Cost parity by 'early 2020s' will be electric vehicle tipping point

A new report by McKinsey forecasts a rapid switch from gas guzzlers to electric vehicles on the world's roads will be boosted by the plummeting costs of owning a battery powered vehicle.

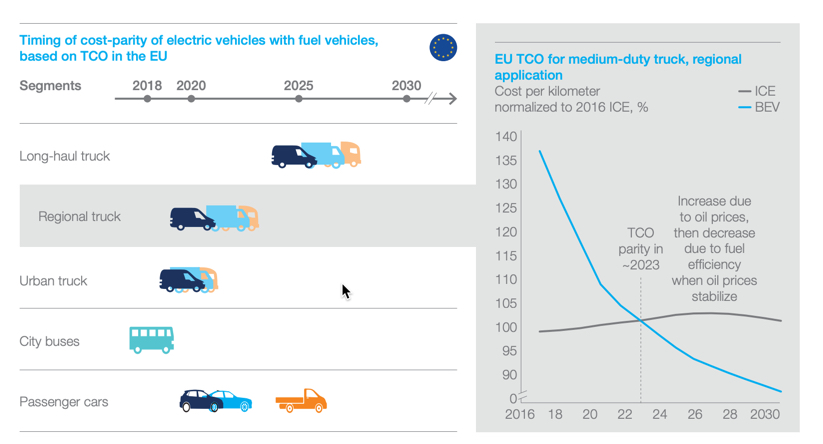

The consulting firm's 2019 Global Energy Perspective report foresees a two-thirds drop in the cost of EV battery packs by 2030. The tipping point at which EVs will be cheaper to own than internal combustion engine-powered vehicles is forecast to be reached in the early 2020s:

The timing of total cost of ownership (TCO) parity in the US and China is comparable to Europe, with China slightly earlier and the US slightly later, reflecting differences in fuel taxation and subsidies for electric vehicles.

After this tipping point, "economic considerations alone" would be sufficient to accelerate the growth of EV sales, says McKinsey. Car sharing and autonomous driving will add further incentives to go electric. Improving battery technologies will mean that even long-haul trucks could be economically electrified during the second half of the next decade.

Source: McKinsey Global Energy Perspective 2019

McKinsey's view of the electrification of the transport sector makes for some dramatic reading:

EV sales jump to 100m units by 2035Battery-powered passenger car sales grow by a factor of 60 through 2050By 2035 there will be 400m EVs on the road in China and developed countriesTo meet demand, 2.4m charging stations must be deployed per year through 2035By 2050 road transport will constitute 27% of electricity demand, up from less than 1% todayDemand for oil could peak as soon as the early 2030sMcKinsey's rosy view of transport electrification stands in contrast to a recent US government study which forecasts electric car sales will be stuck in the slow lane for the foreseeable future.