Copper price jumps to 6-month high

In early trade on Monday copper for delivery in December touched six-month highs with copper futures exchanging hands for $2.3125 per pound in New York and topping $5,000 a tonne in London dealings for the first time since end-April.

Copper has risen during 10 of the last 11 trading sessions, adding nearly 11% in two weeks. While other industrial metals and steelmaking raw materials have jumped in value this year, the bellwether metal has advanced a more modest 8% this year. The copper price hit six year lows in January following a 26% decline in 2015.

China's economy "is now showing clear signs of a cyclical upturn in activity"The latest leg up for the red metal was sparked by confidence that the economy of China, responsible for nearly half the world's copper demand, has returned to more robust growth. Thanks to copper application in a variety of industries including electricity, construction, manufacturing and transport, copper is often thought of as a barometer for economic activity.

During the third-quarter GDP expanded at a 6.7% rate for the third straight quarter as Beijing brought forward massive infrastructure spending and other monetary and fiscal stimulus measures from Beijing worked its way through the economy.

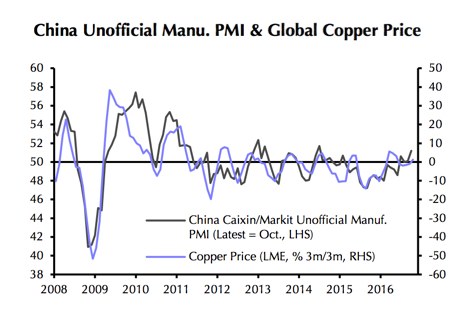

Source: Capital Economics

The copper price often moves in tandem with manufacturing (see graph) and last week Chinese manufacturing data for October comfortably beat expectations with the Caixin manufacturing PMI rising to its highest since July 2014. Output rose to a five-and-a-half year high as new orders boosted activity. After years of concerns about inflation, the underlying price indices of the gauge reached levels last seen in 2011.

China's vehicle sales have also picked up dramatically jumping more than 30% in October after five months of 20%-plus growth. While some of the increase in deliveries could be ascribed to government incentives on small car purchases expiring at the end of the year, car sales is expected to top 20 million units for the first time ever in 2016.

In a research note Capital Economics says China's economy "is now showing clear signs of a cyclical upturn in activity, suggesting that the copper price could rise further."