Could the Debt Ceiling Drama Uplift Gold Price? / Commodities / Gold & Silver 2023

While the 2011 analog paints anoptimistic portrait for gold, silver and mining stocks, a re-enactment of thelast debacle is unlikely to unfold this time around. Back then, gold soaredamid the debtceiling chaos, while the USD Index was a major casualty. And whileit’s possible lawmakers could ignite a similar event, most learn from theirpast mistakes.

While the 2011 analog paints anoptimistic portrait for gold, silver and mining stocks, a re-enactment of thelast debacle is unlikely to unfold this time around. Back then, gold soaredamid the debtceiling chaos, while the USD Index was a major casualty. And whileit’s possible lawmakers could ignite a similar event, most learn from theirpast mistakes.

For example, while bloated stockvaluations were the BlackSwan in 2000, the 2008 global financial crisis (GFC) was a housingmarket phenomenon, while the 2020 pandemic was a health scare. As a result,different catalysts often cause distress, and when this recession arrives, it will likely be driven by somethinginvestors least expect.

So, with the debt ceiling drama highlyanticipated, it reduces the odds of the event unfolding in line with investors’expectations. Therefore, it’s likely more semblance than substance, and thebulk of the PMs’ rallies should be in the rearview.

Here Comes the USD Index

As evidence, the USD Index hassuffered recently, and there are concerns that the ECB could out-hawk the Fed.Well, the reality is that theEUR/USD has largely benefited from a resilient U.S. stock market and lowvolatility.

Please see below:

To explain, the green line above tracksthe daily movement of the EUR/USD, while the black line above tracks theinverted (down means up) daily movement of the Cboe Volatility Index (VIX).

If you analyze the relationship, you cansee that the currency pair has moved opposite the VIX for nearly a year.Moreover, when the VIX falls and risk-on sentiment reigns, currencies like theeuro rally at the expense of the U.S. dollar. However, the environment shouldflip as we move forward. We wrote on Apr. 21:

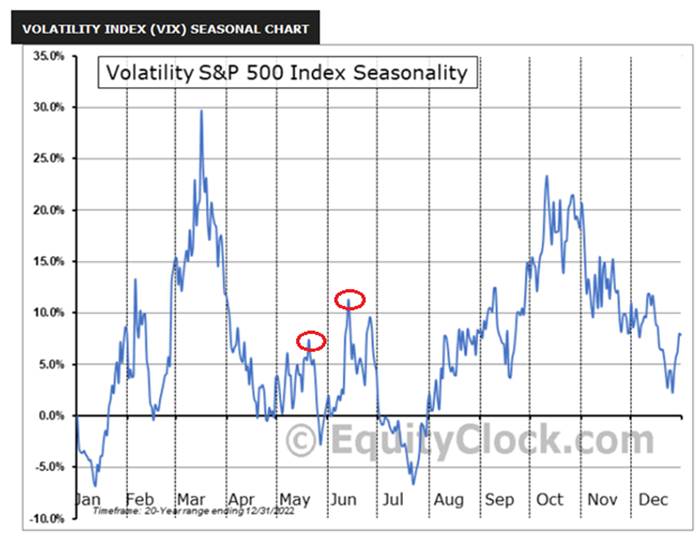

Toexplain, the candlesticks above track the weekly movement of the VIX, while theblack line at the bottom tracks its weekly RSI. If you analyze the horizontalgreen line, you can see that weeklyVIX RSI readings below 40 are rare over the last 10+ years.

We added:

Toexplain, the blue line above shows how the VIX often bottoms near the end ofApril, then rises in May, falls again, then hits a new high in June. So, withthe VIX’s clock turning bullish after next week, coupled with the rare weeklyRSI reading, the data supports more uncertainty.

Thus, while the VIX declined dramaticallyon Apr. 27, the seasonalweakness is normal. Likewise, its weekly RSI did not make a new, andthe shallow reading near 40 highlights how complacency should haunt the bullsin May and June.

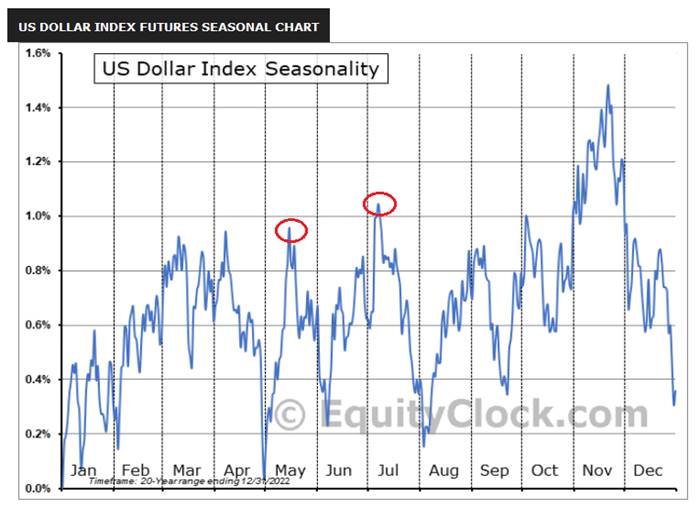

To that point, the USD Index showcases seasonal strength in May and July.

Please see below:

To explain, the blue line above shows howit’s perfectly normal for the USD Index to bottom at the end of April. Then, asharp rally often follows in early May, followed by a pullback, then anotherbreakout to new highs. Therefore, while the crowd assumes April’s winners willmaintain their outperformance, if the VIX and the USD Index jump, the PMs’trends should turn bearish.

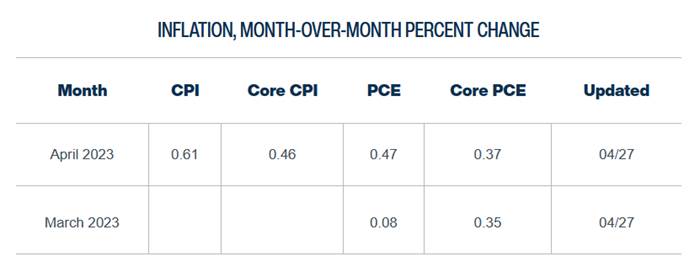

Finally, while investors assume that ratecuts are on the horizon, the data suggests otherwise. Despite inflation fatigue causing investors to ignore theramifications, the pricing pressures remain problematic and theyear-over-year (YoY) base effects end in June. As a result, themonth-over-month (MoM) readings will matter more, and the implications are farfrom priced in.

Please see below:

To explain, the Cleveland Fed expects theheadline CPI to increase by 0.61% MoM in April, which, if realized, would bethe highest MoM reading since June 2022. And while the Cleveland Fed has beenoff on its headline CPI predictions, its core CPI estimates have been accurate.As such, 0.46% MoM annualizes to 5.66% YoY, and a continuation of the themewill look even worse after June.

Overall, we believe the Fed’stightening cycle has more room to run, and a realization is bullishfor the USD Index and real interest rates. In addition, we’re days away fromthe calendar turning bullish for the greenback, and with risk assets rallyingin April, investors loosened financial conditions, which uplifts inflation.Thus, don’t be surprised if the narrative shifts dramatically in the monthsahead.

Will April’s winners suffer in May andJune, or will their bullish trends continue?

By Alex Demolitor

Alex Demolitor hails from Canada, and is across-asset strategist who has extensive macroeconomic experience. He hascompleted the Chartered Financial Analyst (CFA) program and specializes inpredicting the fundamental events that will impact assets in the stock,commodity, bond, and FX markets. His analyses are published at GoldPriceForecast.com.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Alex Demolitorand SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Alex Demolitorand his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingAlex Demolitorreports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Alex DemolitorSunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.