Crude Oil Bulls Attempt to Repair Yesterday's Damage / Commodities / Crude Oil

We haveseen a pretty sharp oil reversal yesterday. The U.S. session sent oil bullspacking. Not giving up, they’re attempting a comeback today. Geopolitical newsto their rescue: the drone attacks on key Saudi pipelines. Emboldened by thistailwind, do the oil bulls stand a chance of reversing the tide of recentdeclines?

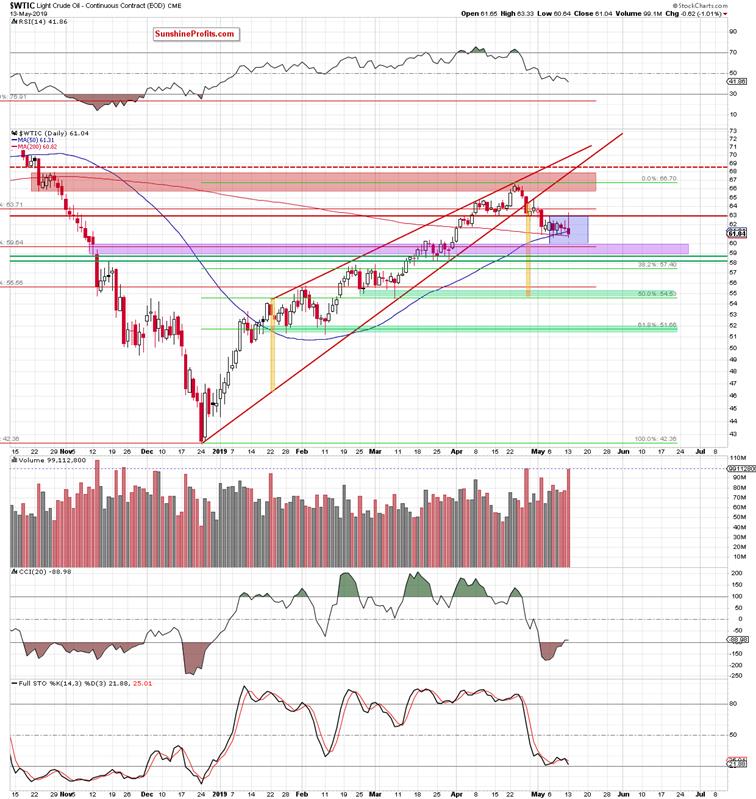

Let’s takea closer look at the chart below (charts courtesy of http://stockcharts.com).

Crude oilhas moved higher during yesterday’s session, there’s no debating that. However,it gave up all its gains and then some, powerfully reversing lower. Its price is still trading below the50-week moving average.

Then,there are the sell signals by the weekly indicators. Finally, the volume of last week’s decline was higher than thatof the preceding week. All these factors suggest that another move lower may bejust around the corner.

The dailychart provides more clarity. Crude oil moved sharply higher in yesterday’searly U.S. trading, but the resistance area created by the mid-April lows stoppedthe buyers. The price reversed sharply lower.

This lookslike another verification of the earlier breakdown below this support-turned-resistance. Itsuggests deterioration in the coming days, today’s modest upswingnotwithstanding.

Lower oilvalues will be however more likely and reliable only if black gold drops belowthe lower border of the blue consolidation and closes the day beneath it. To doso, the bears have to break below both the 50- and 200-day movingaverages and also close the horizontal purple price gap. Until then, short-livedmoves in both directions shouldn’t surprise us.

Summingup, the outlook for oil remains bearish. Oil has givenup all its yesterday’s early gains and today’s modest upswing doesn’t changethe picture. The fact is that oil is still trading inside the blueconsolidation. The bears look to be holding the upper hand as the redhorizontal resistance line (it's based on mid-April lows) has reliably keptyesterday’s gains in check. The position of the weekly indicators supports thedownside move. The bears’ first objective is to break below both the dailymoving averages. The short position continues to be justified.

If youenjoyed the above analysis and would like to receive free follow-ups, we encourageyou to sign up for our daily newsletter – it’s free and if you don’t like it,you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7days of free access to our premium daily Oil Trading Alerts as well as Gold& Silver Trading Alerts. Signup now.

Nadia Simmons

Forex & Oil Trading Strategist

PrzemyslawRadomski

Founder, Editor-in-chief

Sunshine Profits: Gold & Silver, Forex,Bitcoin, Crude Oil & Stocks

Stay updated: sign up for our free mailing listtoday

* * * * *

Disclaimer

All essays, research andinformation found above represent analyses and opinions of Nadia Simmons andSunshine Profits' associates only. As such, it may prove wrong and be a subjectto change without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Nadia Simmons and his associates do not guarantee the accuracy orthoroughness of the data or information reported. The opinions published aboveare neither an offer nor a recommendation to purchase or sell any securities. NadiaSimmons is not a Registered Securities Advisor. By reading Nadia Simmons’reports you fully agree that he will not be held responsible or liable for anydecisions you make regarding any information provided in these reports.Investing, trading and speculation in any financial markets may involve highrisk of loss. Nadia Simmons, Sunshine Profits' employees and affiliates as wellas members of their families may have a short or long position in anysecurities, including those mentioned in any of the reports or essays, and maymake additional purchases and/or sales of those securities without notice.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.