Crude Oil Price Begins To Move Lower / Commodities / Crude Oil

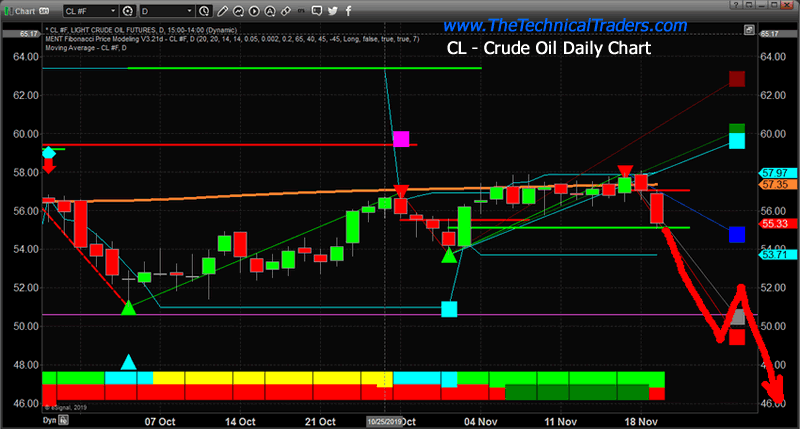

Recently, we posted a multi-part researchpost suggesting a collapse in Crude Oil could be setting up and how we believethis decline in energy prices may lead to a broader market collapse in the nearfuture. Crude oil fell more than 3% onNovember 19 in what appears to be a major price reversal. On November 20, inventory levels and otherkey economic data will be presented – could the price of oil collapse evenfurther over the next 60+ days?

Here is a link to our most recent multi-part article about Crude Oil from November 13 (just a week ago): https://www.thetechnicaltraders.com/what-happens-to-the-global-economy-if-oil-collapses-below-40-part-i/

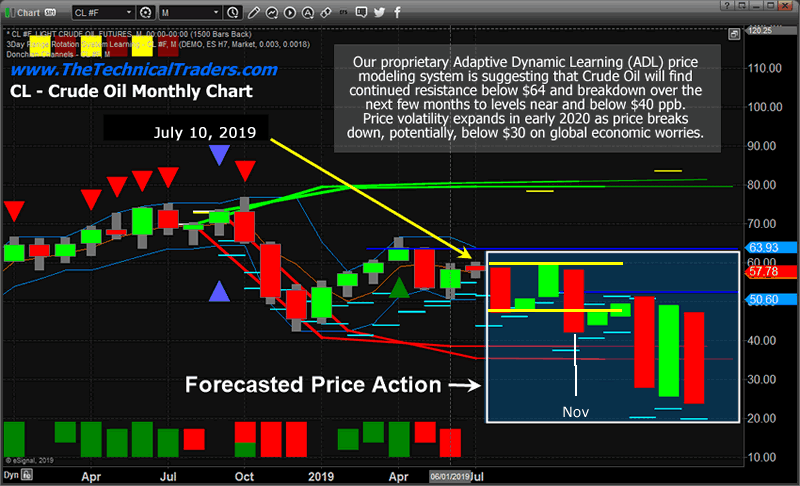

Our original research chart from July 2019

Our original research post, from July 2019, included this chart showing our Adaptive Dynamic Learning (ADL) price modeling system and where it believed the price of oil would go in the future. This chart highlights expected price ranges and directions all the way into April 2020 with a low price level near $25 somewhere between February and April 2020. Is Oil really going to reach a low price near $25 ppb in the near future?

On July 10, 2019, we authored a research article using our ADL predictive modeling for Oil. At that time, we predicted Oil would fall in August, recover in September and October, then collapse to near $42 (or lower) in November and December. You can read our followup to this article here.

In order for these predictions to continueto hold true, Crude Oil will have to fall below $47 ppb over the next 30+ daysand then consolidate through December and January into a fairly tight pricerange between $42 and $49. If thishappens as we predicted back in July, then there would be a much higherprobability that the February, March and April price targets are valid goingforward.

On November 19, Crude oil reversed quite extensively to the downside after weeks of upward price pressure. We believe this downside price rotation may be setting up a bigger, deeper price move that is aligned with our ADL predictive modeling systems results from July 2019 – eventually targeting the sub $50 price level near the end of November or early December.You can get all of my trade ideas by opting into my free market trend signals newsletter.

Concluding Thoughts:

This potential move in Crude Oil is setting up a potentially great trade for active traders if you know how to profit from falling prices and I even talked about how to trade this move in my member’s only trading newsletter service. Remember, if our ADL research is correct, December and January will see very mild price action in Oil. The bigger breakdown move happens in late January or early February.

On Monday another commodity gave us another trade and it popped 3.4% in our favor within the first trading session. Big moves in stocks, metals, and energy are ready for big price swings here, get ready!

As a trader, you need to be aware of the greater implications for the global markets if Crude Oil falls below $45 ppb (eventually, possibly falling below $30 ppb). A large portion of the global market depends on oil prices being relatively stable above $50 ppb. A decrease in oil prices will place extreme pressures on certain nations to maintain oil production and to generate essential revenues. Depending on how this plays out in the future, falling oil prices could translate into far greater risks for the global stock markets and global economics.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involvedin the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader,and is the author of the book: 7 Steps to Win With Logic

Through years ofresearch, trading and helping individual traders around the world. He learnedthat many traders have great trading ideas, but they lack one thing, theystruggle to execute trades in a systematic way for consistent results. Chrishelps educate traders with a three-hourvideo course that can change your trading results for the better.

His mission is to help hisclients boost their trading performance while reducing market exposure andportfolio volatility.

He is a regularspeaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chriswas also featured on the cover of AmalgaTrader Magazine, and contributesarticles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.