Copper Exploration Co. Expected To Break Higher

Technical Analyst Clive Maund explains why he thinks Kobrea Exploration Corp. (KBX:TSX; KBXFF:OTCQB; F31) is an Immediate Strong Buy.

Kobrea Exploration Corp. (KBX:TSX; KBXFF:OTCQB; F31) is a very interesting story at this time and is viewed as an excellent opportunity for investors. There are two very big reasons for this, which can be simply stated as "right place, right time."

It is in the right place because it holds the option to acquire a 100% interest in a massive district-scale property in which 12 porphyry copper targets have already been identified by previous operators including mining giants VALE and Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK), and which is situated in the prolific Neogene porphyry Copper Belt in western Argentina.

It is the right time because Mendoza Province, where the property is situated, has turned much more mining-friendly and is actively promoting the project with the Western Malargue Mining District being designated by the government of Mendoza Province as recently as April of this year and in addition, a severe copper supply crunch is set to hit that is expected to drive its price substantially higher.

The huge opportunity thus being presented to the company and its shareholders is succinctly set out on this introductory slide from the company's latest investor deck.

In addition, we should factor in that the company also holds a 100% interest in the 5,300 Hectare Upland Copper Project in British Columbia, which also has a lot of potential.

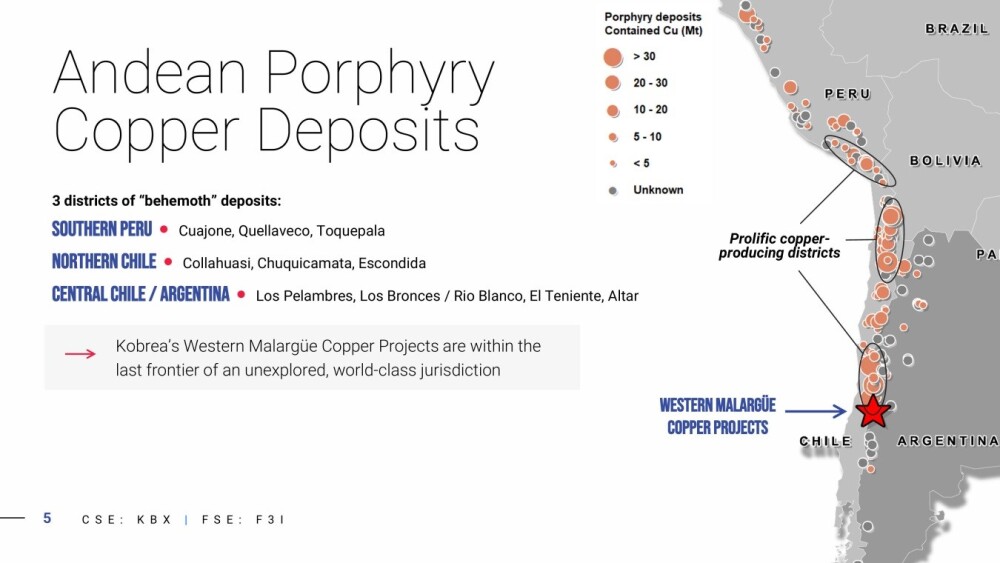

Western Malargue is situated in the most southerly of the 3 districts of "behemoth" copper deposits in the Andes, which hosts some of the biggest and most famous copper mines in the world, such as Chuquicamata, Escondida, and El Teniente.

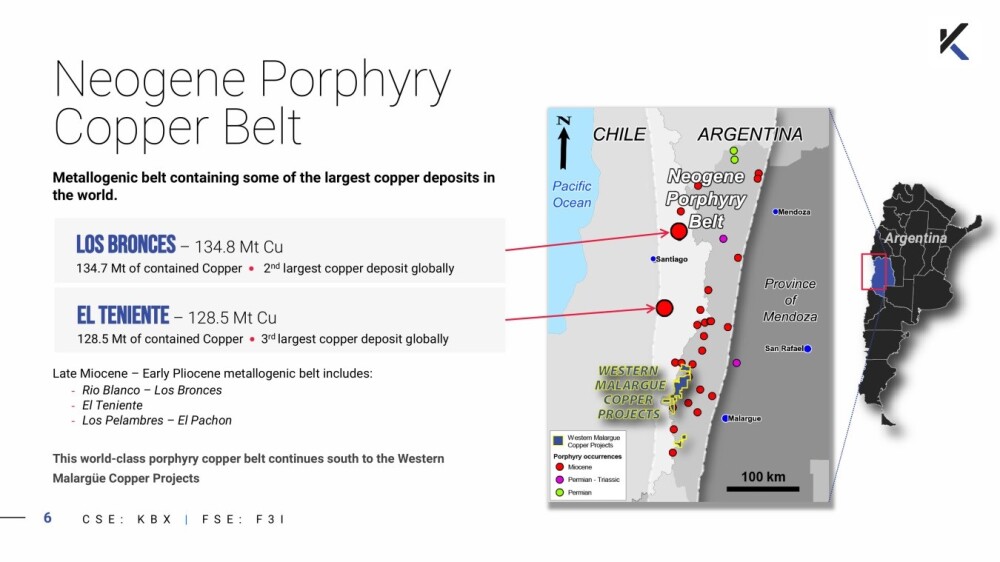

It is also located in the world-class Neogene Porphyry Copper Belt, not very far south of the giant El Teniente copper deposit over the border of Chile

Mendoza province is famous for its wines, but with it opening up to mining, it could soon also be famous for its copper mining.

In furtherance of its concerted efforts to promote mining in the province, the government of the Province of Mendoza last April created the Western Marlague Mining District and has undertaken studies to expedite mining exploration.

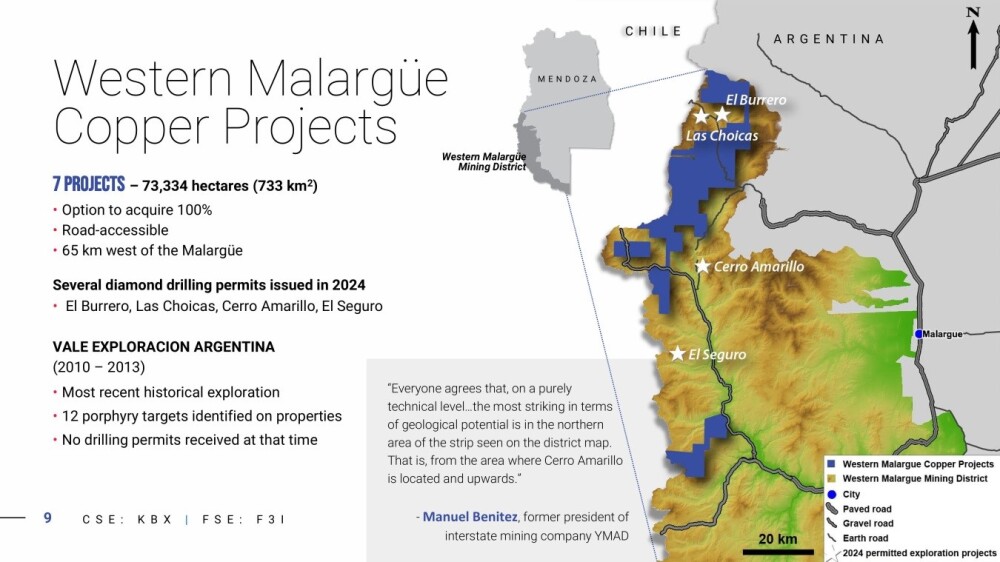

The Western Malargue projects are huge, comprising 73,334 hectares on the province's western border with Chile, and have massive discovery potential. The following map shows their extent and exact geographic location.

A range of diamond drilling permits have been issued so far this year, and it appears that the main reason VALE didn't move forward with the projects in the past was that in a different environment it did not receive the necessary permits.

The potential of the Western Malargue projects becomes clearer when we consider that the seven main targets are not merely targets but are projects in their own right that each cover a very substantial land area.

Please refer to the investor deck for more detailed information on the individual projects.

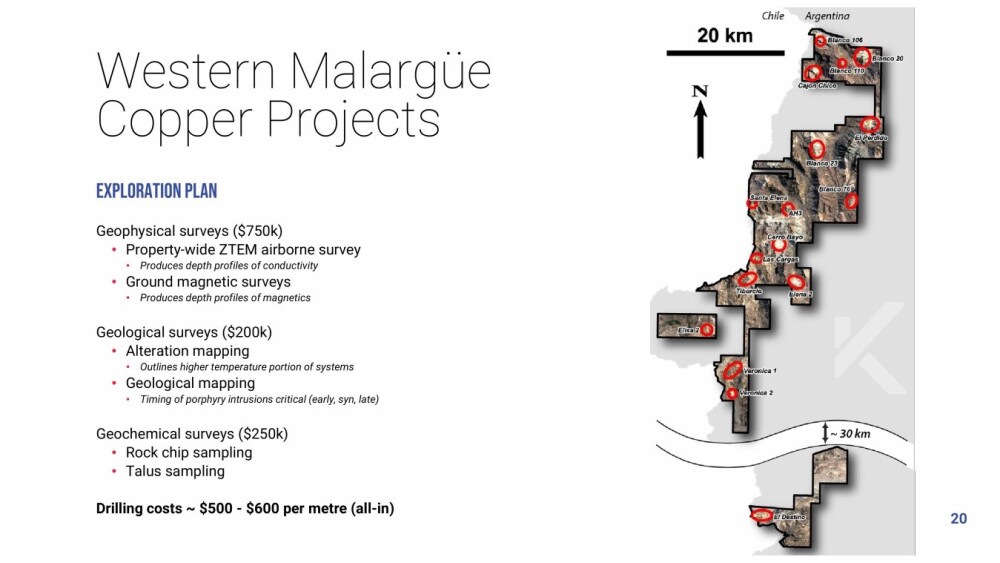

The next slide details the exploration plan for the projects, which includes a property-wide ZTEM survey and ground-based geochemical, geophysical and geological surveys to develop targets for drill testing.

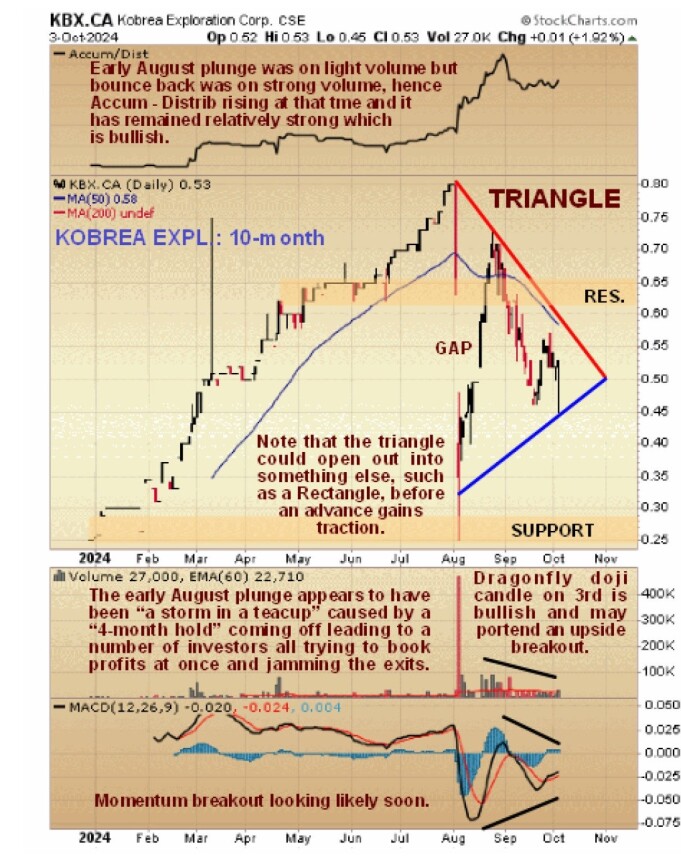

Now we will examine the latest stock chart for Kobrea Exploration and as it only started trading last December, only one chart is required with a 10-month timeframe including all of the action in the stock.

On the chart, we see that, after it started trading, it advanced steadily and quite steeply for about seven months, doubtless in appreciation of the potential of the company, but then, early in August, it got really slammed, losing about two-thirds of its value in a couple of days. The apparent reason for this was that a "4-month hold" came off a quantity of stock, and a number of investors all headed for the exits at the same time, and with only modest bids present, they drove the price sharply lower.

However, this "storm in a teacup" ended almost as quickly as it began, with other investors and maybe the same investors realizing that the selling had been overdone, buying back in and driving the price back up so that, like a ball that has been dropped to the ground from a height, the price has stabilized in a series of diminishing fluctuations.

Observe how, when the price plunged early in August, the Accumulation line, shown at the top of the chart, actually rose, which indicates that there was no great weight of selling but heavy buying right after the lows, which is bullish, and we also see that this indicator held up relatively well on the September reaction. The diminishing fluctuations have resulted in a Symmetrical Triangle forming on the chart, which, as it is now closing up, suggests that a larger move is to be expected soon, although we should be aware that there is some chance that the pattern could open out into a somewhat longer range where it morphs into, say, a Rectangle before the expected advance gains traction.

That said, the "dragonfly candle" that formed on the chart for October 3 is bullish and increases the chances of an upside breakout soon.

Given the stellar potential of the company's projects in Argentina and the impending major copper supply crunch that is expected to drive the copper price much higher, and the fact that commodities, generally copper in particular, are starting to advance again, Kobrea Exploration stock is expected to break higher from this Triangle, and even if it were to break lower, it would likely be a "head fake" or false move that would quickly lead to a reversal to the upside.

Kobrea Exploration is therefore rated an Immediate Strong Buy for all time horizons.

Kobrea Exploration's website.

Kobrea Exploration Corp. (KBX:TSX; KBXFF:OTCQB; F31) closed for trading at CA$0.53, US$0.2684 on October 3, 2024.

| Want to be the first to know about interestingBase Metals andCritical Metals investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Kobrea Exploration Corp.Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts' Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.