Copper: The Indispensable Metal Powering Modern Advancements

John Newell of RSD Discovery Group takes a look at British Columbia's copper and gold porphyry deposits, and shares two companies he believes may offer strategic entry points into the booming copper sector.

Copper has long been a cornerstone of human progress, dating back to ancient civilizations that utilized its antimicrobial properties and conductive abilities.

Today, copper's importance has only grown, playing a critical role in modern technology, healthcare, and the global push towards electrification and renewable energy. This article delves into the multifaceted uses of copper, the current market dynamics, and the emerging super cycle that promises to reshape the industry's future.

The Versatility and Importance of Copper

Copper's unique properties make it indispensable across various sectors. Its excellent electrical conductivity is crucial for wiring, motors, and renewable energy systems like solar panels and wind turbines. In healthcare, copper's antimicrobial benefits are well-documented, significantly reducing bacteria on high-touch surfaces and lowering infection rates in hospitals.

Investment Thesis: A Bullish Outlook

The long cycle of mine development, coupled with increasing demand, creates a compelling investment case for copper. The transition to clean energy and electrification is significantly driving up copper demand, including its use in electric vehicles (EVs), renewable energy infrastructure, and power grid modernization. As demand surges, supply constraints due to underinvestment and lengthy development timelines are expected to lead to higher prices.

Recent Copper Price Increase

The recent rise in copper prices is driven by increased demand, particularly from Chinese smelters operating at higher capacities. However, smelters are struggling with profitability due to lower treatment charges, which have been driven down by competition to secure mine supply.

Supply Constraints and Disruptions

Significant disruptions in copper supply have been caused by geopolitical issues and weather conditions affecting major mines. The industry faces challenges with declining ore grades, higher costs, and increasing political and environmental risks. New projects often face lengthy permitting processes, stringent environmental regulations, and opposition from local communities, further complicating supply growth.

Demand Outlook

The demand for copper is expected to rise significantly due to the electrification of the world. EVs require about 2.4 times more copper than traditional cars, and renewable energy sources depend heavily on copper for efficient energy transfer. The rise of AI and data centers also increases copper demand, emphasizing the need for a robust supply chain.

China's Role in the Copper Market

China is a major consumer and refiner of copper but relies heavily on imports from countries like Chile and Peru. The country is boosting consumption and investing in renewable energy and AI, despite weak consumer spending, further driving copper demand.

Emerging Copper Projects

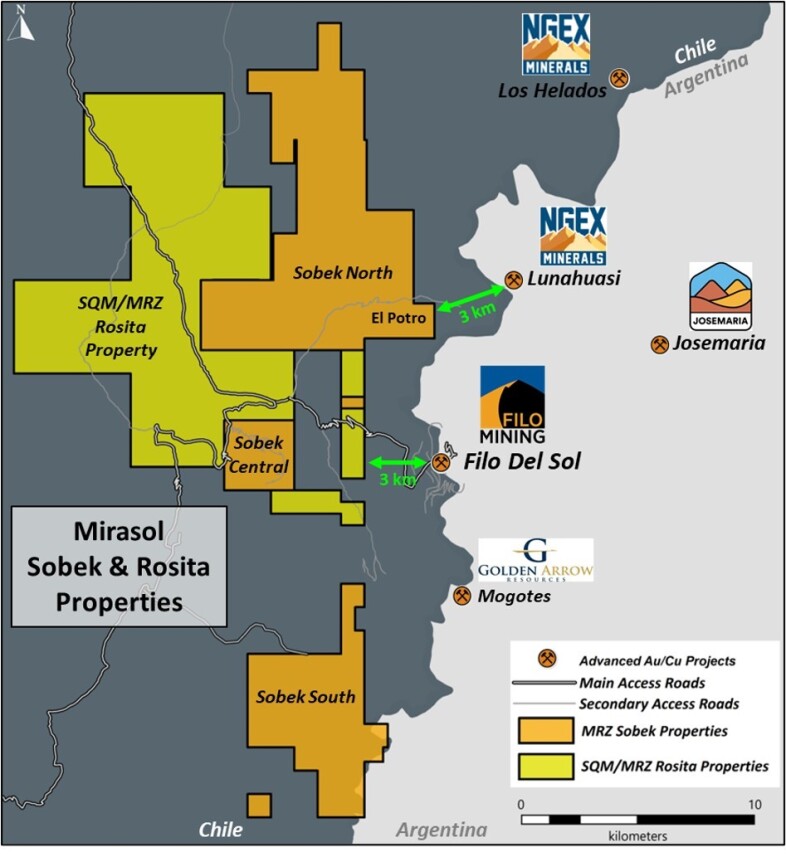

The Vicu?a district, straddling Argentina and Chile, is highlighted as an emerging significant copper district. However, many of the next generation of copper projects are still in the early stages and controlled by junior companies, posing risks for future supply meeting demand. Recent events, such as BHP and the Lundin Group's joint takeover offer of Filo Mining, further validate the thesis of the ever-increasing demand for robust copper properties. However, copper exploration remains dominated by junior exploration companies.

Future Supply Challenges

There is a projected massive shortfall in copper supply by 2025 due to the lengthy and expensive process of developing new mines and prolonged periods of underinvestment. Mergers and acquisitions have been the preferred method for increasing reserves, slowing the industry's response to rising prices and exacerbating supply constraints.

Role of Recycling

Copper scrap plays a significant role in the market but is not sufficient to meet the overall demand. The increasing need for copper in various modern applications underscores the importance of developing new sources of supply.

Technological Demand

The rise of EVs, green energy, and AI will further increase copper demand. Copper's superior electrical conductivity, with limited substitutes like silver being cost-prohibitive, makes it essential for these technologies.

Geopolitical and Environmental Influences

Geopolitical tensions, protectionist policies, and environmental regulations are driving the need for secure, local supply chains. Resource nationalism and disruptions in key copper-producing regions can elevate costs and complicate supply chains. Stricter environmental regulations and community opposition also delay new projects, leading to supply constraints.

Conclusion: Ensuring a Stable Copper Supply

Copper's dual role as an antimicrobial agent and a critical component in modern electrification highlights its importance in today's world. Increasing its use in hospitals and public spaces could significantly enhance public health, while its role in electrification supports the transition to a sustainable future. However, the underinvestment in new supply and exploration presents a significant challenge. Ensuring a stable supply will be crucial to meeting the demands of a rapidly changing world.

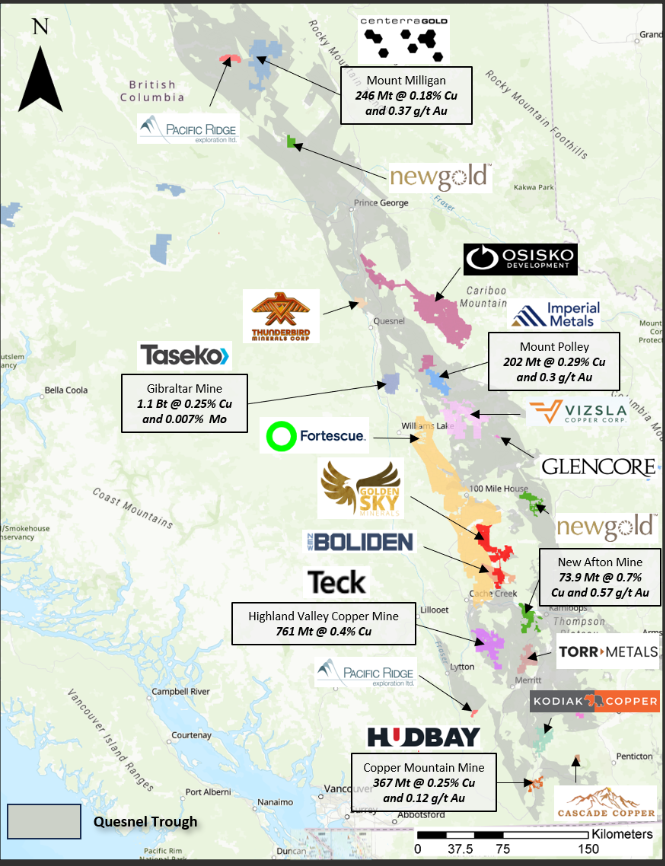

The Quesnel Trough: A Promising Exploration District

The Quesnel Trough, one of the last great underexplored copper exploration districts in the free world, represents significant potential. Large international corporations are building substantial land positions in this district, recognizing its importance in addressing future copper supply needs. Quesnel Trough Article

Map of the Quesnel Trough

This map illustrates the strategic positions of key players in this promising district, highlighting the area's potential to become a major source of copper in the future.

Torr Metals: Positioned for Copper's Future Demand

Torr Metals Inc. (TMET:TSXV) is an exploration company focused on discovering new copper supplies in British Columbia.

With a strategic emphasis on responsible and sustainable exploration, Torr Metals is well-positioned to capitalize on the increasing demand for copper.

The company is led by Malcolm Dorsey and a strong team of experienced professionals with a proven track record in mineral exploration and development, guiding Torr Metals toward potential discoveries and value creation.

The Kolos Copper-Gold Project: A Significant Exploration Opportunity

Located within British Columbia's primary copper-producing belt in the prolific Quesnel Trough, the Kolos Copper-Gold Project is a promising exploration venture led by Malcolm Dorsey, a geologist with a master's degree who completed his thesis on the southern Quesnel Trough.

The 100% owned, approximately 140 km? project contains Nicola Belt geology, like the copper-gold porphyry mines at Copper Mountain, Highland Valley, and New Afton. The project is strategically located adjacent to Highway 5, providing year-round access and substantial infrastructure from the nearby city of Merritt.

Project Overview

Geological Setting: The Kolos Project is situated in the Quesnel Terrane, a prolific porphyry belt in British Columbia. The region hosts major deposits and long-lived mines, largely consisting of Late Triassic calc-alkaline and alkaline intrusions. The project area contains six identified copper and gold notable occurrences: Ace, Kirby, Lodi, Rea, Helmer, and Clapperton, that have never been drill-tested, presenting highly prospective exploration targets with significant discovery potential.

Infrastructure and Access: The project's advantageous location near Highway 5 offers year-round drive-on access facilitated by numerous forestry service roads. This accessibility is complemented by the proximity to Merritt, which is just 23 km to the south, providing the necessary infrastructure for operations.

Historical Context and Exploration Potential: The Kolos Project area has seen intermittent exploration since the 1960s, driven by the porphyry copper-molybdenum discoveries at Highland Valley. Historical work includes rock and soil geochemical sampling, trenching, and EM geophysical surveys. Despite this, the six significant copper and gold occurrences have never been drill-tested, highlighting the untapped potential of the project.

Vizsla Copper: Emerging Leader in the Copper Market

Vizsla Copper Corp. (VCU:TSX; VCUFF:OTCMKTS), a spinout from Vizsla Silver Corp. (VZLA:TSX.V; VZLA:NYSE), focuses on copper exploration and development in British Columbia.

With significant land holdings and a commitment to aggressive exploration, Vizsla Copper is poised to become a major player in the copper market.

Strategic Exploration: Vizsla Copper is dedicated to exploring and developing high-grade copper projects in well-established mining districts, leveraging its expertise to identify and advance promising properties.Strong Financial Position: With a robust financial foundation and access to capital, Vizsla Copper is well-equipped to undertake extensive exploration programs and drive project development.

Conclusion

British Columbia's copper and gold porphyry deposits are vital to the global copper market due to their large reserves, high-quality ore, and strategic location. Major mining companies are drawn to these deposits because of their economic viability, significant production capacity, and potential for future expansion.

The continued development and operation of these mines ensure that British Columbia remains a key player in the global copper supply chain. Investing in companies like Torr Metals and Vizsla Copper offers strategic entry points into the booming copper sector, leveraging favorable market conditions and provincial support to deliver significant value and growth.

| Want to be the first to know about interestingCritical Metals andBase Metals investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

John Newell: I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.