Covid, Debt and Precious Metals / Commodities / Gold & Silver 2020

Precious metals are loving the uncertainty the coronavirus hascreated.

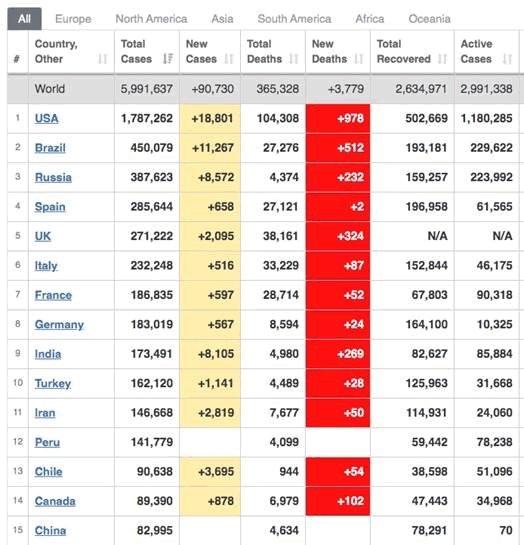

Despite limited successessome countries have had with reopening, the virus is nowhere near contained. Asof this writing, close to 6 million worldwide are infected and 365,328 havedied. The important columns in the table below from the heavily visited Worldometer's coronavirus page, are the yellow andred.

The United States is byfar the world “leader” in covid-19 cases and deaths, a respective 1,787,262 and104,308. That is more than triple the next-worst-hit country, Brazil.

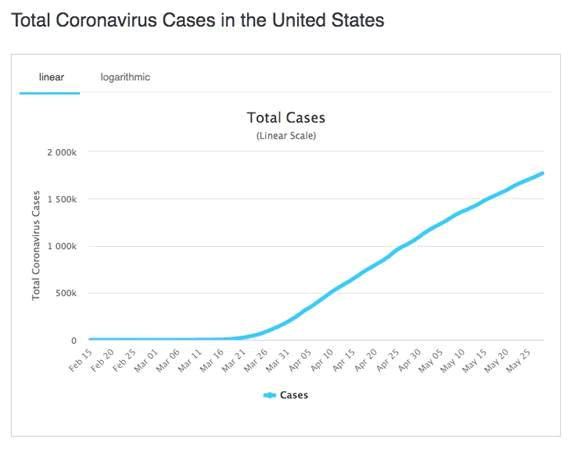

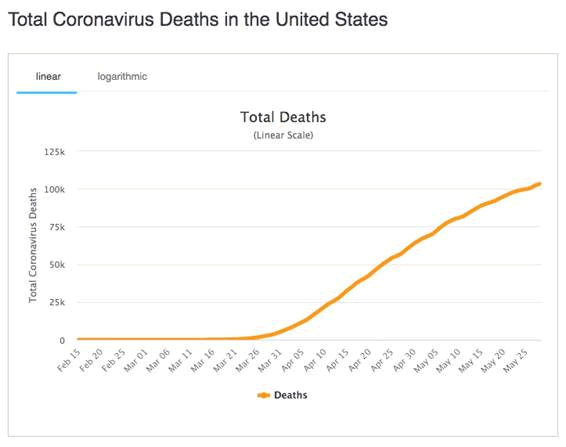

Despite roughly 1,800deaths per day and rising infection rates, at least 41 US states are easingrestrictions or planning to do so. The fact is, reopening plans are failing tomeet key benchmarks established by public health officials. This has promptedthe Federal Emergency Management Agency (FEMA) to throw previous forecasts ofthe virus’s toll out the window. Its new prediction has 3,000 Americans dyingdaily by June 1 - a 9/11 every day. Do the graphs below look to you like aflattening curve?

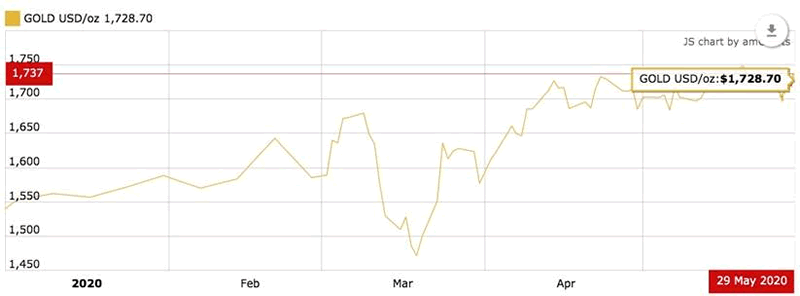

Gold and silver have beenthe main beneficiaries of the global pandemic.

Spot gold gained $10 anounce on both Thursday and Friday, finishing the week at $1,728 in New York.Gold futures for August delivery were even higher, rising $15 to settle at$1,743/oz. Since dipping sharply in mid-March, gold has soared $257, or17%.

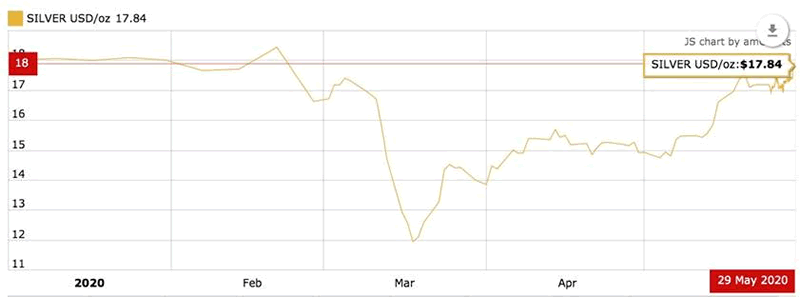

The really big performerthough is silver. Since taking a dive in March to $11.94/oz, spot silver hasrisen nearly $6.00, for a gain of 47%! The “poor man’s gold” made a 50-centmove Friday, hitting $17.84 in New York.

In this article we returnto one of our current favorite topics, how precious metals are likely toperform during what looks increasingly like a prolonged war against covid-19,specifically the impact of out-of-control debt levels many countries are beingforced to incur, as their economies are ravaged by the new and scarilyunpredictable respiratory illness.

The return ofcovid

From the very beginningsof the crisis, health officials have warned of the potential for a resurgence.Historically, it is common for these types of viruses to re-infect populations.Often the second round is worse than the first. According to health experts,the fact that covid-19 is so deeply entrenched in the world population, means itis unlikely to be eradicated, like SARS was in 2003, and instead is likely toreturn regularly, like seasonal influenza.

Indeed, after a few weeksof experimental lifting of social restrictions, we are seeing boomerang-likereturns of coronavirus cases in a number of countries. The most surprising areChina and South Korea, early victims in the crisis whose strong lockdownmeasures and testing protocols appeared to nip covid in the bud.

This week, South Koreasaw three straight days of rising infections, with 79 new cases reportedThursday, the most since April 5.

Earlier this month,Korea’s success at containing the virus was threatened by hundreds of party goerswho descended upon a neighborhood popular with young South Koreans andforeigners. The country rescinded a go-ahead for bars and clubs to re-openafter a spike in cases, prompting a warning from President Moon Jae-in to“brace for the pandemic’s second wave” said the PhiladelphiaInquirer.

Earlier in the year, whencoronavirus cases in China peaked, Beijing locked down millions of people inHubei province, including the 11 million inhabitants in the virus epicenter cityof Wuhan.

On May 12, a month afterthe lockdown was lifted, Wuhan saw a cluster of new cases, followed by 34 casesand one death reported in the northeastern province of Jilan.

Fresh covid-19 cases havealso appeared in Germany, Iran and Lebanon. In France, a partial reopening onMay 11 has backfired, with more than 3,000 new daily infections reported.

One of the most concerningdevelopments is the spread of the pathogen in Russia; on May 14, 232 new deaths werereported in 24 hours. The sprawling country now has the third most cases in theworld, although surprisingly few deaths, at 4,374 versus Canada’s 6,979. Manyhowever question the accuracy of Russia’s low death count, suspectingunder-reporting by government officials.

India has had one of theworld’s strictest lockdowns since March 24, but it has only slowed the spreadof the virus, not flattened the curve in the country of 1.3 billion. Recently The Guardian reported the virus beginning tooverwhelm the teeming metropolis of Mumbai.

Nearly a quarter ofIndia’s covid-19 deaths are in the state of Maharashtra, and the city of 20million has emerged as the center of the outbreak. According to healthofficials, the peak began on May 6 but shows no signs of flattening, with casesstill doubling every week.

Another scary scenario isthe coronavirus hitting Africa, where countries lack adequate sanitation andmedical facilities. Millions of Africans are poor and living in slums, wherecramped conditions prevent social distancing and where the virus could spreadlike wildfire. On Friday Global News reported Ascases steadily riseacross Africa, too, officials who are losing the global race for equipment anddrugs are scrambling for homegrown solutions.

US reopeningfail

The Trump administrationhas been widely criticized for the manner in which it has handled the pandemic- an “epic fail” in today’s youth parlance.

At first Trump downplayedthe seriousness of the virus, then quibbled with governors over whoseresponsibility it was to provide personal protective equipment and life-savingventilators - preferring to pick on Democratic governors thus shamefullypoliticizing a state of emergency - one he did not officially declare untilmid-March, 8 weeks after the first case appeared in Washington State.

After two months oflockdowns the White House released a set of re-opening guidelines, whichinclude that states show a “downward trajectory” of cases. As of May 7, overhalf of US states had begun to reopen their economies, but most failed thefederal criteria recommended for resuming business and social activities. Inover 50% of the states easing restrictions, The New York Times reported, case counts aretrending upwards, positive tests are rising, or both.

Time Magazine writes an interesting narrativecomparing the way the US has handled containment and tried to reopen, versusother countries that have done both more successfully. The common elementsappear to be: test early and as many as possible (duh), do contact tracing toidentify virus clusters and locations; maintain social distancing; and imposestrict lockdowns, no half-measures.

Countries that haven’tloosened too much, too fast have done much better in preventing the virus frommaking a second appearance. Here are the key takeaways from Time:

Countries thatacted more quickly to curb the spread of the virus have limited the damage onboth fronts. In the early days of their fight against COVID-19, New Zealand,Norway and Switzerland tested their populations at nearly 40 times the U.S.rate, per capita, and now have one-fifth the death rate.

Having failed inits initial response, the U.S. now risks risks making matters worse… In manycases, governors are plunging ahead with reopening despite failing to meet keybenchmarks established by public-health officials.

To avoid theseshocking death rates, Americans should look at what has worked elsewhere.Industrialized nations in Europe and Asia have begun opening up their economiesby relying on continued social distancing, widespread testing, and a network ofcontact tracing to identify and contain new outbreaks. South Korea built aninnovative digital infrastructure to identify and track every new coronaviruscase within its borders. Germany set the standard for preventative testing andan incremental, staged plan for reopening.

So, if the wayforward is clear, can the U.S. simply copy what’s working elsewhere? The straightforwardanswer is no. Unlike in places like South Korea, there’s no national reopeningplan in the U.S. Instead, 50 governors are charting their own paths. The WhiteHouse and the CDC have released bare-bones guidance for reopening, but neitherentity can dictate what states do; they can only hope that governors choose theright course.

As of early May,that wasn’t happening. More than a dozen governors’ reopening plans appeared toeither outright ignore, or interpret very loosely, the Trump Administration’snonbinding reopening guidelines, according to an Associated Press analysis. Atleast 17 states that are in the process of reopening, including Georgia,California, Florida, Massachusetts, North Carolina, Pennsylvania, Rhode Islandand Texas, failed to meet the White House’s key metric for reopening: adownward trajectory of new cases or positive test rates for at least 14 days.

As US re-openings fail, thevirus will make a comeback. There is always about a 10-day lag in the reportingof new cases. We should begin to see the first data this week or next. Expectthe curve in the US to keep going up and up.

Meanwhile the economicstatistics that keep rolling in paint a darkening picture. Despite the gradualreopening of businesses throughout the country, last week 2.1 millionAmericans were thrown out of work, bringing to 41 million the number who havejoined the ranks of the unemployed since covid-19 took hold in mid-March.

InApril US unemployment shot up to 14.7%, the highest since the Great Depression.Economists expect it will be near 20% in May.

“Thatis the kind of economic destruction you cannot quickly put back in the bottle,”Adam Ozimek, chief economist at Upwork, was quoted in the AssociatedPress.

Covid and debt

The US government andpolicymakers around the world have no choice but to unfurl massive stimulusprograms to help their citizenries to deal with what is already known to be theworst recession since World War II, and what many believe is heading for adepression.

Governments that don’thave the funds to pay for these programs have two choices: print money orborrow it. Money-printing is inflationary, so most choose to borrow, especiallywith interest rates at record lows.

As of May 15, the Economic Times of Indiareported central banks and governments worldwide had unleashed $15trillion of stimulus, via bond-buying and spending.

The Globe and Mail in April made aninteresting point:

In fact, the urgentquestion isn’t whether these countries can afford to take on more debt. It’swhether they’re taking on enough debt to fund the stimulus programs necessaryto avert an even deeper downturn.

Analysts at Bank ofAmerica describe the massive US$2-trillion stimulus package passed by U.S.Congress in March as the “bare minimum.” Scott Minerd, chief investment officerat Guggenheim Partners, told Reuters he expects more support will be needed forthe U.S. economy. If so, Canada is likely to be caught short as well.

Currently there is anadditional $3 trillion tied up in the US Senate, the new package of stimulusmeasures having originated in and passed by the Democrat-led House ofRepresentatives. The Republicans control the Senate.

The Globecontinues,

Without relief,many households will go bust. Their incomes will shrink or vanish, and theywill default on mortgages, rent payments and car bills. Meanwhile, manyrestaurants, retail stores, travel operators, malls, hotels and airlines willtumble into bankruptcy. With all those employers gone, many workers will nothave jobs to go back to when the virus does come under control. The slump couldstretch on for years and turn into a full-on depression.

This week the Centre for Risk Studiesat the University of Cambridge Judge Business School determined that the global economy facesan “optimistic loss” of $3.3 trillion in the case of a rapid recovery, and $82trillion in the event of a depression. The consensus projection is a loss of$26.8 trillion, or 5.3% of global GDP, in the coming five years.

For governments, one ofthe biggest worries of the pandemic extending beyond a few months, is the fallin tax revenue, with so many people out of work and businesses closed.

Earlier this week, the Financial Times quoted the OECD saying thatsharp drops in tax revenues are expected to dwarf the stimulus measures.Average government liabilities are anticipated to rise from 109% of gross domesticproduct to 137%, placing public debt burdens on countries at the current levelof Italy, or a $13,000 debt per person.

According to the WorldBank, countries whose debt-to-GDP ratios are above 77% for long periodsexperience significant slowdowns in economic growth. Every percentage pointabove 77% knocks 1.7% off GDP, according to the study, via Investopedia. The United States’current debt-to-GDP ratio is 106.5%.

In fact debt levelsacross the world’s richest economies were becoming unsustainable long beforethe coronavirus washed up on their shores.

In 2019 the global debtto GDP ratio hit an all-time recordof 322%. Over the last 13 years, debt has increased by $128 trillion,but GDP has only risen by $27 trillion. Ie. countries borrowed five times morethan their economies managed to produce. Finland, Canada and Japan saw thelargest increase in debt-to-GDP ratios of all the countries tracked in aone-year period.

The Institute of InternationalFinance in January predicted that total global debt will exceed $257 trillionin 2020, and that was before the coronavirus.

Prior to covid-19, thefederal deficit for the current fiscal year was expected to be $1.1 trillion.According to the Congressional Budget Office (CBO), this has been tripled to$3.7 trillion - which is more than the total federal debt President Clintonincurred while he was in office, and much higher than the $1.4 trillion deficitduring the 2007 financial crisis.

In November, total USdebt surpassed $23 trillion for the first time. Adding the projected budgetshortfall to the existing debt means the national debt will rise to $26.9trillion by September 30, 2020. And this is assuming no additional stimulus isneeded, which is highly unlikely. Remember, the US Senate is poised to sign offon an economic stimulus plan worth $3 trillion.

We already know that whengovernment debt reaches a certain threshold - according to the Bank forInternational Settlements it’s 85% of GDP - economic growth is impeded.

Forbes does a nice job of explaining why theballooning US federal debt is such a big deal:

Any debt incurredtoday must be repaid using future revenue, which reduces the amount of moneyavailable in the future for investment, spending, and saving. As more debt isincurred, larger payments are required to service it. A CBO paper from 2014entitled, CBO:Consequences of a Growing National Debt, lists four mainproblems a country will encounter if it accumulates too much debt. Excessivedebt will lead to:

Lower nationalsavings and income Higher interestpayments, leading to large tax hikes and spending cuts Decreased abilityto respond to problems Greater risk ofa fiscal crisisWith respect tonumber four (in sync with the BIS paper), the CBO said, “All else beingequal, the larger a government’s debt, the greater the risk of a fiscalcrisis.” Yes, the federaldebt is about to mushroom. Since all debt must be repaid, the federalgovernment will be forced to extract more and more dollars from the economy toservice it, leaving less for spending, investing, and saving. This will lead toslower economic growth as the private sector struggles to fund public sectorspending.

Gold and debt toGDP

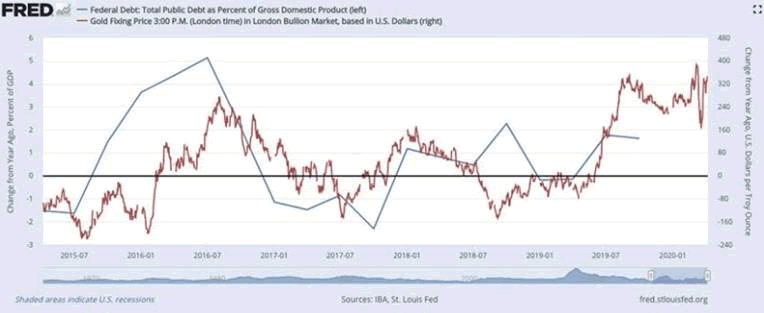

In a previous article we discussed the closerelationship between gold and the debt to GDP ratio.

Historically, we knowthat as the percentage of debt to GDP rises, so does gold. For a reminder ofhow this works, look at the FRED chart below.

Moribund for five years,as the commodities boom of the late 2000s ran out of gas and led to a bearmarket for most metals, we see the gold price coming back to life in 2016 whenit rose above $1,300 and has kept going to its current ~$1,700 an ounce. Thiscorresponds to rising debt and falling GDP.

This week, the Commerce Departmentreported gross domestic product, the broadest measure of economic health, fell5% in the first quarter, an even bigger decline than the 4.8% estimated a monthago. The Atlanta Fed projects economic growth during the second quarter tocontract 41.9%!

That is the GDP side ofthe equation. On the debt side, covid crisis emergency stimulus measures includeat a minimum, $2 trillion in new spending, and possibly doubling the Fed’sbalance sheet to $10 trillion. As of May 20, the Federal Reserve balance sheetwas at a record $7.09 trillion.The longer stimulusmeasures continue, and GDP falls, along with a creeping expansion of the Fed’sbalance sheet and negative real interest rates (interest rates minus inflation)which are always bullish for gold, we see no reason to doubt that gold will keepclimbing.

Consider what a $10trillion Fed balance sheet will do to the debt-to-GDP ratio. Already at 106.5%,a level not seen since World War II, it’s not inconceivable for the ratio tospike to $150%, or 200%. That would mean for every dollar the US economy produces, ithas to borrow $1.50, or $2.00. That’s insane.

Now think about what thiscould mean for gold.

Returning to the St LouisFed chart, gold’s red line showing volatility at the far right side, reflectedin the stock market convulsions in February-March, could very well begin asteadily upward trend, similar to what happened in 2008-11, possibly eventesting the $1,900 highs reached in September 2011.

It seems thatunsustainably high debt is baked into the cake, as far as gold prices go. Inthe current environment, without a change in the weather, so to speak, regardingthe coronavirus, governments simply have no choice but to keep spending, takingon more debt, as economic growth continues to falter.

We believe the only wayout is a “Debt Jubilee” that retires all of the massive accumulation of globaldebt.

This is not asfar-fetched as it sounds. A reading of history shows that retiring debt canactually make a country’s economy, and its indebted citizenry, all the betterfor it, as we explained in our ‘Debt Jubilee’ article.

Because we live in a fiatmonetary system, currencies are not backed by anything physical; the reservecurrency, the US dollar, was de-coupled from the gold standard in the early1970s. It's not like a raid on vaults full of gold, which have an inherent,physical store of value.

In reality there is nothingpreventing central bankers from doing a complete global reset, putting all debtback to zero.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2020 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.