Copper Stock's Drilling Begins Next Month

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the market and one copper stock he expects to have above-average share price performance.

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the market and one copper stock he expects to have above-average share price performance.

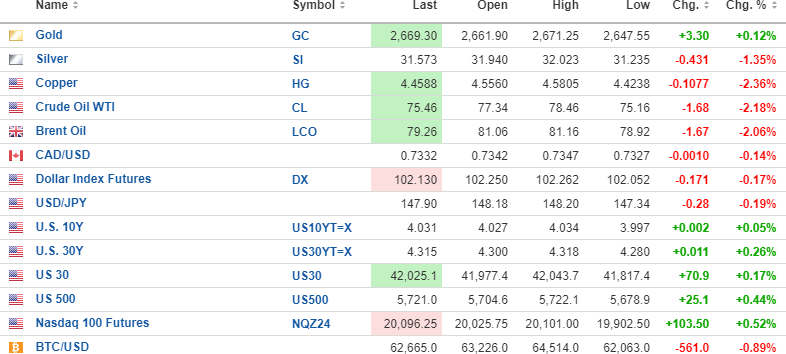

The USD Index futures are down 0.17%, with the 10-year and 30-year up 0.05% and 0.26% to 4.031% and 4.315%, respectively.

Metal prices are mixed, with gold up 0.12% to $2,669.30, but silver (- 1.35%), copper (-2.36%), and oil (-2.18%) are off sharply.

Stock index futures are rebounding off yesterday's trouncing up between 0.17% and 0.52%, while risk barometer Bitcoin is down $561 to $62,665. The Shanghai market last night took out four days of gains with one massive red candle, most certainly causing the downdraft in copper.

Yesterday afternoon, it looked like volatility was going through the roof, prompting no fewer than ten emails from subscribers asking, "Is it still ok to buy the UVIX?" to which I responded with my intentions to SELL, not BUY the VIX calls.

They closed at $7.50 but are called lower this morning as the U.S. equities experience a bounce. If these were November calls, I would hold on for another two weeks, but since there are only nine trading days left, overboard, they go.

In the GGMA 2024 Trading account:

Sell 50 VIX October $15 calls at $6.50.

If executed, the cash position will be back to $297,428 (25.66% of the portfolio).

Freeport McMoRan Inc.

Freeport-McMoRan Inc. (FCX:NYSE) is called $2 lower on the opening and looks to be headed down to fill those two big gaps that were formed on the way up after the "China stimulus" story broke a few weeks ago. Now that the orgiastic rekindling of China love has subsided, as with all tail events, markets should correct the excesses of the advance.

I see FCX back in the $45-46 range after a $52.61 print on September 26 and after I exited 50% of the stock (at $51.50) and all of the November calls (at decent profits) in September.

As always happens, I am nervous being underweight the name but not as nervous as I was when I sold all positions last May at the peak of the copper run at around $5.19/lb.

Nevertheless, it is a great company, and as an investment/trading vehicle, it has treated us very well since 2020, and I want it back in full into weakness that hopefully arrives before month-end.

Fitzroy Minerals Inc.

It appears as though some new players have entered the funding fray for Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) as I am hearing a rumor that the company has nailed down a CA$2 million (+) funding, which means the 2024 total now exceeds $5 million in a market where junior explorer/developers are still struggling to keep the lights on.

This is a testimonial to the FTZ portfolio of properties spearheaded by the Buen Retiro IOCG asset but not to be totally outshone by the dark horse Polimet which I have liked since I first sat down in Toronto with corporate advisor Gilberto Schubert, during which he sketched a wonderful schematic on the back of my linen napkin.

There are going to be some drill holes to report once they get going at Polimet so when you throw Caballos (Cu-Au-Ag) and Taquetren (Au in Argentina) into the mix, it is quite a package and now a well-funded package, which is a feather in the cap of management.

It is my largest junior holding right now, and with drilling to begin this month in Chile, I expect above-average share price performance right through the end-of-year rush.

| Want to be the first to know about interestingCritical Metals andBase Metals investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.