Crude Oil's Sign for Gold Investors / Commodities / Gold & Silver 2024

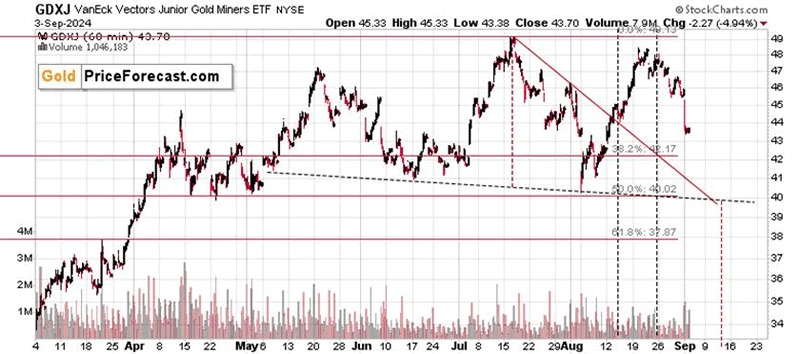

So, the GDXJ plunged about 5%yesterday, and it refused to get back up, even though goldprice did.

Continuationof GDXJ Decline Likely

What a demonstration of weakness!

After the vertical plunge, the GDXJsimply paused. This simply confirms what I wrote previously – that this is NOTthe end of the decline, it’s just an acceleration in it.

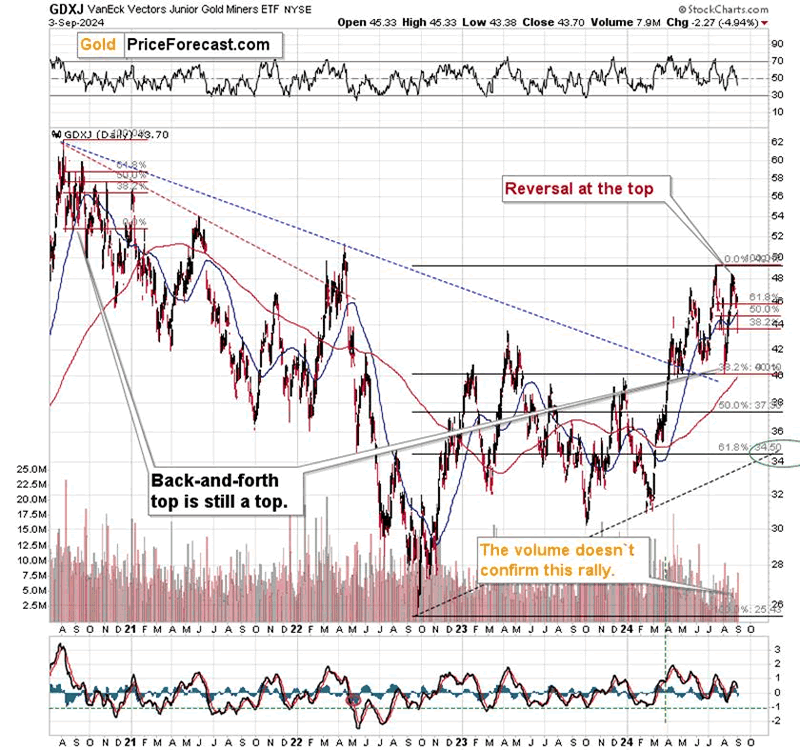

My yesterday’s comments on the likelyhead-and-shoulders top formation in the GDXJ remain up-to-date:

Sincethe GDXJ didn’t move above its July high, but rather topped slightly above itsMay high, (and given that the next big decline is likely just around the corner)it seems that we’re seeing a head-and-shoulders pattern, with the May andAugust tops being shoulders and the July high being the head of the patterns.

Thedownside targets based on this formation are created by copying the height ofthe head and pasting it below the neck level, which I’ve done using red, dashedlines. This technique points to the target at about $33. We’ll know more whenthe GDXJ breaks below the neck level and it’s closer to this target – based onwhere gold, stocks, and the USD Index are. For now, however, its seems quitepossible that the GDXJ will slide there before rebounding (and not from $34).The $34 level is more conservative, so I’m still basing my target on it (thefirst GDXJ chart from today’s analysis still supports it), so we’ll probablyend up taking profits at about $34, anyway, but I wanted to share this bearishconfirmation with you either way.

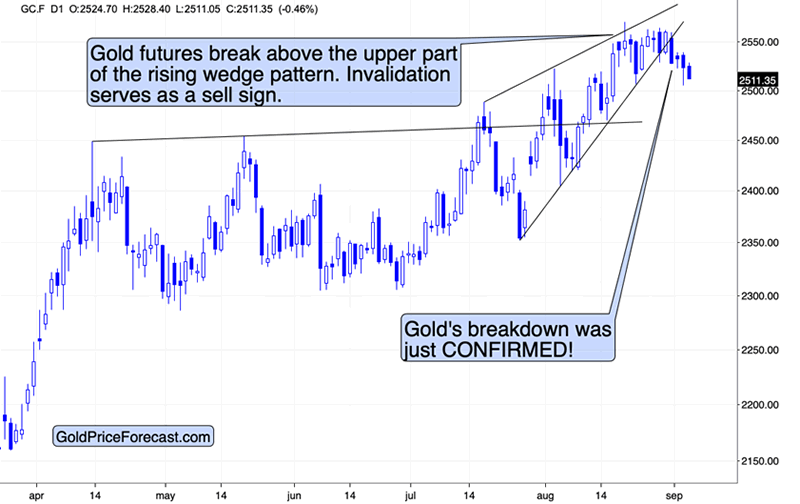

Gold corrected most of its intradaydecline during yesterday’s session, but that’s not really important. Theimportant thing is that was the third daily close below the lower border ofgold’s rising wedge pattern, which means that the breakdown is now fullyconfirmed.

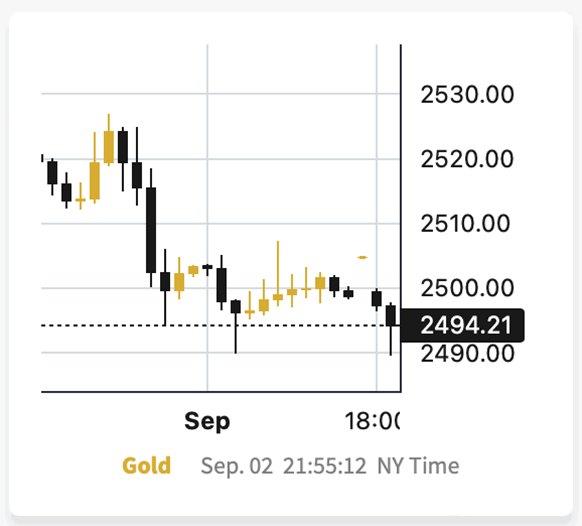

This means that MORE declines are morelikely on the way. In fact, we already see them in today’s pre-market trading.

And this shouldn’t come as a surprise toyou, given that youwere prepared in advance for gold’s slide after the U.S. Labor Day.

Also, please note that spot gold justverified its move back below $2,500 by moving back to this level and thendeclining again.

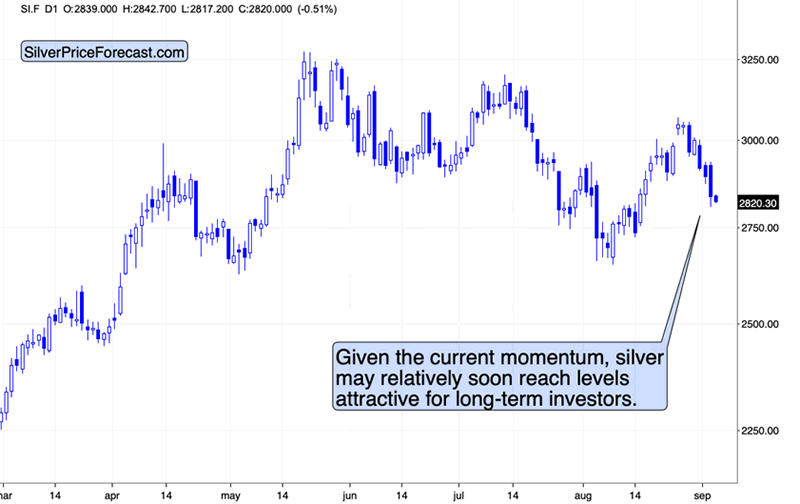

Silver Fails to HoldAbove $30

Meanwhile, silver is also declining.

The white metal once again failed to holdabove the $30 level and it declined in the immediate aftermath.

While the short-term outlook for thesilver price is bearish in my view, let’s not forget that silverhas great long-term potential. Some may view the near-term declinesas an opportunity to short the silver market (I continue to prefer shortingjunior mining stocks over silver, also due to what’shappening in the GDXJ:silver ratio), while some may view it as something thatbrings one a great buying opportunity.

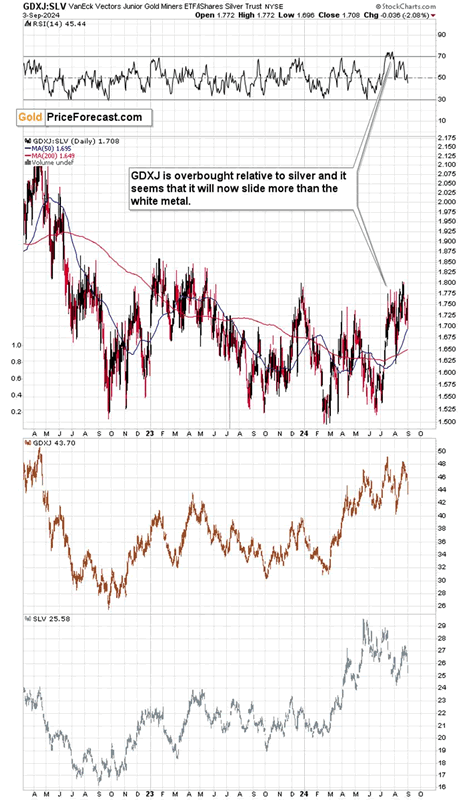

Speaking of the GDXJ to silver (SLV)ratio, here it is.

The RSI based on the ratio was just veryoverbought as measured by the RSI indicator, and while it’s no longeroverbought in this way, it hasn’t really declined yet.

This is similar to what we saw in early2023 – the RSI was close to 70, then it declined but the ratio continued totrade sideways. What happened next?

The ratio declined, meaning that juniorminers declined more than silver. In other words, to was better to be shortingGDXJ than SLV. If one was shorting GDXJand was long silver at the same time, they would make money (assuming similarexposure to both markets).

All right, I know what you’re thinking –the title mentioned crude oil, and I haven’t even touch on that market yet.Let’s catch up.

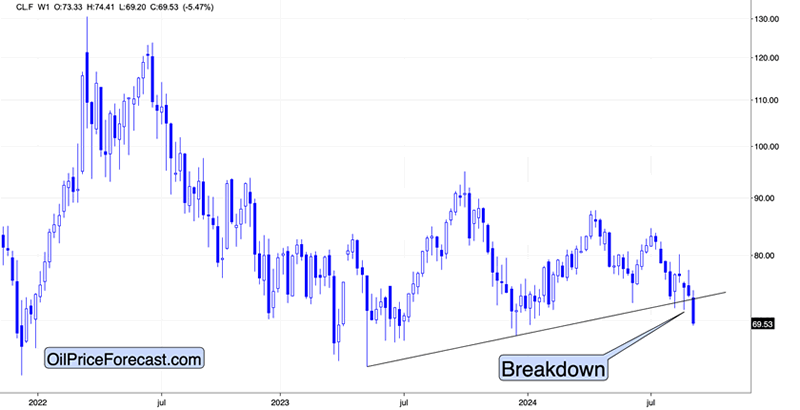

The reason that I’m featuring crude oil today (even though we have a completely separateservice dedicated to this market) is that:

Since 1990, there were three similarcases, when black gold’s price moved below its rising, medium-term supportlines:

As you may have guessed, crude oildeclined in a significant way in each case. In particular, the decline thatfollowed in 2014 was huge.

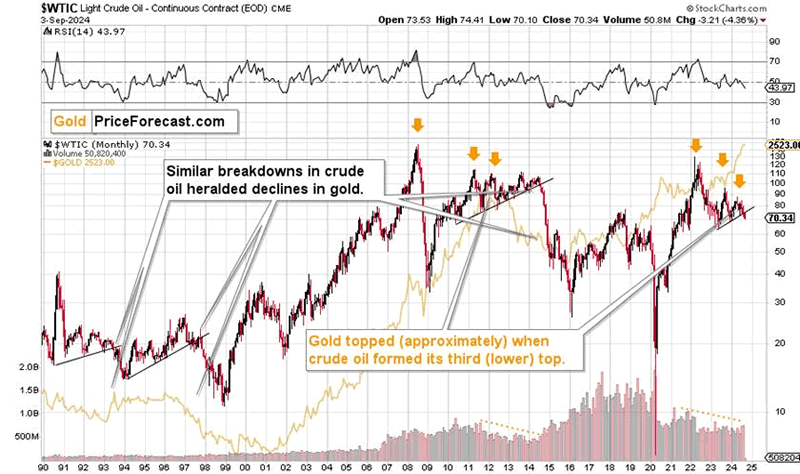

However, from our – precious metalsinvestors’ and traders’ – point of view, something else is much moreinteresting.

The thing is that in all those threecases, it was not only crude oil price that fell – gold price fell as well.

In 1993, gold topped and then declined.

In 1997, gold’s decline simply continued.

In 2014, gold’s decline continued.

The fact that it’s just three cases mightmake this analogy seem irrelevant, however, I would like to emphasize thatbetween 1990 and now gold has been in an uptrend in most of the years.Consequently, sell signals are much more difficult to get than buy signals.

I mean that if you randomly pick somedates, the odds are that gold would be rallying after those days. That’s whyyou also have so many analysts that appear successful while only saying “goldwill go up” over and over again… Making money on both: rallies and declinesmight indicate skill, but if one is a perma-bull, those successes don’t reallyshow it.

Getting back to crude oil, seeing threebearish confirmations and no bullish ones is an important indication. Iwouldn’t say it’s safe to trade based just on it, but it’s not the only factorthat we’re considering here – there’s many of them, and this simply confirmsthe other ones.

One more thing. I marked a similartriple-top pattern in crude oil with orange arrows – the first top wasparticularly notable – it caused RSI to move above 70, which we also saw rightnow. These were lower highs in both cases, and gold continue to move up throughthose highs in crude oil… Until it topped close to the third top in crude oil.

As we recently saw the third top in crudeoil, we have a confirmation that the final top in gold (for a longer time) isin.

The biggest trading opportunity here isnot in gold, though, but in junior mining stocks. I know that I wrote it somany times in the recent months, but this simply remains to be the case, and Idon’t want anyone to think that (in my view) this opportunity is gone or over –it’s still here, and those, who are strong and patient, are likely to be verywell rewarded.

Naturally, the above is up-to-date at themoment when it was written. When the outlook changes, I’ll provide an update.If you’d like to read it as well as other exclusive gold and silver priceanalyses, I encourage you to sign up for our freegold newsletter.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.