Copper price jumps on record Chinese imports

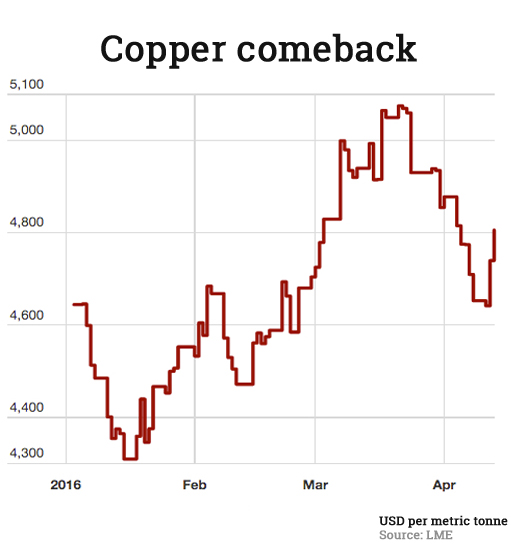

In New York trade on Wednesday copper for delivery in May gained for the fourth day in a row after customs data from top consumer China showed a huge jump in imports of the red metal.

May copper futures jumped to $2.18 per pound or around $4,805 a tonne, up 1.5% from Tuesday's close before paring some of those gains by lunchtime. The price of copper is up 12.6% from a seven-year low hit mid-January.

China is responsible for more than 45% of copper demand and according to customs data released today imports of refined metal surged by 36% to a record 570,000 tonnes in March compared to February and 39% from a year earlier. For the first three months of the year the country's imports are up 30% to 1.43 million compared to the first quarter of 2015.

China is responsible for more than 45% of copper demand and according to customs data released today imports of refined metal surged by 36% to a record 570,000 tonnes in March compared to February and 39% from a year earlier. For the first three months of the year the country's imports are up 30% to 1.43 million compared to the first quarter of 2015.

February imports of copper concentrate slowed to 1.37 million from February's 1.46 million tonnes, but for the first three months imports are up 34% at 4 million tonnes. Concentrate imports hit an all-time high in December.

While global LME stocks have been declining falling below 150,000 tonnes this week down more than 200,000 tonnes since September, warehouse inventories in Shanghai hit record highs of 395,000 tonnes a month ago after more than doubling in the space of just three months.

With domestic prices higher than LME values, the surge in imports can be partly explained by Chinese metal traders making the most of arbitrage opportunities, rather than strong end user demand.