Copper-gold Deposits to Help Gold Miners Overcome Depletion Dilemma / Commodities / Gold and Silver Stocks 2020

Every fiscalquarter the World Gold Council puts out a wonderful little report on the gold market,that is made into an article by just about every mining news outlet. Forreasons unknowable to mere mortals like us, the report focuses on gold demand.The reader has to go deep into the report to find the other half of the story,gold supply, and in particular, mined gold supply.

Every fiscalquarter the World Gold Council puts out a wonderful little report on the gold market,that is made into an article by just about every mining news outlet. Forreasons unknowable to mere mortals like us, the report focuses on gold demand.The reader has to go deep into the report to find the other half of the story,gold supply, and in particular, mined gold supply.

Doing so inthe WGC’s latest instalment, the full-year 2019gold market report, reveals some startlingconclusions about “peak gold”.

The concept ofpeak gold should be familiar to most readers, and gold investors. Like peakoil, it refers to the point when gold production is no longer growing, as it hasbeen, by 1.8% a year, for over 100 years. It reaches a peak, then declines.

While goldproduction has been increasing every year, it’s been growing in smaller andsmaller amounts. That is, while gold output in 2018 was higher than 2017, itwas only 1% higher - 3,347 vs 3,318 tonnes, according to the World GoldCouncil. Production in 2017 was 1.3% more than 2016.

This is itselfdoes not disprove peak gold, nor does the WGC’s total gold supply figures whichinclude mine production, recycled gold and net producer hedging, which contributesto overall supply.

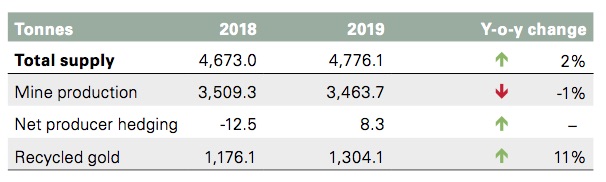

According tothe report, in 2019 gold demand reached 4,355 tonnes, against 4,776 tonnes ofsupply. Mined gold production was 3,463 tonnes, jewelry recycling hit 1,304tonnes, and 8.3 tonnes were hedged.

If we stopthere, we show a slight gold supply surplus of 421 tonnes. Peak gold debunked!

Not so fast,let’s think about those numbers for a minute. In calculating the true pictureof gold demand versus supply, we, at Ahead of the Herd don’t, and won’t, countjewelry recycling. What we want to know, and all we really care about, iswhether the annual mined supply of gold meets annual demand for gold. Itdoesn’t! When we strip jewelry recycling from the equation, we get an entirelydifferent result. ie. 4,355 tonnes of demand minus 3,463 tonnes of productionleaves a deficit of 892 tonnes.

This is significant,because it’s saying even though major gold miners are high-grading theirreserves - mining all the best gold and leaving the rest - even hitting record goldproduction in 2018, they still didn't manage to satisfy global demand for theprecious metal, not even close. Only by recycling 1,304 tonnes of gold jewelrycould gold demand be satisfied.

Gold recyclingincludes people selling their jewelry when they think they can get a good pricefor it. Recall that the gold price started its rally in June, after the USFederal Reserve decided to stop raising interest rates, an outcome that isalways good for the precious metal. Gold shops did a roaring trade for the restof the year, and after the last rings, bracelets and necklaces were melted downfor cash, gold recycling in 2019 ended up 11% higher than the previous year -and the most since 2012!

Unsurprisingly,gold recycling was strongest in countries with weak currencies in relation tothe US dollar, where physical gold holders rushed to capitalize on gains in thelocal gold price. This included Iran, Turkey, southern Asia and southeast Asia.In India, the gold price in rupees gained 24% between the end of 2018 andyear-end 2019.

The takeaway?If gold recycling in 2019 hadn’t been so high, owing to strong gold prices(spot gold gained 18% in 2019), total gold supply would likely have been in asignificant deficit, not a 2% surplus.

Indeed theGold Council is quick to point out that 2019 supply of 4,776 tonnes was 2%higher than 2018, apparently torpedoing the argument for peak gold. But wait!It turns out that 2019 mined gold, 3,463 tonnes, is 1% less than 2018. No bigdeal, until you read that last year was the first since 2008 that there hasbeen a decline in gold output. Thatmeans 2018, a record year for gold production, was the last year that goldoutput rose compared to the previous year - a trend that has held since since2008, and for most of the last 100 years except for 2016 - an outlieryear.

For over adecade I’ve been saying that one of these years the industry will reach peakgold, for all the reasons I’ve been writing about: the depletion of the majorproducers’ reserves, the lack of new discoveries to replace them, productionproblems including lower grades, labor disruptions, protests, etc.

Turns out Iwas right - that year was 2018. The following year, gold output starts falling,and we believe, will continue to fall further.

To review,annual mine production in 2019 was 3,463 tonnes - the first annual decline inover 10 years. And that was in the face of record gold buying by central banks(whose reserves grew by 650 tonnes - the second highest total in 50 years), andrecord investment in gold ETFs (buying continued for the first three quartersthen dropped off in Q4, when gold became too expensive).

Gold supplyincreased, as we’ve mentioned before, from recycling jewelry – taking advantageof high prices – and hedging by producers – again taking advantage of highprices.

The WGC reportbreaks down reasons for the decrease in mined gold output. This is veryinteresting because it tells us where the “softness” in gold production lies,and whether this trend is likely to continue.

We find themine with the most impact on gold production was Grasberg in Indonesia. Thelargest copper mine in the world also produces significant gold. But Grasbergis undergoing a major transformation, from an open pit to an underground mine –the above-ground reserves, including thehigh-grade ore, has been mined out. We know that capital spending on the expansion is expected to average$0.7 billion per year, meaning we shouldcontinue to see downward pressure on Grasberg output for the duration of the4-year project.

Due toGrasberg’s lower production, Indonesia saw the largest year on year gold outputdecline in the third quarter - down 41%.

In China, goldproduction fell 6% last year, for a third consecutive year. The largestgold-mining country is cracking down on mines with poor environmental records,a trend that is likely to continue, considering that Beijing is alwayssensitive to the concerns of a populace that has shown a historical willingness- witness recent explosive events in Hong Kong - to rise up.

Strikes inSouth Africa, especially during the first half of the year, curtailedproduction well into the third quarter, and in Latin America, disputes betweenlocal communities and contractors weighed on output, the report states. Peru’sthird-quarter production lagged 12% due to falling grades. Chile and Argentinaare seeing a wave of socialunrest due to real and perceivedinequality - mining unions are not immune.

Of coursecountries where gold production decreased were offset by those that managed toincrease output of the yellow metal. Russian gold mine production was up 8%,and West Africa continued to surpass South Africa, whose gold fields are instructural decline. The country produces 83% less gold than it did in 1980, despite having the second-largest reserves in the world,and lost its continental gold output crown to Ghana in 2018.

Australiapumped out 3% more gold in 2019 owing to higher production at its many goldmines and the ramp-up of projects like Mount Morgans and Cadia Valley. Howeverit’s important to note that Australia’s day in the sun as the world’s secondbiggest gold producer may soon be setting.

ABC News quotes analystsat S&P Global Intelligence, who say the country’s aging gold mines arerunning out of ore and not enough discoveries are being made to replace them.The analysts predict output will fall by more than 40% over the next five yearsand that Canada and Russia will overtake Australia - despite it having theworld’s most gold reserves. Output is also expected to take a serious hit from droughts, which are forcing authorities to implement waterrestrictions.

We know thatgold production is falling, mostly because of depleted reserves (expansionsrestricting output and unexpected closures play roles too), and a lack of newgold discoveries to replace them.

My suggestionfor gold companies looking to acquire fresh reserves and resources, is to minecopper, specifically, copper-gold porphyries or large sedimentary copperdeposits that also contain gold, silver or even platinum-group-elements (PGEmetals rhodium and palladium are both trading much higher than gold at thepresent time).

The CEO ofBarrick Gold makes much the same argument in an article this week in theFinancial Post. Here’s Bristow, the former head of South Africa’s Randgoldbefore it was acquired by Barrick last year, talking about Freeport-McMoran andits monstrous Grasberg copper-gold mine in Indonesia, being a potential takeovertarget, as the world’s second biggest gold company continues to accumulateassets:

Mr. Bristow recentlydescribed copper as a "strategic metal" because of the role it wouldplay in the shift to a greener economy. "The new, big gold mines are goingto come out of the young geologies of the world," he said. "And inyoung rocks, gold comes in association with copper or vice versa."

Whether or notcopper is a “strategic metal” is debatable, but the real reason Bristow istalking up copper is because Barrick, and other major gold miners, needcopper-gold deposits to help them overcome the depletion dilemma they are allfacing.

A 2018 reportfrom S&P found that 20 major gold producers had to cut their remainingyears of production by five years, from 20 to 15, based on falling reserves.

Kitco reported on findings by BMO Capital Markets that global gold production is expected to keep dropping.“When we look out over the next five years, there are very few large scale newgold projects earmarked to come on-stream,” the BMO analysts said. “The onlylarge-scale gold projects that we see as probable to enter the top 10 producinggold mining operations by 2025 are the Donlin Creek project, owned by Barrickand Novagold, and Sukoi Log owned by Polyus Gold.”

Anotherinteresting stat: The 10 largest gold mines operating since 2009 will produce54% of the gold as a decade ago - 226 tonnes versus 419 tonnes.

It’s notsurprising that gold companies are finding it tougher to add to reserves.

According toMcKinsey, in the 1970s, ‘80s and ‘90s, the gold industry found at least one +50Moz gold deposit and at least ten +30 Moz deposits. However, since 2000, nodeposits of this size have been found, and very few 15 Moz deposits.

Any new depositswill cost much more to discover. This is because they are in far-flung ordangerous locations, in orebodies that are technically very challenging, suchas deep underground veins or refractory ore, or so far off the beaten path asto require the building of new infrastructure from scratch, at great expense. Thecosts of mining this gold may simply be too high.

Moreover, goldgrades have been declining since 2012, meaning more ore has to be blasted,crushed, moved and processed, to get the same amount of gold as when the gradeswere higher, significantly adding to costs per tonne.

Add to thisthe practice of high-grading where, instead of mining a deposit as it shouldbe, economically, by extracting, blending both low-grade and high-grade ore ata given strip ratio of waste rock to ore – the company “high-grades” theorebody by taking only the best ore, leaving the rest in the ground.

Totaled up,these factors explain Barrick combining with South Africa’s Randgold, theBarrick-Newmont joint venture in Nevada, the $10 billion fusing of Newmont andGoldcorp, Newcrest’s 70% purchase of Imperial Metals’ Red Chris mine in BritishColumbia, and other 2019 examples of gold M&A.

According tothe Refinitiv Eikon database, gold-mining companies in 2019 spent $30.5 billionon 348 merger or acquisition deals, nearly $5 billion more than in 2010, the heightof the mining supercycle.

Knowing allthis, ie., the record amount of M&A in the gold sector as companiesincreasingly mine out their reserves and fail to replace them withmulti-million-ounce deposits, sending gold miners on a shopping spree to acquiresmaller companies’ assets, makes it easier to appreciate why Bristow is sobullish on copper – and it has nothing to do with its green credentials.

Copper-gold porphyries andsedimentary copper deposits offer both size and profitability.

They are two of the fewdeposit types containing precious metals that have both the scale and the potentialfor decent economics that a major mining company can feel comfortable goingafter to replace and add to their gold or silver reserves.

Porphyry orebodiesare usually low-grade but large and bulk mineable - they typically containbetween 0.4% and 1% copper, with smaller amounts of other metals such as gold,molybdenum and silver.

There are twofactors that make these kinds of deposits so attractive. First, by focusing onprofitability and mine life instead of solely on grades, lower costs realizedby economies of scale can offset the lower grades. This results in almostidentical gross margins between high- and low-grade deposits. Low-grade can infact mean big profits for mining companies – copper-gold porphyries offer bothsize and profitability.

The secondfactor affecting the profitability of these often immense deposits is thepresence of more than one payable metal ie. for gold miners using copperby-product accounting, the cost of gold production is usually way below theindustry average. (the copper credits off-set the gold mining costs per ounce)

The economicsof mining porphyries comes down to by-product accounting. Here’s how it works,using Barrick as an example.

As a goldminer, Barrick needs to replace its gold reserves as they’re mined out. If,instead of a gold deposit, Barrick acquires a copper-gold porphyry, by-productaccounting takes place - because the deposit not only has gold but copper, maybemolybdenum, and other metals too. The copper and moly by-products are mined,processed and sold - with by-product revenues put against production costs.This allows the gold company to mine the gold at three-quarters the cost of agold-only deposit, or half, even 100% - in which case the miner is using therevenues from by-product metals to mine gold for free!

An interestingnote to AOTH readers: I made these comments in 2009, on the suitability ofacquiring copper-gold porphyries as a way for gold miners to increase theirreserves. So I felt some satisfaction in reading the CEO of Barrick Gold makingmuch the same argument in an article this week in the Financial Post - 11 yearslater.

In mining,costs per ounce can make or break a company. Imagine Barrick not only adding toits gold reserves, but lowering its costs per ounce, to below the industryaverage, through the sale of by-product metals. Barrick’s financials turn uprosy, and CEO Bristow ends up looking like a hero!

Yet from whatwe’ve read in the Financial Post, Bristow doesn’t want to go after porphyries -which hold 20% of the world’s gold reserves and are, in our opinion, ano-brainer to develop. Instead the CEO of the world’s second-largest goldcompany says he’s looking at Grasberg as a potential take-over target. A minethat, while still claiming the title of world’s largest copper mine, hasdepleted all its high-grade, above-ground ore. What’s left underground willlikely be more costly to extract.

Instead, wehumbly submit a better solution. Mr. Bristow, if you’re reading this, how abouttaking a look at a junior resource company that already owns one of thesecoveted copper-gold porphyries or large sedimentary copper-silver deposits in“young rocks”, that you could acquire, for pennies on the dollar?

I can think ofa few to choose from, right here on my front page.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2019 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.