Copper price big loser as other commodities rally

In afternoon New York trade on Friday copper for delivery in July suffered another down day exchanging hands for $2.0175 a pound ($4,458 a tonne) settling at its lowest level since mid-February.

Copper's weakness comes despite Chinese trade data released earlier this week showing 2016 imports of refined copper are up 22% compared to the first five months last year. The increase in copper concentrate imports is even more dramatic with Chinese smelters taking up 34% more at 6.7 million tonnes so far this year.

The copper price is being pulled in all directions:

Source: LME, SteelIndex, COMEX, NYMEX

After more than halving over the past year global LME stocks this week shot up more nearly 40% driven by massive deliveries into Asian warehouses from Chinese stockpiles. The copper market is also back in contango (when copper for delivery in the future is more expensive than spot) after a being in elevated backwardation for most of the year which means plenty of metal is available in the market.

Despite a reduction in stocks on the Shanghai Futures Exchange, spot premiums for physical delivery also continue to fall, reaching a four-year low of $45 a tonne this week. The premiums paid in an indication of the tightness of the market and the sharp fall from October premiums of $125 a tonne suggests demand remains subdued.

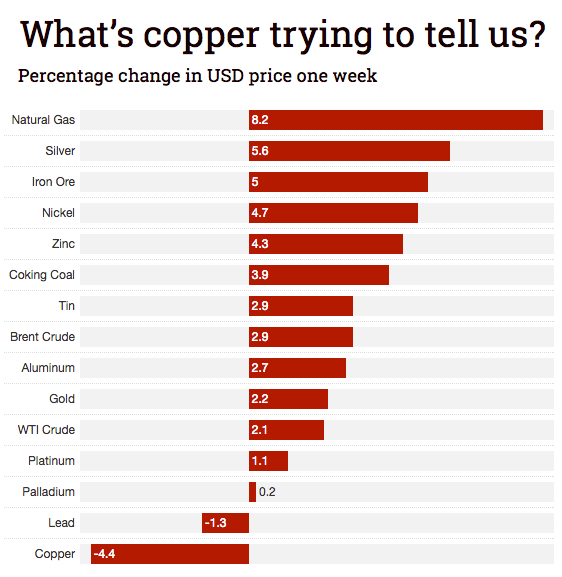

Copper is the second worst performing metal this year behind lead and is down more than 12% since end April. This week again copper went in the opposite direction of other commodities which made the most of a weaker dollar.

Given its widespread use transport, construction, electricity infrastructure and telecommunications copper is frequently used as a barometer of economic health. Whether the weakness in the red metal is an indication that China and the global economy is in worse shape than thought or that recent declines are simply the result of short-term trading strategies in Asia is unclear at this moment.