Copper prices may weigh on Rio Tinto's looming decision on Oyu Tolgoi expansion

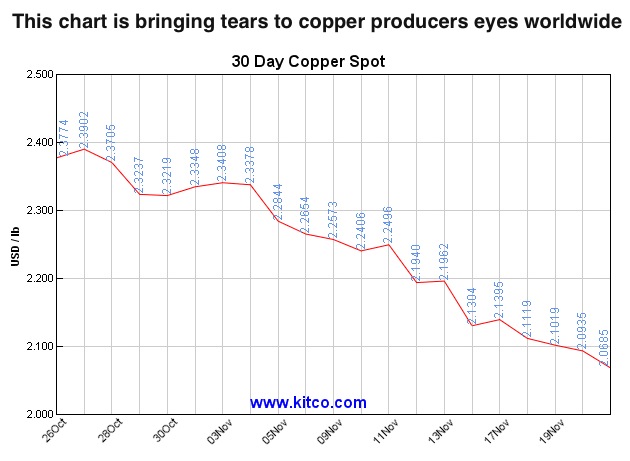

Rio Tinto's (LON:RIO) decision on its long-delayed expansion of the Oyu Tolgoi copper and gold mine in Mongolia is likely to be affected by the current slump of the metal, which hit a fresh six-year low this week.

Rio Tinto's (LON:RIO) decision on its long-delayed expansion of the Oyu Tolgoi copper and gold mine in Mongolia is likely to be affected by the current slump of the metal, which hit a fresh six-year low this week.

The world's-second biggest miner, which began production from an open pit of Oyu Tolgoi over two years ago, has not finished lining up financing for the $5 billion expansion, Reuters reports. However it said it would announce a final decision on the matter early next year, as the company believes it has "the right environment today."

Speaking at a Bloomberg News-sponsored forum, Rio's copper and coal chief executive, Jean-Sebastien Jacques, said that while the company believes the copper market is facing two or three years more of pain, it is the one commodity they expect to recover the fastest.

Expanding the mine - the biggest single foreign investment in Mongolia - would significantly increase Rio's exposure to copper, while reducing its reliance on iron ore, where growth in supply and lacklustre demand has sent benchmark prices plummeting to record post-2008 lows this week.

Courtesy of Kitco Metals.

Oyu Tolgoi phase II is a truly giant project - the latest feasibility study including the underground expansion shows recoverable copper of 25 billion pounds, 12 million ounces of gold and 78 million ounces of silver over a mine life of 41 years.

A separate economic assessment to develop Oyu Tolgoi further and include other deposits at the property shows just what a rich find Oyu Tolgoi really was. This scenario provides a 94 year mine life and recoverable copper of 56.5 billion pounds, 27.9 million ounces of gold and 195.2 million ounces of silver, pushing the value of the mine to closer to $200 billion.

After the extension, the Oyu Tolgoi mine, located about 80 kilometers (50 miles) north of the Chinese border, will contribute about a third of Mongolia's economy when at full tilt, according to Rio Tinto-controlled Turquoise Hill Resources (TSE,NYSE:TRQ), the mine operator.

The Canadian miner owns 66% of Oyu Tolgoi, while Mongolia owns the remaining 34%.