Copper prices plummet on China worries, oil collapse

Copper prices fell the most in two weeks in London, as investors' worries over China's deepening economic slowdown and collapsing oil prices dampened sentiment across commodities markets.

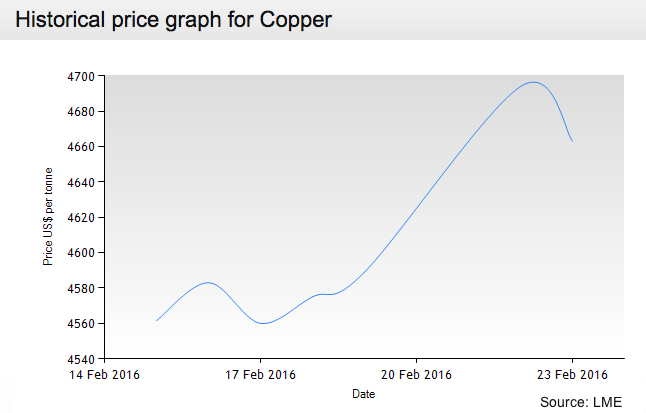

The London Metal Exchange's three-month copper contract fell as much as 1.4%, the most since Feb. 10, to $4,580 a metric ton and was at $4,591.50 by 12:11 p.m. on the London Metal Exchange. Other industrial metals were also trading lower.

The drop in prices dragged producers of the red metal along. Freeport-McMoRan (NYSE:FCX), the world's largest listed copper miner, was down more than 8% to $6.6 Wednesday morning.

BHP Billiton (ASX, NYSE:BHP) sank as much as 9.05% in New York, following its biggest slide since 2008 in Sydney, where it closed 8.22% down to $16.18. The world's largest miner on Tuesday cut its dividend for the first time in 15 years as first-half profit tumbled 92%.

Glencore (LON:GLEN), another top red metal producer, was one of the most affected. The stock was more than 10% down to 116p in late afternoon European trading.

Glencore (LON:GLEN), another top red metal producer, was one of the most affected. The stock was more than 10% down to 116p in late afternoon European trading.

Antofagasta (LON:AAL), also saw its shares crumble. The Chilean miner was down more than 5% in London midafternoon. And world's No. 2 miner, Rio Tinto (LON:RIO), was shedding almost 5.6% at 3:30 pm GMT.

Copper is a key component in manufacturing of everything from high tech devices to houses, and it is often looked to as a gauge of economic health. China's speedy expansion of recent years has been a strong demand driver, but weakening conditions there and robust global production have come to weigh heavily on the market.