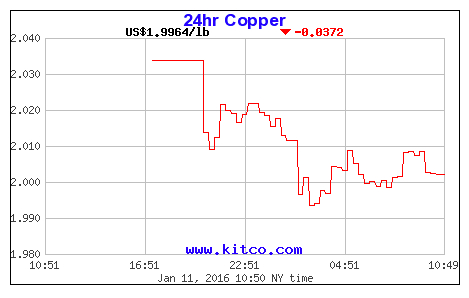

Copper prices falling like it's 2009

Image courtesy of Codelco.

Copper prices hit Monday a six-year low after more equity losses in Shanghai increased concerns over the Chinese economy, the world's largest consumer of the red metal.

The effects on most miners were as dramatic as quick. Diversified miner BHP Billiton (ASX:BHP), the world's largest mining company, reached the lowest in a decade, closing almost 5% down in Sydney to $15.55.

Rio Tinto's (ASX:RIO) shares also fell, though not as much - it closed 3.34% lower at $40.5

Freeport-McMoRan (NYSE:FCX) did follow suit. The world's largest listed copper producer was down 13.9% to $4.66 at 10:19 am ET.

Glencore (LON:GLEN), another top red metal producer, was slightly down in afternoon trading in London to 77.26p.

Southern Copper (NYSE:SCCO) was also down (0.96%) in New York to $23.84 and Poland's KGHM (WSE:KGH) was trading 1.74% lower at $53.65 Polish Zloty.

Chart courtesy of Kitco Metals.

Copper is a key component in manufacturing of everything from high tech devices to houses, and it is often looked to as a gauge of economic health. China's speedy expansion of recent years has been a strong demand driver, but weakening conditions there and robust global production have come to weigh heavily on the market.

Analysts divided

Some analysts insist there is light at the end of the tunnel. "Copper continues to face headwinds moving into 2016," wrote the commodity strategists at Bank of America Merrill Lynch. However, "another round of production cuts on top of those announced last year could help rebalance the market. Meanwhile, if some of the copper intensive sectors in China continue to rebound, copper prices could find increasing support towards 2H16," they added.

The slightly brighter outlook sent Anglo American (LON:AAL) shares up 4% on Monday to 238.25 pence in late afternoon trading.

Other forecasters are not so sure a potential rebound. "Despite a marginal recovery in early trade amongst UK miners, given current fundamentals and any recent rally history the downside pressure will remain pertinent with copper now trading below $2 per pound," wrote Monday Ipek Ozkardeskaya, market analyst at London Capital Group.