COVID-19 Test-Kit Maker Shines Ahead of Earnings

Co-Diagnostics will put out its first-quarter earnings after the close this evening

Co-Diagnostics will put out its first-quarter earnings after the close this evening

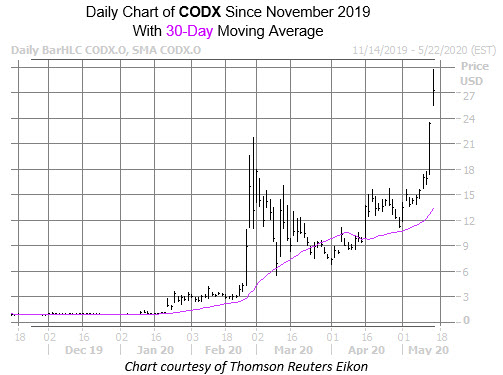

Biotech Co-Diagnostics Inc (NASDAQ:CODX) has been in the spotlight recently as one of the companies producing COVID-19 test kits. The stock has tacked on 137% in May alone, undoubtedly on the back of these test kits' success rates, shared earlier in the month. Now, CODX is once again capturing the attention of traders, up 23% at $28.83 so far today, as it gears up for its first-quarter earnings report due out after the close this evening.

Not only did CODX earlier hit a fresh record high of $29.72 earlier today, its pacing for its biggest one-week win since late-February, up 86.1% so far, thanks to two consecutive bull gaps of 20% or more. Prior to the shares' meteoric rise this week, pullbacks last month found support a their 30-day moving average.

The biotech's upcoming earnings reporthas the options pits abuzz, with 28,000 calls and 7,483 puts exchanging hands at last check today, options volume that is six times the average intraday amount. The monthly May series -- which expires tomorrow May 15 -- is by far the most popular, with positions being opened at the 20, 35, and 30 call contracts. This suggests some of these traders are expecting even more upside for the underlying stock following the firm's quarterly report.

This penchant for calls is far from unusual. In the last 10 days 16,659 calls were picked up compared to 2,692 puts, while CODX sports a 10-day call/put volume ratio of 6.19 at the International Securities Exchange (ISE), Cboe Exchange (CBOE), and NASDAQ OMX PHLX (PHLX).

That being said, even with earnings so close at hand, options are incredibly cheap right now. This is per CODX's Schaeffer's Volatility Index (SVI) of 258%, which stands in the lowest quartile of its annual range. This means options players have been pricing in relatively low volatility expectations at the moment.