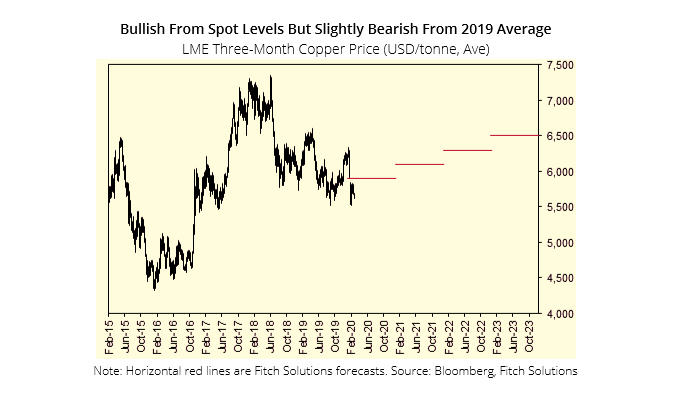

Copper price revised up on bullish H2 2020 outlook

Dragon statue in Shanghai covered in coins by joelwillis

Dragon statue in Shanghai covered in coins by joelwillis

In a new report, Fitch analysts are revising up their 2020 copper price forecast to $5,900/tonne from $5,700/tonne as they now expect increased stimulus from the Chinese government to lift prices higher over the back half of the year.

The research firm expects copper sentiment to remain subdued in the short term, thus weighing on prices, as investors react to the latest Covid-19

Fitch analysts expect the majority of shuttered manufacturing hubs and supply chains in China to be freed of restrictions by April

Fitch expects the majority of shuttered manufacturing hubs and supply chains in China to be freed of restrictions by April, paving the way for higher copper demand later in the year.

As trade tensions between the US and China eased following the signed phase one trade deal in January and major markets' manufacturing expanded according to January PMI data, copper prices enjoyed relief from 2019 woes and traded above $6,300/tonne.

However, the positive sentiment was short-lived as the spread of the Covid-19 epidemic in China led to the lockdown of multiple cities, congested supply chains and shutdown of factories that use primary copper metal.

This has especially dampened short-term demand expectations for copper as manufacturers and construction projects in China remain constrained by the government's efforts to contain the virus. This exogenous shock has led Fitch's Country Risk team to revise China's real GDP growth forecast from 5.9% y-o-y to 5.6% y-o-y in 2020.

But Fitch analysts are expecting Beijing to cushion the impact from the virus by instituting aggressive stimulus measures in order to maintain its goal of doubling the country's GDP by end-2020 from the 2010 level.

As such, Fitch asserts, these measures, including the front loading of infrastructure projects and tax and fee cuts to vulnerable sectors, will lead to increased demand for copper and thus lift prices from spots levels of $5,685/tonne.

Over the long term, the firm expects prices to remain elevated due to persistent deficits in the copper market driven by increased demand from the power and autos industries.

Beyond 2020, Fitch forecasts the copper market to switch back into a deficit as consumption growth recovers, driving prices higher over the coming years.

Read the full report here.