Crude Oil's Failure Leads to a Profitable Opportunity / Commodities / Crude Oil

Crudeoil moved sharply higher yesterday, almost touching the previous August highs,but it didn’t manage to break above them. The resistance that we outlined inthe previous Oil Trading Alerts kept the rally in check, and we already see theresult. Crude oil simply declines. What’s next? How far can it decline?

Crudeoil moved sharply higher yesterday, almost touching the previous August highs,but it didn’t manage to break above them. The resistance that we outlined inthe previous Oil Trading Alerts kept the rally in check, and we already see theresult. Crude oil simply declines. What’s next? How far can it decline?

Inshort, the previous outlook remains up-to-date, simply because the situationdeveloped in tune with what we wrote.

Ofcourse, a daily rally appears bullish at the first sight, especially for theinexperienced traders, but this is a false signal. To be clear, a daily rallyis not bearish on its own, but it’s not enough to make the situation bullisheither. Let’s keep in mind that price tops have to – by definition – happenafter a rally, not after a decline… So why is thesomething-rallied-so-it’s-going-to-rally-again way of thinking so popular? It’seasy to extrapolate the most recent trends into the future as that’s what makessense… Emotionally. And that’s exactly what makes this business hard in thelong run. One of the most difficult trading tips one needs to adhere to inorder to make money is that one usually needs to act against what seems soobvious at the first sight.

Thetruth is that a daily rally is just a piece of information that investors and traderscan use. And the way one uses it will determine if they will make money or not.How should one use it? As always, the context is the king. And what does theking tell us today?

Let’stake a closer look at the charts below for details.

Asfar as the daily chart is concerned, in yesterday’s Alert, we wrote the following:

Yesterday,crude oil tested the red resistance zone created by the previous peaks andfurther reinforced by the 61.8% Fibonacci retracement. While the bulls'unsuccessful break above it triggered a pullback, the commodity still closed the day abovethe Wednesday's green gap.

Earliertoday, we saw another test of the green gap - the unsuccessful attempt to movelower translated into a rebound. This suggests that we could see a retest of the redresistance zone later in the day.

That’sexactly what happened yesterday. We saw a retest and this retest failed. As youcan see, the price is declining today.

Let’szoom in a bit.

Asfar as the 4-hour chart is concerned, here’s what we wrote:

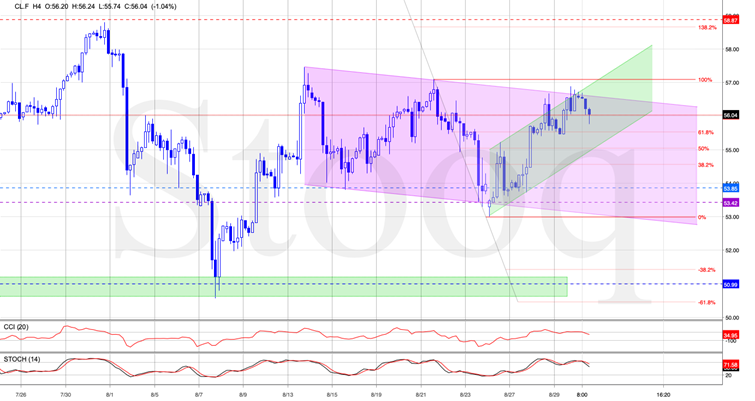

The red zone isreinforced by the upper border of the declining purple trend channel and theupper border of the rising green trend channel of the 4-hour chart. Theseresistances combined with the position of the 4-hour indicators suggest a highlikelihood of an upcoming reversal.

Where would the bearsaim to take black gold then?

(...) Should the bullsfail to push prices higher (or should we see an invalidation of a potentialbreakout above the upper border of the channel), the sellers will likely takethe reins. Then, crude oil futures can be expected to trade down to atleast the lower border of the formation or even to the lower border of thepurple declining trend channel and the recent lows.

That’sexactly what happened. The tiny breakout above both trading channels wasquickly invalidated, and price moved back into the purple trade channel,suggesting further declines.

Moreover,the sell signals generated by the 4-hours indicators suggest furtherdeterioration in the coming day(s). They serve as the confirmation of thealready-bearish case for crude oil.

Thetarget is created by the lower border of the purple trend channel and therecent lows.

Summing up, oil bulls haveonce again been stopped at the red resistance zone and the 61.8% Fibonacciretracement, and they invalidated small breakouts above the short-term tradechannels. This is a bearish combination that is further reinforced by sellsignals from the indicators on the 4-hour chart. Consequently, the shortposition remains justified from the risk to reward point of view.

If youenjoyed the above analysis and would like to receive free follow-ups, we encourageyou to sign up for our daily newsletter – it’s free and if you don’t like it,you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7days of free access to our premium daily Oil Trading Alerts as well as Gold& Silver Trading Alerts. Signup now.

Nadia Simmons

Forex & Oil Trading Strategist

PrzemyslawRadomski

Founder, Editor-in-chief

Sunshine Profits: Gold & Silver, Forex,Bitcoin, Crude Oil & Stocks

Stay updated: sign up for our free mailing listtoday

* * * * *

Disclaimer

All essays, research andinformation found above represent analyses and opinions of Nadia Simmons andSunshine Profits' associates only. As such, it may prove wrong and be a subjectto change without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Nadia Simmons and his associates do not guarantee the accuracy orthoroughness of the data or information reported. The opinions published aboveare neither an offer nor a recommendation to purchase or sell any securities. NadiaSimmons is not a Registered Securities Advisor. By reading Nadia Simmons’reports you fully agree that he will not be held responsible or liable for anydecisions you make regarding any information provided in these reports.Investing, trading and speculation in any financial markets may involve highrisk of loss. Nadia Simmons, Sunshine Profits' employees and affiliates as wellas members of their families may have a short or long position in anysecurities, including those mentioned in any of the reports or essays, and maymake additional purchases and/or sales of those securities without notice.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.