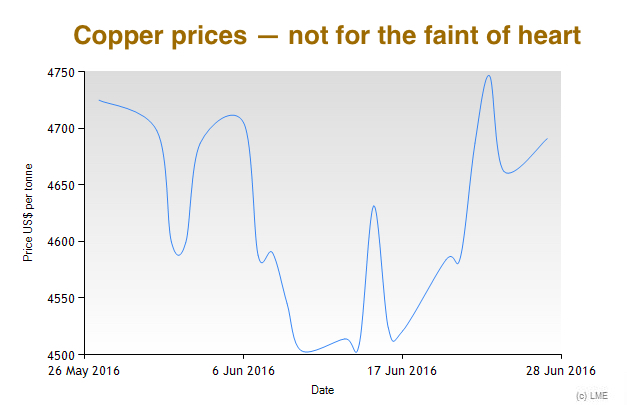

Copper is soaring, hits 7-week high

Copper prices soared to a seven-week high on Tuesday morning in London driven by growing expectations of monetary stimulus, a weakening US dollar and slightly more steady global markets.

Britain's decision to leave the European Union won't have major long-term implications on the copper market, say analysts, unless it triggers a complete fall apart of the EU.The London Metal Exchange's three-month copper contract was up 1.9% in midmorning European trade at $4,798 a tonne, after hitting earlier $4,800 a tonne - its highest level since May 6.

The sharp gain came even though markets continue to be affected by worries and uncertainty following Britain's decision to leave the European Union.

Given its widespread use in the communication, transportation, manufacturing and construction industries, copper is perceived as a bellwether for the mining and metals sector as a whole.

Rumours of the US Federal Reserve delaying interest hikes until December are weighing on the dollar. When it falls, it makes US currency-denominated commodities (such as copper) cheaper for foreign companies, which in turn boosts demand.

Chart courtesy of LME.

The chance of monetary policy easing in China - responsible for nearly half of global metals demand - is also helping the industrial metal.

Analyst at the Economic Calendar say the result on the Brexit referendum won't have major long-term implications on the copper market, unless it triggers a complete fall apart of the EU.

If that happens, they write, economic turmoil will likely impact the metal, but - in the near-term - they believe demand from China is a far bigger concern.