Crude Oil Is in the Fast Lane, But Where Is It Going? / Commodities / Crude Oil

What’s the price level exit for theblack gold?

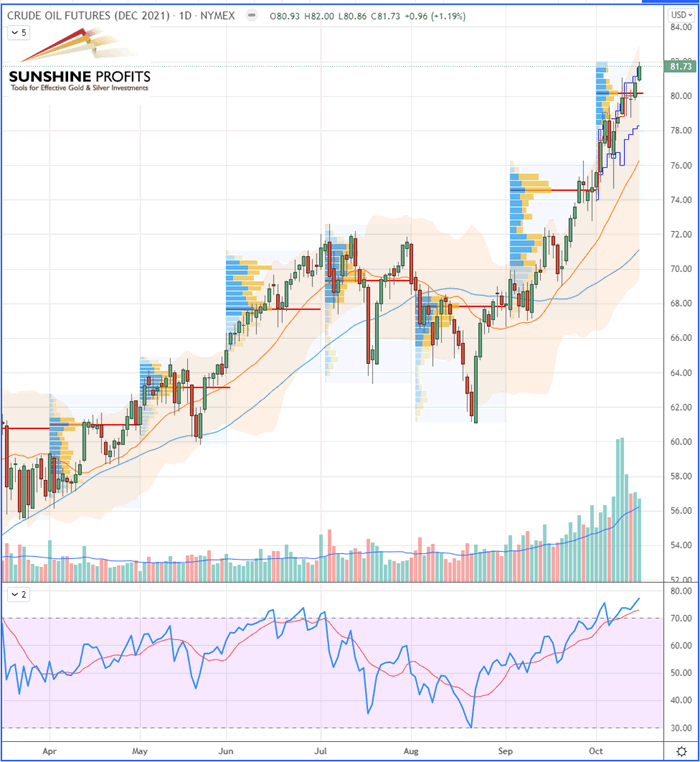

The new front month contract (as weswitched now to Dec’21) for WTI Crude Oil futures closed the week at $82 perbarrel on Friday (Oct. 15th).

Fundamentally, nothing seems to be able to stop, in the short term, the surge incrude oil prices which continued to rise on Friday amid concerns over supply,since the WTI hit a new high in almost seven years.

In addition, the slight decline of the USdollar may signify a more marked optimism of the markets in the perspectives ofa gradual recovery of the global economy.

OPEC+ remains stuck in its timetable forthe gradual increase in production, thus tightening a market which suffers frominsufficient supply.

If a return in global demand appears tobe faster than that of supply (as we are getting close to the winter season andits cooler temperatures), more shipping and other requirements are needed.

WTI Crude Oil (CLZ21) Futures (December contract, daily chart)

Insummary, in times of uncertainty, we are wondering where the oil market isgoing to drive us with such directional moves. So far, it’s in the fast lane onthe highway. However, the question now is: which exit is it going to take? $82?Or is it driving with a sufficiently full fuel tank in order to reach thepsychological $100 exit? For now, let’s just enjoy the road and let us knowwhat you think!

Like what you’ve read? Subscribe for our daily newsletter today, andyou'll get 7 days of FREE access to our premium daily Oil Trading Alerts aswell as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

* * * * *

The information above represents analyses and opinions of SebastienBischeri, & Sunshine Profits' associates only. As such, it may prove wrongand be subject to change without notice. At the time of writing, we base ouropinions and analyses on facts and data sourced from respective essays andtheir authors. Although formed on top of careful research and reputablyaccurate sources, Sebastien Bischeri and his associates cannot guarantee thereported data's accuracy and thoroughness. The opinions published above neitherrecommend nor offer any securities transaction. Mr. Bischeri is not a RegisteredSecurities Advisor. By reading Sebastien Bischeri’s reports you fully agreethat he will not be held responsible or liable for any decisions you makeregarding any information provided in these reports. Investing, trading andspeculation in any financial markets may involve high risk of loss. SebastienBischeri, Sunshine Profits' employees, affiliates as well as their familymembers may have a short or long position in any securities, including thosementioned in any of the reports or essays, and may make additional purchasesand/or sales of those securities without notice.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.