Copper price: Lower for longer

Study shows copper price fall matches previous down-cycles going back to 1975, but expect a long painful slog before a sustained recovery

It's been a brutal November for copper which despite a nice bump on Tuesday is down more than 10% during the month.

In New York on Tuesday copper gained 2.5% to $2.06 a pound after coming dangerously close to dropping through $2.00 on Monday, the lowest since March 2009.

Copper traded below the $2-level for a brief seven months at the height of the global financial crisis. It took just 18 months to climb its way back to a record of nearly $4.50.

Is today's big bounce off the psychologically important $2-level (in the absence of any really positive development on commodity markets) the first signs of a bottom in the copper market?

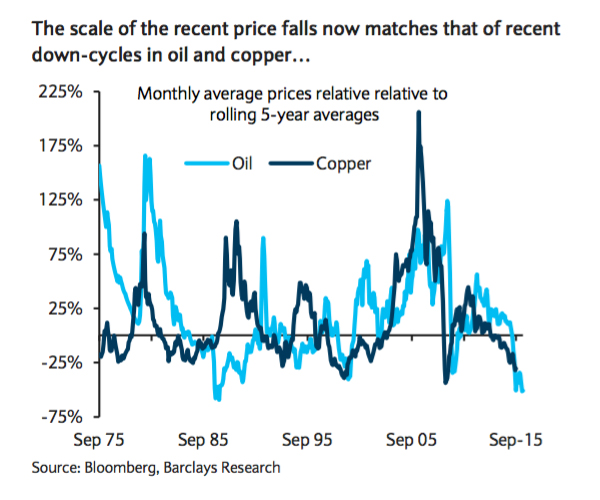

Barclays recently put out a research report that compared copper and crude oil cycles going back to 1975.

Compared to previous downturns - the 1980s global economic slump, the late 1990s Asian crisis and the global financial crisis of 2008-2009 - the current bear market in oil and copper is already more severe.

Relative to their rolling five-year averages, the November average price for copper is down 36% (and at today's price it's just over 40%) and more than 50% below for oil. Copper's decline matches the average maximum decline of 36% during the previous downcycles while oil is clearly overshooting on the downside, according to the study.

But the depth of this bear market is just one half of the story.

Comparing the length of time trading at cyclical lows compared to previous periods indicated the copper market may be "bumping along the bottom" for a while still.

Copper has now traded at 20% or more below its prevailing five-year average for 10 months. According to Barclays during previous downturn the red metal spent 15 months in a bear market.Put another way - copper (and oil) should be performing much better and not making fresh lows if we were witnessing a sustainable recovery.

Dane Davis, commodities research analyst at Barclays, tells MINING.com that given the heights reached during the China-induced boom it is to be expected that the lows may be lower (and longer):

"It took a decade for global copper demand to go from 15 million tonnes to 22 million tonnes. That's an increase of 7 million tonnes. During this time China's demand has gone up 8 million tonnes. So take China out of the picture and global demand has actually been flat or declining."

From Barclays: Primed for crisis, or bottoming out

This year's mini rallies in the copper price came on the back supply cuts, not a pick up in demand. In fact news out of China has only deteriorated and Davis believes November's slide in the copper price was the result of a fear in the market that there won't be any more supply cuts.

The world's top producer Codelco said as much last month announcing that it will focus on cost cutting, not reducing output. Over and above belt-tightening miners have enjoyed substantial cost savings through the drop in the oil price and weakening currencies. That's kept marginal producers in the market for longer than expected."That's the problem with the cost curve. Not only does it rely on historical data, it cannot properly take into account state-owned actors such as Codelco, which doesn't always operate on purely commercial grounds," says Davis.

Recovery for the copper price following previous downturns came on the back of robust economic growth.

The recovery from the Asian financial crisis took place on the back solid global growth, averaging over 4.5% from early 1999 into 2000 while the 1980s lows were also followed by an above trend growth spurt.

From the second quarter of 2009 onward global growth was 4%, 5.3%, 5.1% and 6% and according to the Barclays research, restocking all the way through copper distribution chain "magnified the underlying demand improvement and resulted is sustained periods of very strong demand growth."

Few are predicting such a strong recovery this time around. And as for copper, Davis sees no collapse, but global demand would peak some time over the next five years. A decline after that - including in China - is on the radar.