Copper Enjoys A Pretty Tight Fundamental Backdrop

JJCTF is essentially flat on the year, despite meaningful mine supply tightness.

Global concentrate tightness is set to constrain more pronouncly refined production trends in Q4.

In turn, the global refined copper market is due to show increasing signs of tightness (falling inventories, tighter spreads).

We, therefore, approach JJCTF from a long side, expecting its tight fundamental backdrop to outweigh its weak macro backdrop.

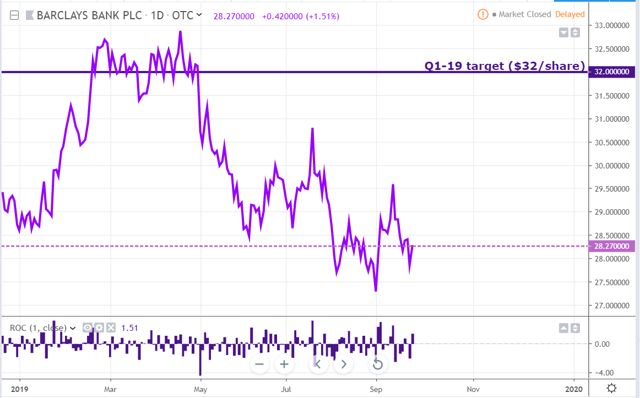

Our Q4-19 target is set at $32/share, a 14% appreciation from in current level.

The iPath Bloomberg Copper Subindex Total Return (JJCTF), which replicates the performance of copper prices, dropped to its lowest since November 2016 at $27.30 per share on September 3. This comes, despite a tight fundamental backdrop, owing to a contraction in mine output this year, in which contrast with 2018 when global mine production grew by 2.3% YoY.

Supply mine tightness is due to constrain markedly refined production, which already contracted by 1.1% YoY in H1 2019.

Signs of tighter refined market conditions should become increasingly visible, namely - an accelerating pace of drawdown of exchange inventories and tighter forward spreads.

In turn, investors are likely to shift their focus from the weak macro backdrop (driven by the economic slowdown and the trade disputes) to the tight fundamental backdrop of the copper market.

We are, therefore, bullish on JJCT for Q4, with a target price of $32 per share - an 11% upside from its current level.

Source: Trading View

About JJCTF

For investors seeking exposure to the fluctuations of copper prices, JJCTF is an interesting investment vehicle.

The fund summary for JJCTF is as follows:

The iPath (R) Bloomberg Copper Subindex Total ReturnSM ETN is designed to provide exposure to the Bloomberg Copper Subindex Total ReturnSM (the "Index"). The Index reflects the returns that are potentially available through an unleveraged investment in the futures contracts on copper.

Its expense ratio is 0.75% per annum.

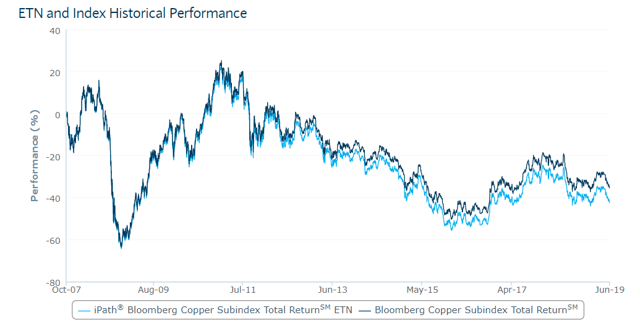

JJCTF tracks copper prices well, as the chart comparing the ETN and the Index illustrates below:

Contraction in mine supply in H1-19

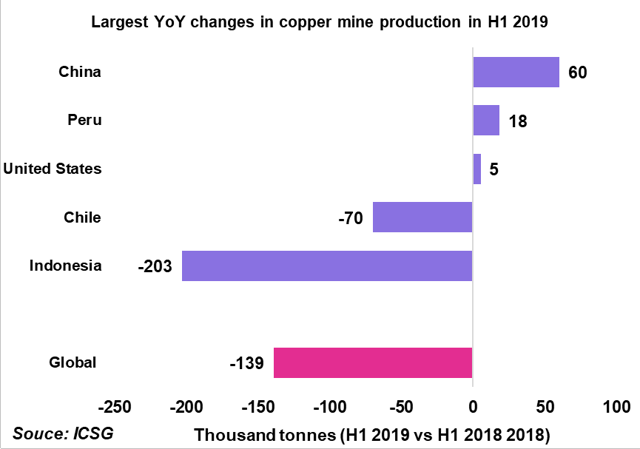

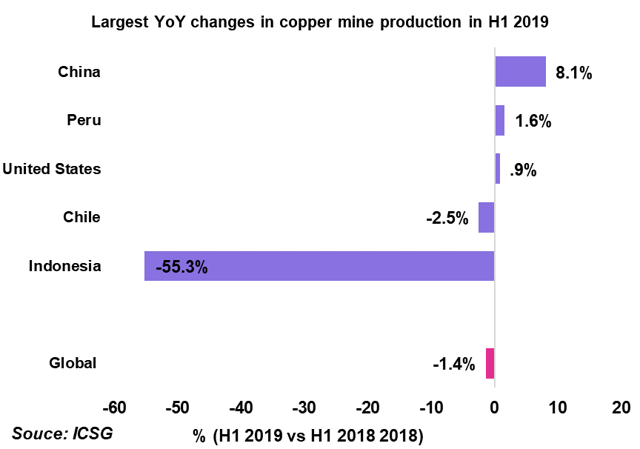

According to the latest press release from the International Copper Study Group (ICSG), world mine production contracted by 1.4% YoY in the first half of the year. This was essentially caused by significant decreases in and Indonesia (-55% YoY) due to due to the transition of Grasberg to an underground operation and Batu Hijau mine to phase 7 and Chile (-2.5% YoY) as a result of lower ore grade. Here are the visuals:

Source: ICSG, Orchid

Refined output growth constrained

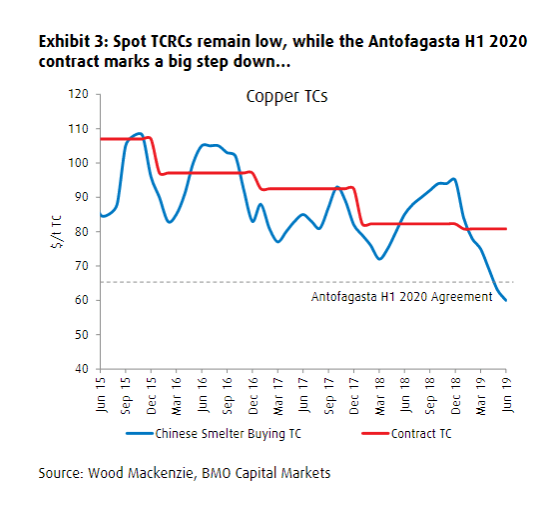

The contraction in mine supply this year has tightened, noticeably, the concentrate market, judging by the marked decline in spot TC/RCs, which are at their lowest level since 2012.

Source: BMO

This has, therefore, prevented smelters from boosting their refined copper output due to increased pressure on smelters' margins. This will remain the case in the first half of next year after the H1-20 Antofagasta agreement, which is not even an actual contract, dropped to ~$65/t and 6.5c/lb, from the $80.8/t and 8.08c/lb for 2019.

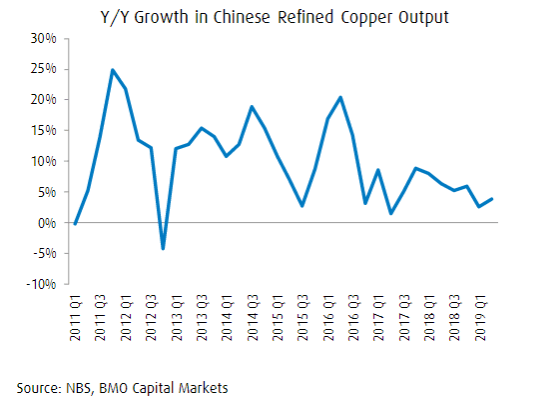

The ICSG reports that global refined production declined by about 1% YoY in H1 2019. Chinese refined output, which still grew by 8% YoY in H1, has seen a decelerating growth since 2016.

Source: BMO

This trend is likely to continue in the months ahead due to extreme tightness in the concentrate market.

Meanwhile, refined output contracted markedly in Chile (-15% YoY) due to temporary smelter shutdowns, in India (-33% YoY) due to the shutdown of Vedanta's (NYSE:VEDL) Tuticorin smelter in April 2018, and in Zambia (-28% YoY) owing to power supply interruptions and a lack of smelter feed caused by the introduction on January 1, 2019, of a 5% custom duty on copper concentrate imports.

Signs of tighter refined market conditions become increasingly visible

As the tightness in the global concentrate market transpires into the global refined market, refined market conditions have already become tighter.

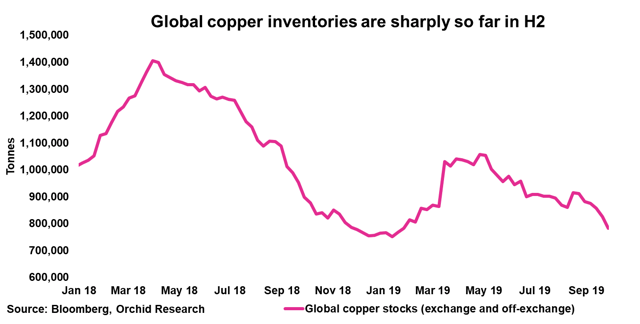

Most notably, global copper inventories (LME, SHFE, COMEX, and Shanghai-bonded) have declined markedly since the start of H2, confirming that the tightening of the refined market has resulted in a stronger drawdown of copper inventories.

Source: Bloomberg, Orchid

We believe that the decline in copper inventories will accelerate in Q4, which should result in tighter spreads and firmer copper prices. This could also prompt financial players, which have been increasingly bearish on copper so far this year due to the negative macro picture, to unwind their bearish bets due to the tight fundamental backdrop.

Closing thoughts

JJCTF, which has been under pressure by the negative sentiment so far this year, is in our view a buying opportunity because the fundamental backdrop is completely overlooked by the market. As we showed above, the contraction in mine output has resulted in extremely tight concentrate market conditions, which in turn has transpired into the refined market conditions, evident in a firm decline in global copper inventories. We, therefore, believe that a solid rebound in JJCT is likely in Q4, with an upside of roughly 11%.

Did you like this?

Please click the "Follow" button at the top of the article to receive notifications.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our research has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. Therefore, this material cannot be considered as investment research, a research recommendation, nor a personal recommendation or advice, for regulatory purposes.

Follow Orchid Research and get email alerts