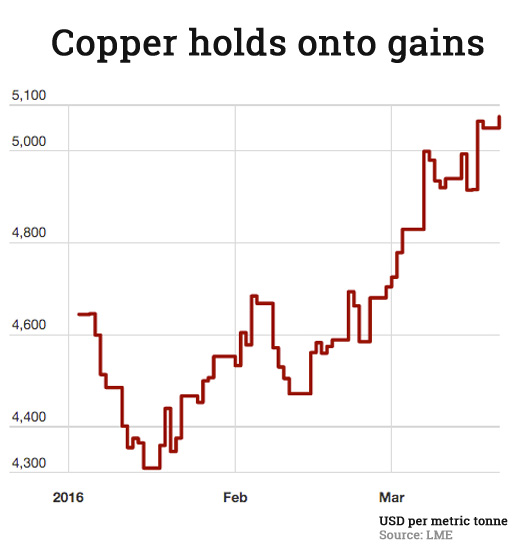

Copper price jumps to 20-week high

In New York trade on Monday copper for delivery in May consolidated recent gains to reach a 20-week high after customs data from top consumer China showed a huge jump in imports of the red metal.

Copper changed hands for $2.3020 per pound or around $5,075 a tonne in lunchtime trade on Tuesday, up o.8% from Friday's close. If the most active futures contract closes above $2.30 it would be the highest closing value since November 5. The price of copper is up more than 18% from a six-year low hit mid-January.Weaker demand than what the import numbers would suggest is also evidenced by declining premiums for physical deliveryChina is responsible for more than 45% of copper demand and according to detailed customs data released today imports of refined metal surged by nearly 56% to 328,604 tonnes in February compared to the same month last year. For the January-February period the country's imports are up 30%.

February imports of concentrate nearly doubled from a year ago and up 24.8% compared to January to 1.46 million tonnes, not far off December's all-time highest monthly volume. For the first two months imports are up 55%.

While global LME stocks have been declining reaching 155,000 tonnes on Monday, warehouse inventories in Shanghai are at record highs above 350,000 tonnes after doubling in the space of just three months. That's an indication of weak end user demand. Weaker demand than what the import numbers would suggest is also evidenced by declining premiums for physical delivery which have fallen to around $80 a tonne from year highs of $130 a tonne in October.

A new report by metals and mining researchers CRU cites high stock levels as a major factor that could end copper's rally this year. Apart from high SHFE stocks, semi-finished products sitting in bonded warehouses around the country amounts to roughly 200,000 tonnes Matthew Wonnacott, a Hong Kong-based analyst at CRU, told the FT:

A new report by metals and mining researchers CRU cites high stock levels as a major factor that could end copper's rally this year. Apart from high SHFE stocks, semi-finished products sitting in bonded warehouses around the country amounts to roughly 200,000 tonnes Matthew Wonnacott, a Hong Kong-based analyst at CRU, told the FT:

"We've had this rally in metal prices on macro developments in China but that hasn't been supported by fundamentals."

Producers are also less than sanguine about the price outlook.

Last week top copper producer Freeport-McMoRan (NYSE:FCX) said the copper market is likely to stay in surplus this year following 147,000 tonnes of oversupply in 2015 (the highest since 2009). The Phoenix-based company said that's despite 700,000 tonnes of supply likely dropping out of the market for the 12 months through June.

Chile's Antofagasta (OTCMKTS:ANFGY), like state-owned Codelco, is also skeptical of a substantial rise in the copper price with CEO Diego Hernandez arguing that the rally seems to be "driven more by financial investors than any change in the fundamentals," adding that a price around $2 or lower is likely for the next two years.