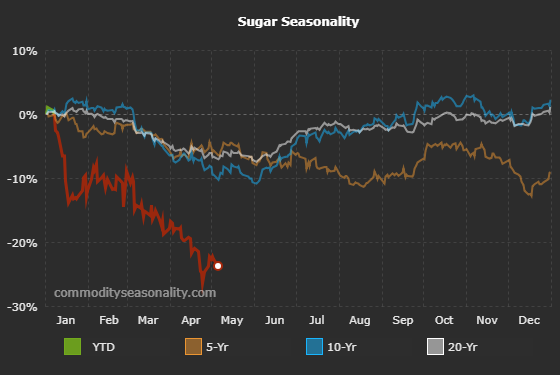

Softs: Sugar seasonality turns in June, lumber futures are in steep backwardation, and cocoa's historically highest average monthly performance has been in June.

This is my weekly update that covers seasonal trends and the term structure of futures contracts. All of the below data and graphs come from my Commodity Seasonality website. The website is completely free, and I use Seeking Alpha as my sole outlet for weekly recap articles. I break down the updates by asset class, so let's get started.

Energy Futures Seasonality

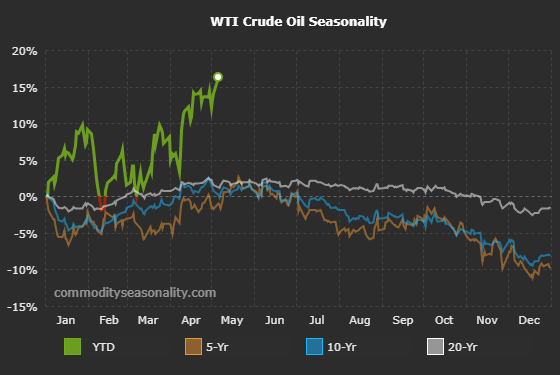

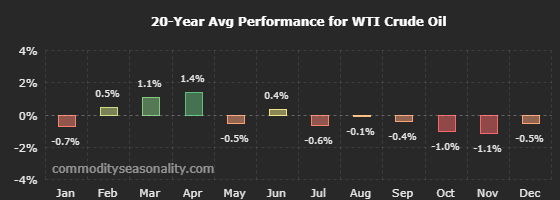

WTI crude oil (NYSEARCA:USO) has been on a tear this year, now up ~20% YTD. May has historically been a seasonal turning point. Over the past twenty years, seasonality has been mixed for the rest of the year, but rest of year seasonality has definitely been negative for 5- and 10-year averages.

Here's a monthly view of WTI seasonality.

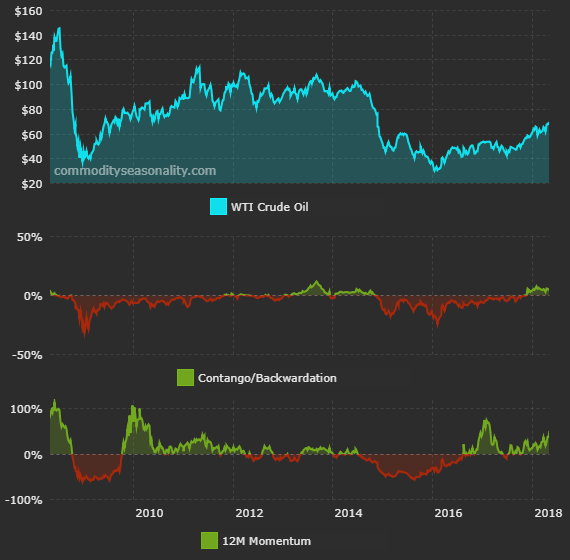

The WTI term structure is still in backwardation and 12-month momentum is accelerating as the trend picks up steam. Backwardation is when contracts further out in time are priced lower than contracts closer to expiration. Backwardation benefits traders with long exposure, while contango detracts from returns. Most people are familiar with the concept of contango in VIX futures, where VIX futures further out in time are typically priced higher than the front-month contract. The same concept applies here.

This is important because most investors get commodity exposure through long-only commodity indices. Energy futures typically make up the majority of these indices. Contango is a headwind for long commodity exposure since there's a "negative roll yield" over time. Since WTI futures are in backwardation, investors who are long commodities benefit from the monthly roll process.

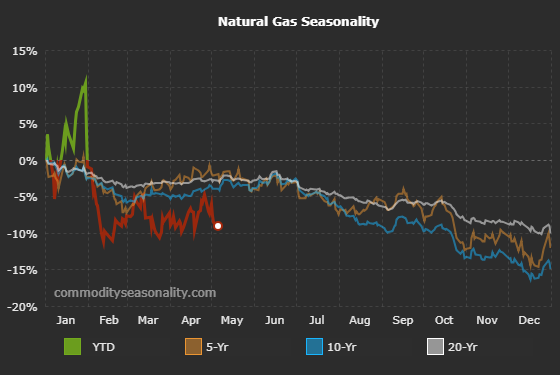

Front-month natural gas (NYSEARCA:UNG) seasonality turns south after June. The below seasonal averages tend to fall over time because front-month natural gas futures have typically been in contango.

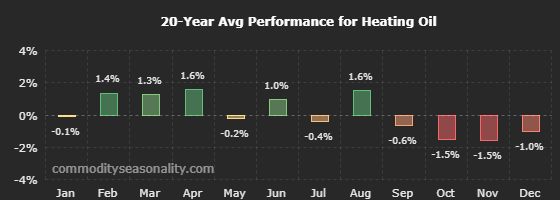

Heating oil (NYSEARCA:UHN) seasonality basically mirrors WTI, although August has historically been a very positive month in heating oil (and not WTI).

Financial Futures Seasonality

April marked the end of the "best six months" seasonality in the S&P 500 (NYSEARCA:SPY). The 20-year seasonal average chops through the summer and then resumes higher in the fall. 5- and 10-year averages are strong throughout the entire year because we've been in a steady bull market.

JPY/USD (NYSEARCA:FXY) 12-month momentum is barely positive. Negative 12-month momentum would likely mean that trend followers would be biased to the short side.

May has historically had the second lowest average monthly performance in EUR/USD (NYSEARCA:FXE).

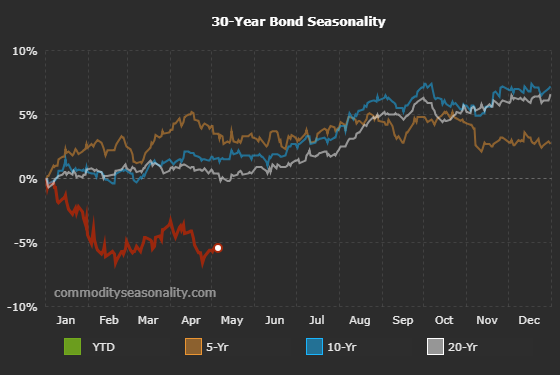

Just as S&P 500 positive seasonality cools off in May, the 30-year Treasury bond (NYSEARCA:TLT) begins to catch a positive seasonal tailwind. The 30-year Treasury is a risk-off asset, typically rising as risky assets like stocks get volatile.

Grain Futures Seasonality

Agricultural commodities have had a strong year, and wheat (NYSEARCA:WEAT) is no exception. Most seasonal averages trend down over time because the front part of the wheat term structure (like natural gas) tends to spend a lot of time in contango.

Rice futures are in steep backwardation.

June has historically been a very strong month for oats.

Metal Futures Seasonality

Silver (NYSEARCA:SLV) seasonality is negative from now until the end of June.

Palladium (NYSEARCA:PALL) is the only precious metal in backwardation.

Gold's (NYSEARCA:BAR) seasonal outlook is weak until August and September.

Copper (NYSEARCA:JJCB) has historically been very strong in July.

Soft Commodities Seasonality

Sugar (NYSEARCA:SGGB) is typically weak until the end of May, and 2018's performance was even worse than the already weak seasonal trend. June has historically been a seasonal turning point.

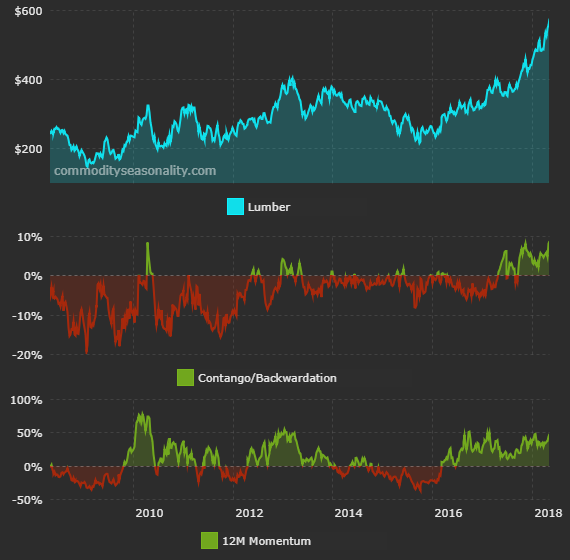

The lumber term structure is in extremely steep backwardation. Lumber has risen more than 150% from the 2015 lows.

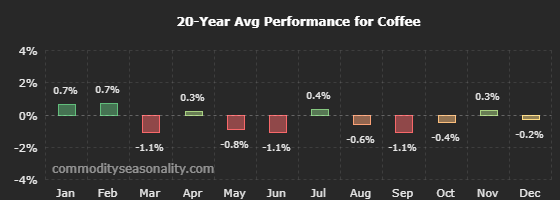

Coffee (NYSEARCA:BJO) futures have historically been weak in May and June.

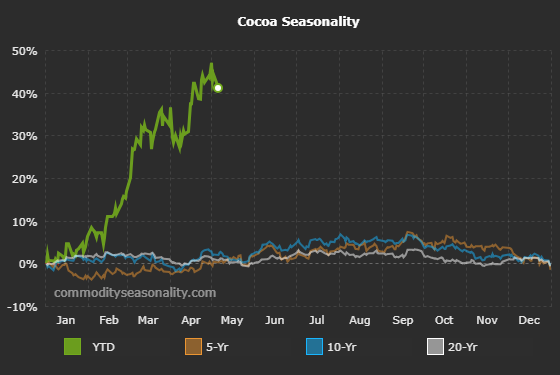

Cocoa (NYSEARCA:NIB) has risen ~40% YTD, and June has had the highest average monthly performance over the past twenty years.

Commodity Seasonality Conclusion

That wraps up coverage of individual contracts. I'll close with my most important charts.

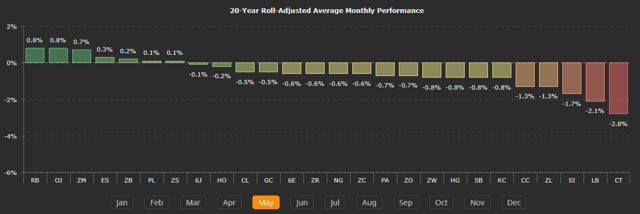

First, let's look at the 20-year average monthly performance numbers for the month of May. The best-performing contracts have historically been RBOB gasoline (NYSEARCA:UGA), orange juice, and soybean meal. The worst performing contracts have historically been cotton (NYSEARCA:BALB), lumber, and silver.

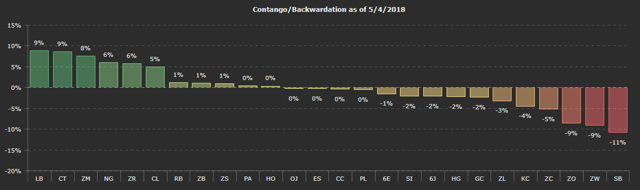

Here's a snapshot of the current amount of contango or backwardation for each contract I track. I compare the contract with the highest open interest to the contract with the third-highest open interest. Lumber, cotton, and soybean meal are in the highest amount of backwardation. Sugar, wheat, and oats are in the highest amount of contango.

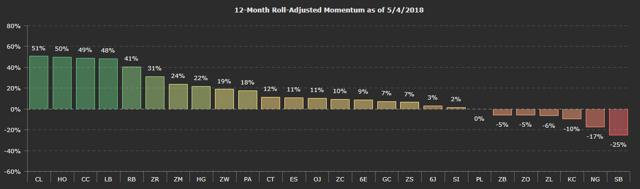

Below are the 12-month roll-adjusted momentum numbers for each contract. WTI crude oil, heating oil, and cocoa have been the top performers. Sugar, natural gas, and coffee have been the three of the weakest contracts.

I hope you've found this article to be useful. It's meant to cut down on your research time and save you some money. Be sure to follow me for my seasonality updates on Seeking Alpha. Let me know if you have any questions in the comments below.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article should not be construed by any consumer as personalized investment advice over the internet. This article does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked in this article or incorporated herein. GraniteShares sponsors the free Commodity Seasonality website but in no way paid for this article. This article and information are provided for guidance and information purposes only. Investments involve risk are not guaranteed. All information provided in this article should not be reproduced, copied, redistributed, transferred, or sold without the prior written consent of the author.

Follow Movement Capital and get email alerts