Crude market hit by coronavirus demand shock - report

Following the recent sharp oil price falls, the risks to the price outlook have now shifted dramatically to the upside. (File image)

Following the recent sharp oil price falls, the risks to the price outlook have now shifted dramatically to the upside. (File image)

The impact of the coronavirus has sent shockwaves across the oil market, says Oxford Economics, an independent global advisory firm.

In its latest publication, Oxford has lowered its year-over-year global demand growth forecast in 2020 to 0.72 mb/d from 1.09 mb/d previously. However, it still foresees a "fairly balanced" market for the year.

On the supply side, the firm expects the current OPEC+ output cut agreement to be extended to year-end, Libyan and Venezuelan outlooks to deteriorate further, and US shale output to slow.

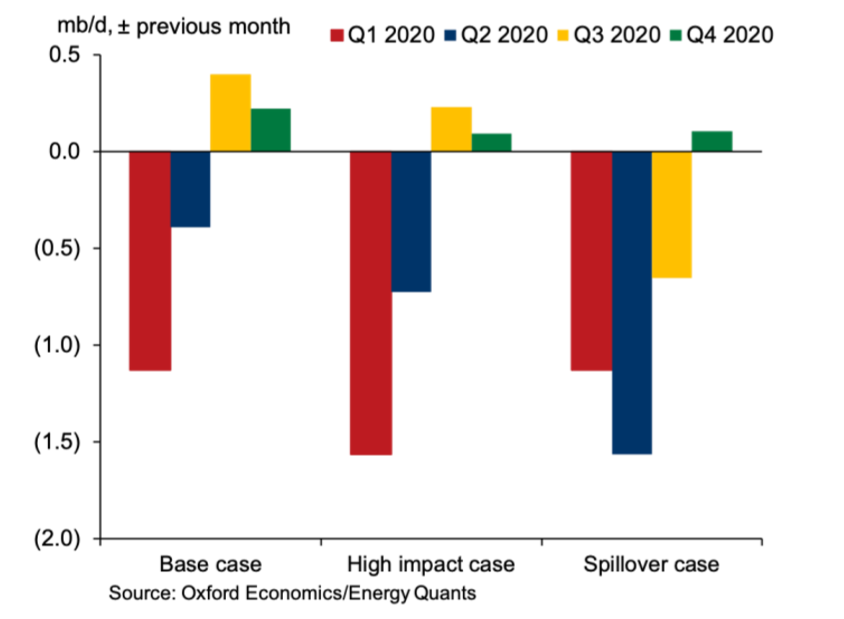

Global demand changes from previous month by coronavirus outbreak scenario

Global demand changes from previous month by coronavirus outbreak scenarioDemand should recover sharply in the second half of 2020 as the knock-on effects on fundamentals from the coronavirus outbreak are confined to the first half. For 2021, the global balance remains unchanged at 0.2 mb/d surplus.

Given the current state of the crude market, Oxford estimates Brent to average $62.2/b in 2020 and $66.7/b in 2021, but demand-side risks that can drag prices down to the low $50/b range remain elevated in the near-term.

At their meeting next month, OPEC+ producers need to weigh with extreme caution the likelihood of severe demand risks materializing if the coronavirus is not contained soon, Oxford cautioned.

If OPEC+ were to delay their response to the second half of 2020, this would require the group to nearly double the recommended cut of 0.6 mb/d to sustain prices in the low $60/b range for the rest of the year.