Could Silver "Do a Palladium"? / Commodities / Gold and Silver 2021

Palladium was manipulated for years. It had the largest short position relative to itssize, while physical demand rose inversely to decreasing supply.

In 2018, demand became so large that itoverwhelmed the shorts.

Physical palladium could not meet the market'sneeds and prices exploded. Shorts eventually decreased their positions untilthey got to a more sustainable level.

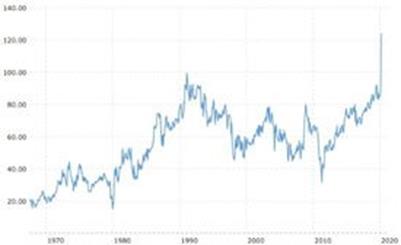

For many years, the platinum/palladium ratio, shownon proprietary charts, averaged 2.4 to 1 in favor of platinum, stretched ashigh as 5:1 in 2009, but then collapsed for a decade into 2020, to where 1ounce of palladium would buy 5 ounces of platinum!

Today, much like what was the case withpalladium, the concentrated short position in silver is unsustainable.

Ted Butler has been writing about it for twodecades, and we can be forgiven for thinking it will never change. But at somepoint soon, it appears the shorts WILL be overwhelmed.

Indeed, the rats are already leaving thesinking ship.

Witness Scotia Mocatta's exit, and if Ted iscorrect, J.P. Morgan's has reversed its long-standing position of beingmassively short silver, to going long.

The"normal" Gold/Silver Ratio is set to fundamentally change.

The"normal" Gold/Silver Ratio is set to fundamentally change.

Silver's price ratio to goldbriefly hit 15:1 in 1980 and set a new record in March 2020 with a spike toabout 125:1. But its "normal" range oscillates between 40 and 80.

Like a stone tossed into a quiet pool, therings of effect will spread out in ever-widening circles, when (not if) thiscomes to pass.

As Willem Middelkoop, Author of The Big Resetsays, "If silver breaks, then the gold manipulation might break aswell, and then you will have a real crisis within the monetary system, becausethen the dollar system is at risk... This is what can happen, and I believewill happen to silver...

There are structural changes for silver in thesupply/demand metric, projected growth of new use cases, degradation of adecades-long pattern of unrestrained "paper silver" futures andmining share selling – not to mention changing investment demand ratioscompared to industrial use.

Therefore, it's probable that – just like thegold-to-platinum, and platinum-to-palladium ratios – silver is set to massivelyoutperform gold.

The First Stage: Justmoving the ratio into the lower range of 40:1 gives us all-time nominal highsand vast outperformance for silver.

The Second Stage: Turning the gold/silverratio on its head. Anotherunderappreciated factor is that Bitcoin's meteoric rise, if sustained, couldblunt global gold demand.

Let's say that silver, as factored above, goesthrough the roof and briefly hits $500 the ounce while gold hits $10,000. Doingthe math gives us a 20:1 ratio.

Then if silver recedes to $250 you would have a"normal" 40:1 ratio. Under this scenario, primary silver producerswould be "digging up money" in exchange for fiat!

Meanwhile, it's not a good idea to"challenge" the COMEX.

In The Art of War, Sun Tzucautioned against attacking an opponent head on. He also said you should setthe field of battle so that you had already won before the conflict began.

This is exactly what the denizens at the"CRIMEX" do, and why they continually defeat all comers.

They can:

Change the rules (-see The Hunt Bros. 1980)Alter margin limits and sell unlimited paper silver.Enforce a trading rule of "offset positions only.""Settle" silver obligations with fiat.A (much) better way to "un-game" thesilver system.

Uber-trader "Plunger" writing onRambus1 com, comments: So why the strength in silver? I think it’s because thebullion bank silver cartel is in the process of unraveling and its ability tomaintain its concentrated short position is entering into its lastdays...despite the army of silver detractors out there, the charts signal to methat silver is on the verge of a breakout..."

The WallStreetBets-Robinhood-GameStop fiascopoked a hole in the vaunted Masters of the Universe's game plan.

The losers are learning the old winner's tacticsand bringing new tools to bear.

Don't try to win by holding "fauxsilver" positions like the ETF SLV.

Don't buy silver from trading houses thatcharge you for an empty vault while they write derivatives and lease out whatthey do have.

Instead…

Attack their flanks and underbelly by purchasing .999 fine physical silver.Add what you can on a regular basis - what happened a few weekends ago was just a preview.This will keep the pressure on the paperpushers as the ongoing effect of declining silver production through lowergrade and a dearth of big discoveries takes silver stores into their fifthconsecutive year of decline... just like what happened to palladium.

News broke this week that BlackRock, theworld's largest asset manager, sold a third of its GLD shares in late 2020 andput a big chunk of the proceeds into the silver ETF, SLV.

It sure looks like the dominoes holding up theold way of doing things are starting to fall. If even BlackRock is now"going for the silver" shouldn't you?

David Smith isSenior Analyst for TheMorganReport.com and a regular contributor to MoneyMetals.com aswell as the LODE Cryptographic Silver Monetary System Project. He hasinvestigated precious metals’ mines and exploration sites in Argentina, Chile,Peru, Mexico, Bolivia, China, Canada and the U.S. He shares resource sectorobservations withr eaders, the media and North American investment conferenceattendees.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.