Copper miners' game of chicken continues

The latest edition of the closely followed GFMS Annual Copper Survey forecasts primary production to continue to grow over next three years, albeit at a slower pace than in the recent past, as miners deliver on investments made during the boom years.

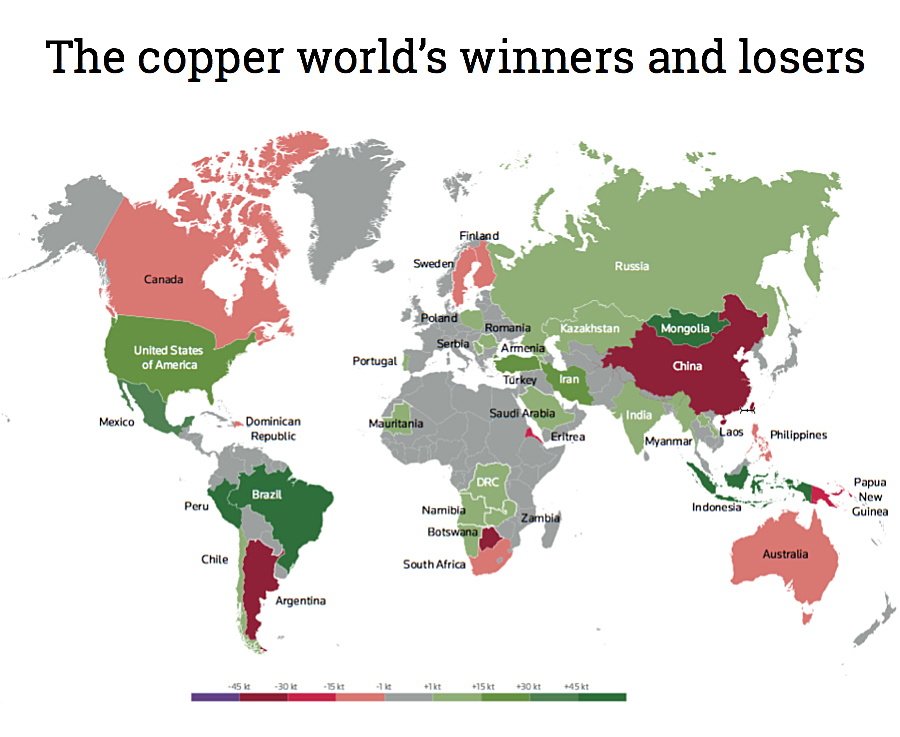

World mine production was up 3.5% or 652,000 tonnes in 2015 to just over 19 million tonnes, compared with a 2.1% increase in 2014, but down substantially from 2013's 8.2% clip. Peru led the pack with a 28% rise in production which saw it surpass the US in the global rankings to take third place behind Chile and China.

Given the well-publicized trend of falling grades and increasingly contaminated concentrate at the world's biggest mines it's interesting to note that a full 722,000 tonnes of increased production came from higher yields, more than the additional supply from expansions, new mines and restarts combined.

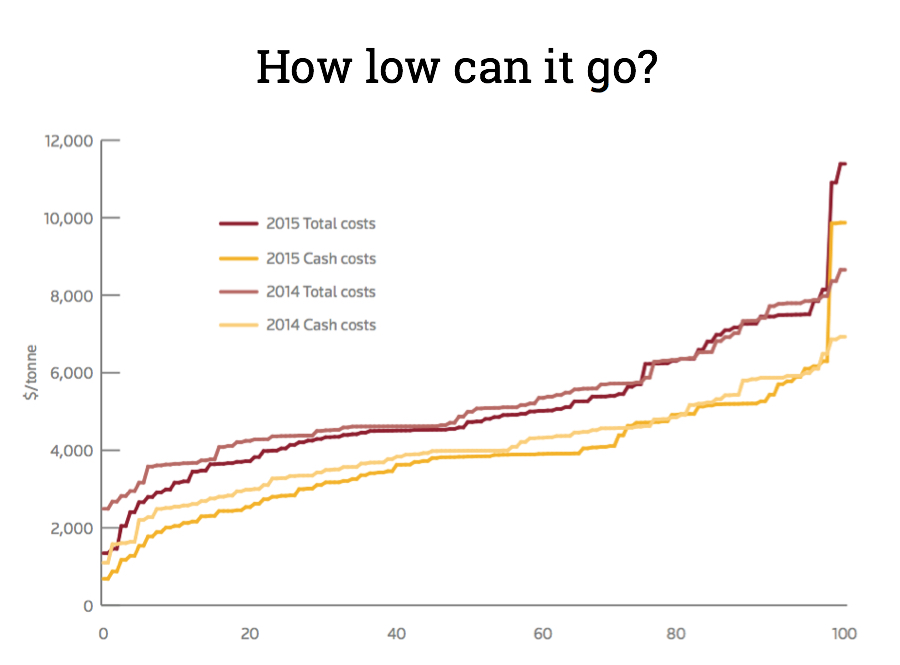

According the Thomson Reuters GFMS study copper miners had a hard time driving costs down amid the falling price environment. Net cash costs for full year 2015 stood at an estimated $3,586 a tonne ($1.62 per pound), a modest 4% or $160 tonne decline year-on-year. However, total costs (a better proxy for sustaining production levels at mines) for the sector at $4,626 a tonne ($2.10 per pound) were only lower by a paltry 2% from levels in 2014.

The cost of mine closures, including labour retrenchments, environmental liabilities, and the possible souring of relationships with governments, all offer resistance to companies in taking the ultimate decisionWhile costs proved difficult to curb revenues declined steeply with the average copper price achieved in 2015 at $5,503 or $2.50 a pound. Average total costs at the world's copper mines are also painfully close to the ruling price which on Tuesday was $2.14 or $4,718 a tonne.

Despite these pressures, GFMS calculates that only 200,000 tonnes of production were cut back on an annualized basis last year with the bulk coming from Glencore suspensions of production the Katanga mine in the DRC and Mopani operations in Zambia. (GFMS also points out that these mines are due to come back on line next year following expansions and upgrades).

GFMS says one explanation for the muted impact of paper thin margins is that it was only in the third quarter of last year that the average copper price dipped below the 90th percentile.

The study points to further closures in coming years but the authors warn that "the scale of any new mine closures should not be overstated":

First, disinflationary pressures from a weak crude price, weak inflation expectations and a strong dollar could potentially shift the cost curve lower in the next three years. Furthermore, the cost of mine closures, including labour retrenchments, environmental liabilities, and the possible souring of relationships with governments, all offer resistance to companies in taking the ultimate decision of shutting a mine.

Source: Thomson Reuters GFMS

Primary supply growth will filter through to higher refined output, which was estimated to grow by an average of 2.1% in the next three years. With an estimated 400 000 t/y of copper smelting capacity ramped up towards the end of last year, GFMS expected a further addition of smelting capacity to enter the markets this year.

The copper world remains all about China, with the country's forecast global share to increase to 46% in 2018, a touch higher than 45.5% in 2015 according to the authors. China's copper consumption growth however, was expected to slow down to an average of 3.2% per year.

"Even so, there is no doubting that the current low price environment is sowing the seeds for the next boom as projects are shelved, delayed, sold or abandoned completely"Moderating demand growth and the robust supply picture will see surpluses through the end of the decade according to the study. Following last year's 363,000 tonnes surplus - the largest in several years - for 2016, GFMS expects the copper market to experiences a surplus of at least 150 000 tonnes, with the same again expected for 2017, as improving demand growth offset rising mine and refined production.

Given the unbalanced picture GFMS predicts the copper price would suffer its fifth year of declines in 2016. The authors forecast prices to improve from 2017 onwards as the global economy picks up some momentum, to gain by 5% year-on-year to reach $5,100 a tonne ($2.31 per pound). Coupled with shrinking surpluses, GFMS expects prices to see a much stronger upswing of 12.5% in 2018 to reach $5,738 a tonne ($2.44). In real terms (2015 prices) however, GFMS expects the price to remain below $5,000 a tonne in 2016, and will only see a positive turn by 2018 according to the study.

"Bearing in mind demand growth consistently below 3% compared with circa 4% as recently as 2014, the transition to a sustained deficit market will now extend beyond our three-year forecast horizon to around the turn of the decade. "Even so, there is no doubting that the current low price environment is sowing the seeds for the next boom as projects are shelved, delayed, sold or abandoned completely.

Source: Thomson Reuters GFMS